Bitcoin (BTC) is a cryptocurrency developed in 2009 by Satoshi Nakamoto, the name given to its unknown creator (or creators). Transactions are recorded in a blockchain, which records the history of each unit and proves ownership.

Unlike traditional currencies, bitcoin is not issued by a central bank or backed by a government. For investors, buying a bitcoin is different from purchasing a stock or bond because bitcoin is not a corporation. Consequently, there are no corporate balance sheets or Form 10-Ks to review, or fund performances to compare.

Learn what influences bitcoin’s price so you can make more informed decisions about choosing it as an investment.

Key Takeaways

- Purchasing stock grants you ownership in a company, whereas buying bitcoin grants you ownership of however much cryptocurrency your money bought.

- Bitcoin is neither issued nor regulated by a central government and, therefore, is not subject to governmental monetary policies.

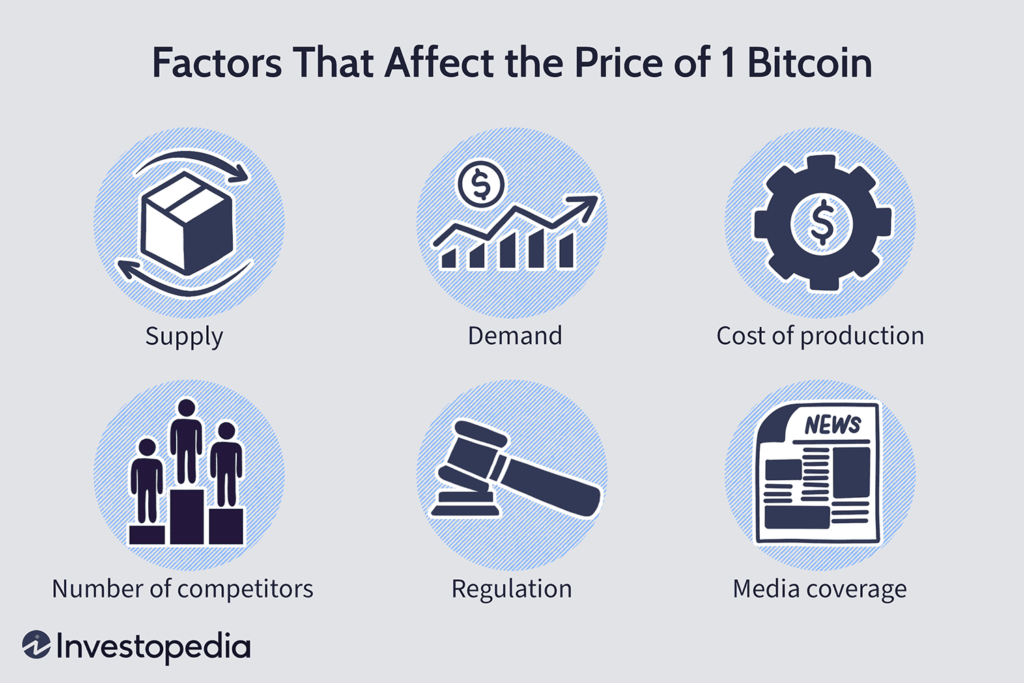

- Bitcoin’s price is primarily affected by its supply, the market’s demand, availability, competing cryptocurrencies, and investor sentiment.

- Bitcoin supply is limited—there is a finite number of bitcoins, and the final coins are projected to be mined in 2140.

Investopedia / Alison Czinkota

What Determines Bitcoin’s Price?

Bitcoin is not issued by a central bank or backed by a government; therefore, the monetary policy tools, inflation rates, and economic growth measurements that typically influence the value of a currency do not apply to bitcoin. Bitcoin acts as more of a commodity being used to store value, so the following factors influence its price:

- The supply of bitcoin and the market’s demand for it

- The cost of producing a bitcoin through the mining process

- The number of competing cryptocurrencies

- Regulations governing its sale and use

- Media and news

Effects of Supply on Bitcoin’s Price

The supply of an asset plays a vital role in determining its price. A scarce asset is likelier to have high prices, whereas one available in plenty will have low prices. Bitcoin’s supply is generally well-publicized, as there will only ever be 21 million produced and only a specific amount created per year. Its protocol only allows new bitcoins to be rewarded at a fixed rate, and that rate is designed to slow down over time.

