atakan/iStock via Getty Images

Introduction

When it comes to long-term investments, I mainly buy companies that fulfill critical roles in the modern economy. This includes transportation companies, healthcare, defense, financial services, energy, and related.

I also try to find a sweet spot between growth and value, as I am neither a pure-play “growth” nor “value” investor.

Hence, my portfolio, more often than not, has a yield between 2.5% and 3.0% with an annual dividend growth rate in the high-single-digit to the low-double-digit range, depending on the state of the economy.

Cigarette giant Altria Group, Inc. (NYSE:MO) is not necessarily a stock I’m considering as a good investment for my portfolio.

- While I don’t care if people decide that smoking is right for them, I’m not necessarily a supporter of the industry.

- The industry is getting massive headwinds from Western governments looking to (indirectly) ban the sale of cigarettes through anti-marketing campaigns, higher taxes, and/or specific smoking bans in certain areas.

- As I have significant exposure in energy and defense companies, my goal is not to add even more non-ESG exposure. Not that I care for ESG, but you get the point from a diversification point of view.

My most recent article on Altria was written on September 20, 2022, when I wrote: “One Big Fat Reason To Buy Altria In Light Of Economic Woes.”

Since then, MO has returned 5%, including dividends.

With all of this in mind, Altria is currently yielding 10%.

Not only that, but its valuation, in general, is attractive. Very attractive!

Even though the company will have to rely on pricing to maintain decent growth, we’re likely looking at many years of consistent EPS growth, success in its alternative segments like NJOY, and a healthy balance sheet that can withstand a potentially prolonged period of elevated rates.

Even if I were to give the company a ridiculously low valuation multiple, I see a very realistic path to >15% annual returns.

So, let’s get to it as I explain why I’m considering buying the MO ticker for my dividend growth portfolio!

I Like Value In This Market

In my 2024 Outlook article, I highlighted the need to shift toward value investments in light of a lofty stock market valuation.

Multpl.com – Shiller P/E Ratio

While I’m not bearish (I don’t short, nor am I a net seller), this is what I wrote in my outlook:

At current valuations, odds are the S&P 500 will return between 3% and 5% per year over the next 10 years. It could be lower or higher, depending on how high economic growth is. After all, the price-to-earnings ratio relies both on price and earnings.

Bank of America

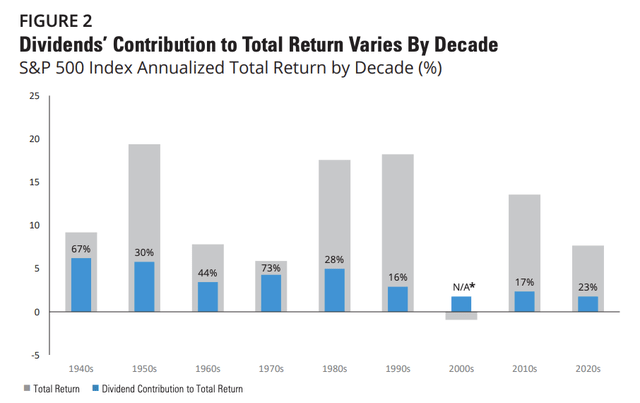

While many factors influence the market’s performance, generally speaking, lofty valuations favor investments with better valuations and higher yields, as I also expect that a substantial part of the market’s total return over the next ten years will come from dividends.

In recent years, dividends did not play a major role, as capital gains were elevated, allowing the S&P 500 to return roughly 13% per year since the Great Financial Crisis.

That’s where Altria comes in, which may be one of the ultimate value stocks on the market.

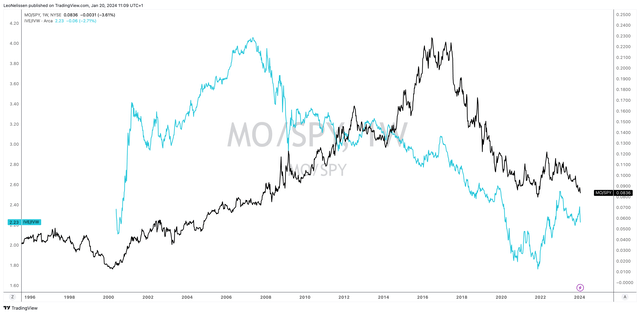

The chart below compares two lines:

- Black: the ratio between the Altria stock price and the S&P 500 (including dividends).

