The United Auto Workers reached an agreement with Mack Trucks to avert a strike and Apple said it would release a software update to address iPhone 15 overheating issues. Here’s what investors need to know today.

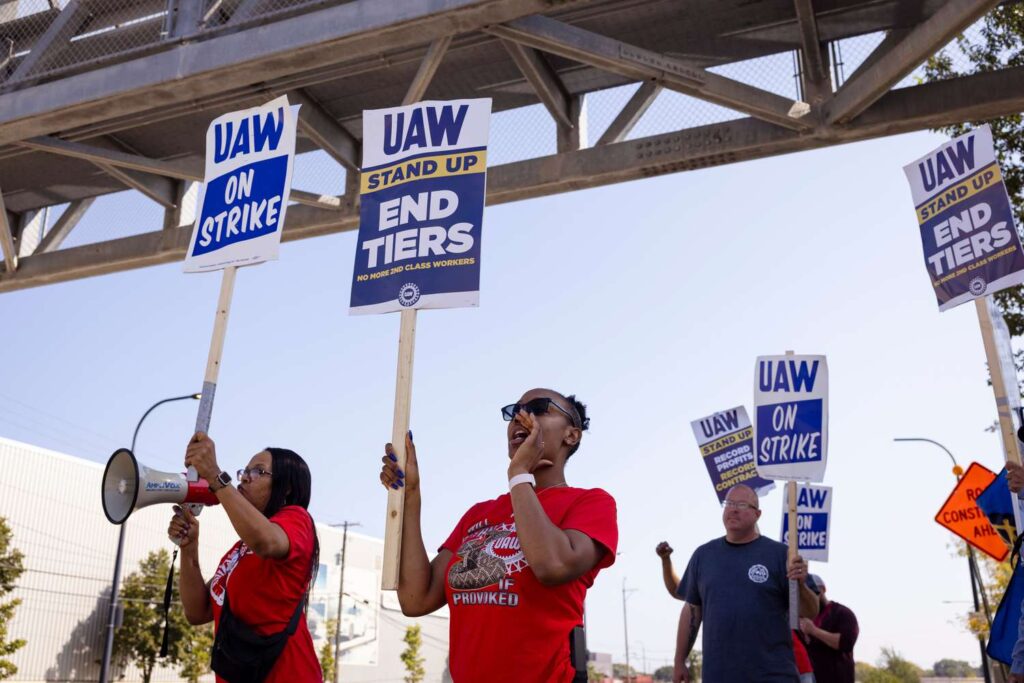

1. UAW Reaches Agreement with Mack Trucks to Prevent Strike

The United Auto Workers (UAW) reached an agreement with Volvo Group-owned Mack Trucks that would increase wages and extend benefits to the automaker’s nearly 4,000 U.S. workers after the union authorized a strike. The tentative agreement still requires ratification by union members and comes after the UAW expanded its strikes against the Detroit “Big Three” automakers last week. Shares of Ford (F) and General Motors (GM) were up 0.5% in pre-market trading, while Stallantis (STLA) shares moved up by 0.3%.

2. Apple to Release iPhone 15 Software Update to Fix Overheating Issue

Apple (AAPL) shares ticked down by 0.1% in pre-market trading after the company said it would release an iOS 17 software update to improve problems with its iPhone 15 overheating. The company said that a bug in iOS 17 software, along with updates to third-party apps, are the primary cause of the overheating problem, and that its titanium casing is not a factor.

3. Tesla Shares Gain Ahead of Third-Quarter Unit Sales Data

Shares of Tesla (TSLA) moved higher by 0.5% in the pre-market ahead of its report on third-quarter unit sales today. Analysts have delivered a range of estimates, with the average coming in at 461,000 deliveries, compared with about 466,000 vehicles Tesla delivered in the second quarter, as slower growth was attributed to planned downtime for facility upgrades.

4. AMC in Talks to Screen Beyonce Concert Film

AMC Entertainment (AMC) shares rose 1.1% in the pre-market after reports that the makers of a concert film based on Beyonce’s Renaissance World Tour were in talks to bring the film to the movie theater chain’s screens. AMC is preparing to release a Taylor Swift concert film on October 13 that estimates point to topping $100 million in ticket sales for the opening weekend.

5. Manufacturing Index Expected to Tick Higher While Construction Spending Slows

The ISM manufacturing index is projected to increase to a reading of 48 in September, up from 47.6 in the prior month, when that data is released at 10 a.m. ET. Also at that time, construction spending is expected to increase 0.6% in August, less than July’s 0.7% increase, while the final S&P U.S. manufacturing PMI will be released at 9:45 a.m. ET.