- Blue: the ratio between the S&P 500 Value (IVE) and the S&P 500 Growth (IVW), also including dividends.

As we can see above, value stocks started to underperform growth stocks during the Great Financial Crisis, when the global economy witnessed a shift to subdued rates, supported by (often) low inflation and consistent GDP growth.

That was the perfect environment to buy growth stocks.

However, it took until 2017 before MO started to underperform the S&P 500!

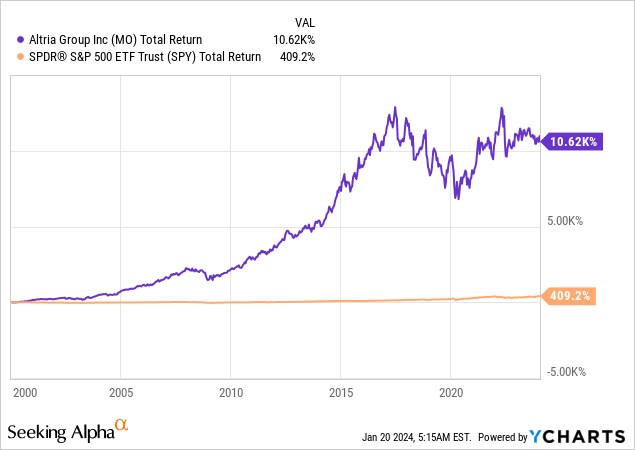

In fact, going back to the year 2000, MO shares have returned 10,620%, including dividends, making it one of the best performers over the past two decades.

Also, the past two decades included the accelerating fight against cigarettes, which shows the impact of pricing power and consistent dividend growth.

The Dividend Continues To Shine Bright

When people think of Altria, they think of a juicy dividend.

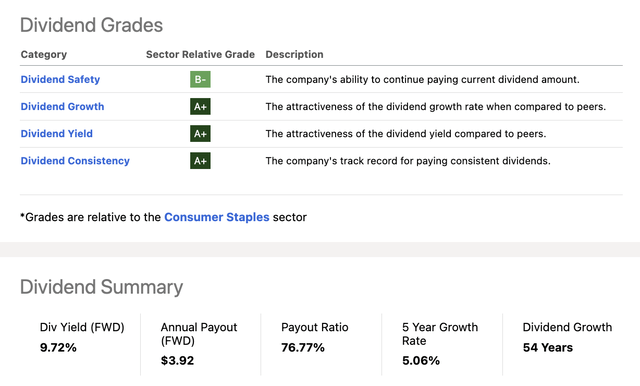

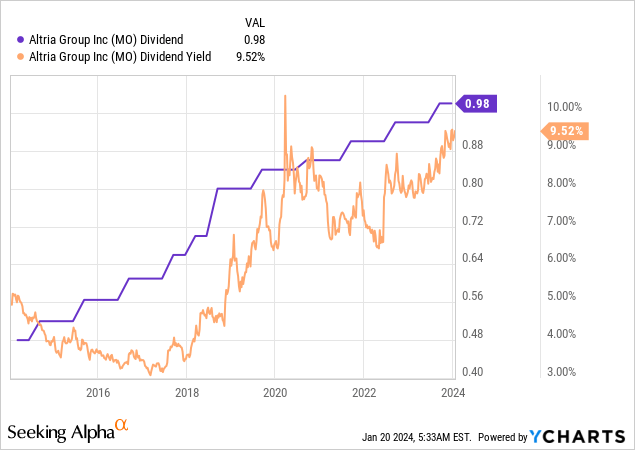

After hiking its dividend by 4.3% on August 24, 2023, Altria currently pays $0.98 per share per quarter. This translates to a yield of 9.7%.

The dividend king, which has hiked its dividend for more than 50 consecutive years (adjusted for the Phillip Morris (PM) spin-off), yielded barely more than 3% in 2017. Now, it yields 10%, one of the highest numbers in its recent history.

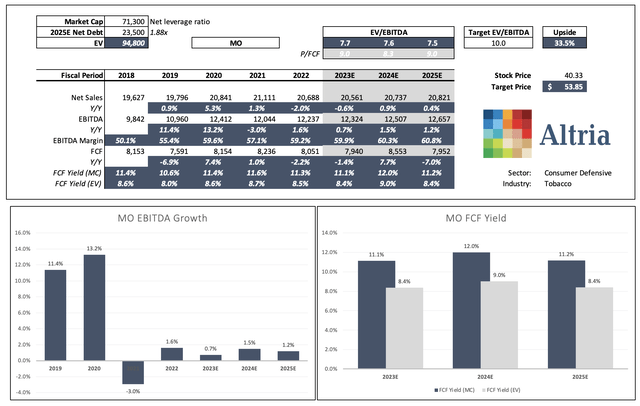

Thanks to a healthy balance sheet with an investment-grade BBB credit rating and a sub-2.0x net leverage ratio, the company can prioritize shareholder returns over debt reduction.

It also has a healthy payout ratio.

In 2024, MO is expected to generate $8.6 billion in free cash flow, roughly 12.1% of its current market cap!

This translates to a cash payout ratio of 80%.

Next year, free cash flow is expected to fall to $8.0 billion, which would still be 11.2% of its $71.3 billion market cap.

As a result, the five-year dividend CAGR is 5.1%, which is extremely high for a company with a 10% yield (or any yield above 7%, frankly).

These numbers explain why the company has one of the best Seeking Alpha dividend scorecards in the consumer staples sector:

With that in mind, let’s take a closer look at the company’s numbers.

Paving The Way For Consistent Growth

Altria is on a path for consistent earnings growth.

In its most recent quarter, 3Q23, the company reported a 3.3% growth rate in adjusted diluted earnings per share for the first nine months of the year.

According to the company, this performance reflects the resilience of their traditional tobacco businesses in a dynamic operating environment.

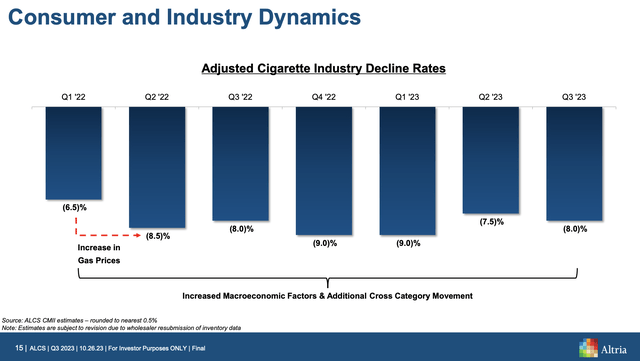

This growth rate was possible despite a notable continuation of high declines in the volume of the cigarette industry.

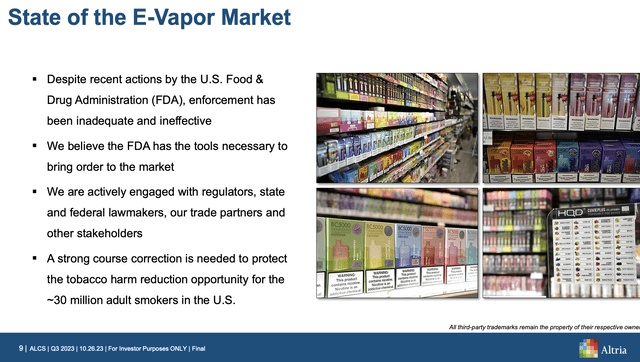

This trend was primarily attributed to a combination of macroeconomic factors and the increasing prevalence of illegal disposable e-vapor products.

According to Altria, the illicit products, which are distributed through unconventional and untracked channels, pose a challenge in accurately estimating their impact on the industry.

Current estimates suggest that the growth of illegal flavor disposable e-vapor products contributed to a decline in the cigarette industry within the range of 1.5% to 2.5% over the twelve months ending in 3Q23.

Regardless of these challenges, the company’s strategy in its NJOY product segment involves a comprehensive approach, starting with strengthening NJOY’s supply chain to support the initial phase of ACE expansion.

Distribution of ACE has grown to approximately 42,000 stores, with plans to reach 70,000 stores by the end of the year.

In addition to distribution expansion, the company is actively working on enhancing visibility at retail through new point-of-sale and fixture signage.

Hence, amid challenges, the company sees growth opportunities in the smoke-free market.

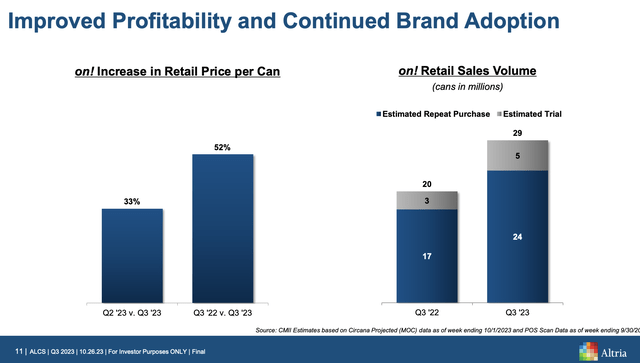

The nicotine pouch category has experienced substantial growth, contributing to a 5% increase in total U.S. oral tobacco volumes over six months ending in the third quarter. The company’s brand, “on!” has performed well in this category, with reported shipment volumes increasing nearly 37% year-over-year.

There is also an international growth opportunity, as on! PLUS begins its test launch in Sweden, one of the largest modern oral tobacco markets globally.

With that in mind and moving over to “classic” products, the strategic focus during the third quarter within the smokeable products segment was on maximizing the profitability of combustibles over the long term.

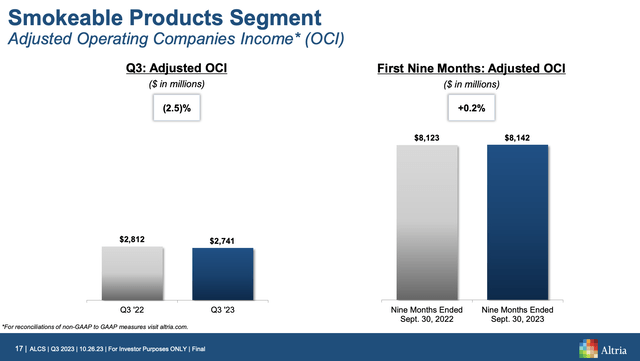

Simultaneously, efforts were made to balance investments in the prominent brand, Marlboro, with funding the growth of smoke-free products. Despite the decline in adjusted operating income by 2.5% during the third quarter, the company reported a growth of 0.2% for the first nine months.

The decline in adjusted operating income during the third quarter was primarily attributed to elevated industry volume declines (also see the volume chart above), influenced by the aforementioned macroeconomic factors and increased promotional investments.

However, net pricing for the segment remained robust, with a net price realization of 8.6% in the third quarter and 9.8% for the first nine months.

Furthermore, the good news is that Altria has pricing power.

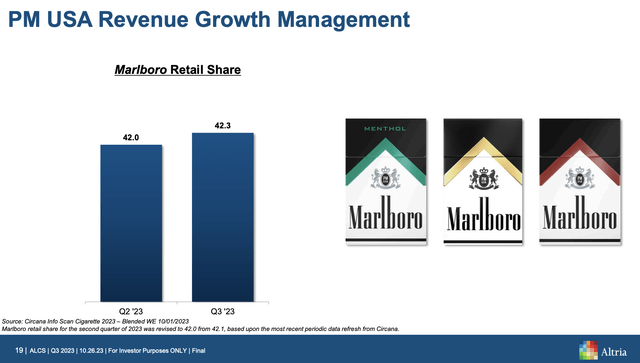

For example, despite aggressive price hikes, the Marlboro retail share within the cigarette category rose by 0.3 points to 42.3%, supported by brand promotions.

Additionally, Marlboro showed growth in its share within the stable premium segment, reaching 58.9%, with a sequential increase of 0.3% and a year-over-year increase of 0.4%.

Despite cyclical challenges and issues due to illegal competition, the company expects to deliver adjusted diluted earnings per share in the range of $4.91 to $4.98 for FY2023, representing a growth rate of 1.5% to 3% from the base of $4.84 in 2022.

Altria is expected to announce its earnings on February 1 before the market opens.

Analysts expect $1.17 in EPS, which is based on six estimates without any upgrades or downgrades over the past four weeks.

Full-year EPS is expected to come in at $4.96, which is close to the upper bound of Altria’s own guidance range.

While I have a hard time guessing if the company may beat earnings estimates in 4Q23, I believe that positive comments regarding e-vapor regulations and potentially lasting pricing power could put a floor under the stock price.

This brings me to the valuation.

Valuation

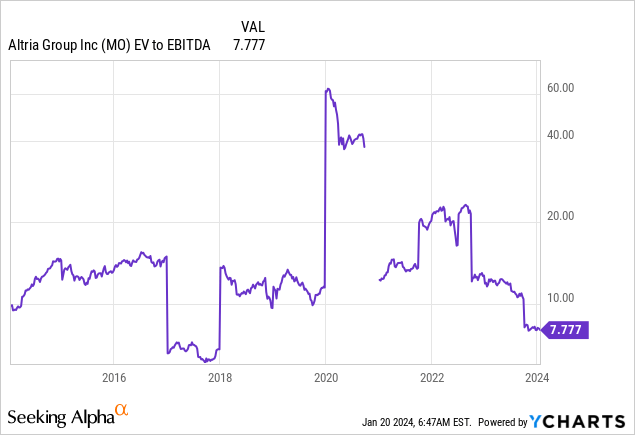

Over the past ten years, MO has traded close to 10x EBITDA. It currently trades at less than 8x LTM EBITDA.

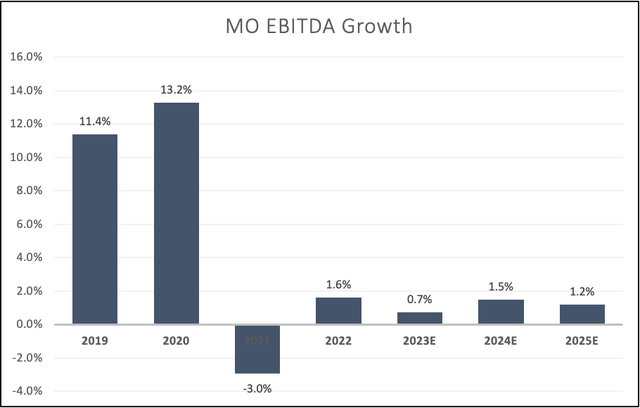

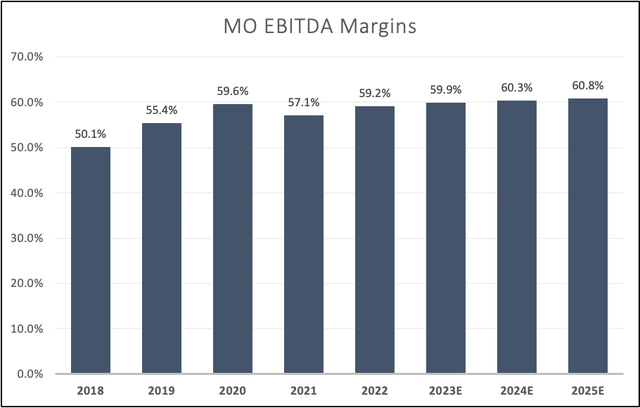

Looking at the chart below, analysts expect EBITDA growth to remain in the mid-1% range going forward. I expect this to continue after 2025 as well.

Leo Nelissen (Based on analyst estimates)

Furthermore, the company is expected to maintain strong EBITDA margins with a gradual increase to the high-60% range if analysts are correct.

Leo Nelissen (Based on analyst estimates)

This bodes well for its valuation.

If we apply a 10x EBITDA multiple, the stock is up to 34% undervalued, with a fair price target of $54. The current consensus price target is $47.

Leo Nelissen (Based on analyst estimates)

Even better, if the company were to gradually move to this target over the next three years, it could return north of 15% per year, including its dividend and potential buybacks.

This is a conservative estimate.

At $40 per share, a 10% dividend yield, a sub-8x EBITDA multiple, and post-dividend buyback potential, the company could return between 15% and 20% on a prolonged basis.

Using a P/E valuation, we find similar findings.

Based on the data in the chart below:

- MO has a normalized P/E multiple of 13.4x.

- It is currently trading at a blended P/E ratio of just 8.1x.

- EPS is expected to grow by roughly 3% per year (supported by potential buybacks).

- Even a 9x multiple (the pink line in the chart below) would pave the road for >15% annual returns.

A potential trigger for improving its valuation could be a mix of higher e-vapor regulation and rising consumer confidence.

While this may take a while in an environment of elevated inflation, investors are paid 10% per year while waiting for this to unfold.

Moreover, a potential rotation from growth to value stocks bodes well for MO, thanks to its valuation and yield.

Hence, I am now looking at how to incorporate MO into my portfolio.

Given my elevated cash position, I’m considering making it a 3-5% position in the months ahead.

Takeaway

Altria may not align with my usual investment preferences, given the challenges faced by the tobacco industry.

However, its current 10% yield and attractive valuation, paving the road for potentially elevated total returns in the years ahead, have sparked my interest.

Altria’s dividend history, resilient earnings, and strategic moves in alternative segments position it as a potential value gem.

As I emphasize the shift towards value investments in 2024, Altria’s undervaluation and robust earnings outlook make it a compelling consideration for a 3-5% position in my dividend growth portfolio.