The rate at which bitcoin is rewarded is reduced about every four years. This is called a halving, where the number of coins given as a reward for successfully mining a block is cut in half, the last of which was in May 2020.

Bitcoin’s future supply is therefore dwindling, which adds to demand. This is similar to a reduction in corn supply if harvests were to be reduced every four years until no more was harvested, and it was publicly advertised that it would happen—corn prices would skyrocket.

Bitcoin’s Price and Demand

Bitcoin has attracted the attention of retail and institutional investors, increasing demand fueled by increased media coverage, investing “experts,” and business owners touting the value bitcoin has and will have. Bitcoin has also become popular in countries with high inflation and devalued currencies, such as Venezuela. Additionally, it is popular with those who use it to transfer large sums of money for illicit and illegal activities.

This means that shrinkage in future supply has coupled with a surge in demand to fuel a rise in bitcoin’s price. However, its price still fluctuates in alternating periods of booms and busts. For example, a run-up in bitcoin’s prices in 2017 was succeeded by a prolonged low, then two sharp increases and downticks through 2021.

Production Costs and Bitcoin Price

Like other commodities, production costs play an essential role in determining bitcoin’s price. According to some research, bitcoin’s price in crypto markets is closely related to its marginal cost of production.

For Bitcoin, the production cost is roughly the sum of the direct fixed costs for infrastructure and electricity required to mine the cryptocurrency and an indirect cost related to the difficulty level of its algorithm. Bitcoin mining consists of a network of miners competing to solve for an encrypted number—the first miner to do so wins a reward of newly minted bitcoins and any transaction fees accumulated since the last block was found.

An indirect cost of bitcoin mining is the difficulty level of its algorithm. The varying difficulty levels of bitcoin’s algorithms can hasten or slow down the bitcoin production rate and affect its overall supply, thereby affecting its price.

Solving the hash to open a block and earn a reward requires brute force in the form of considerable processing power. In monetary terms, the miner will have to buy many expensive mining machines. The bitcoin-mining process also requires costly electricity bills. According to estimates, electricity consumption for the bitcoin-mining network equals more than that of some small countries.

Competition and Bitcoin’s Price

Though Bitcoin is the most well-known cryptocurrency, hundreds of other tokens are vying for investment dollars. As of 2023, bitcoin dominates trading in cryptocurrency markets. But its dominance has waned over time. In 2017, bitcoin accounted for more than 80% of the overall market capitalization in cryptocurrency markets. By 2023, that share was down to less than 50%.

The main reason for this was increased awareness of and capabilities for alternative coins. For example, Ether has emerged as a formidable competitor to bitcoin because of a boom in decentralized finance (DeFi). Investors who see its potential in reinventing the rails of modern financial infrastructure have invested in ether (ETH), the cryptocurrency used as “gas” for transactions on its network. Ethereum accounts for around 20% of the overall market cap of cryptocurrency markets.

New cryptocurrencies are introduced daily. CoinMarketCap maintains a list of recently added coins.

Other cryptocurrencies that continue to be introduced have surged in popularity. Tether, BNB, USDCoin, and Solana are a few other coins taking market capacity away from bitcoin. Even though they have siphoned some away investment dollars from the Bitcoin ecosystem, competition has attracted investors to bitcoin. As a result, demand and awareness about cryptocurrencies have increased. As a standard-bearer of sorts for the cryptocurrency ecosystem, bitcoin has benefited from the attention, and its prices have remained high.

Regulations and Bitcoin’s Price

Bitcoin was released in the aftermath of a financial crisis precipitated by the loosening of regulations in the derivatives market. The cryptocurrency itself remains unregulated and has garnered a reputation for its border- and regulation-free ecosystem.

Bitcoin’s lack of regulatory status has both benefits and drawbacks. The absence of regulation means it can be used freely across borders and is not subject to the same government-imposed controls as other currencies. However, governments and interested parties are continuing to push for cryptocurrency regulation.

Investors also influence prices when they become overly excited over an asset, causing it to be overvalued. They can also cause it to drop when they panic about possible losses. Investors need an accurate way to track and monitor coin values.

The development of a regulatory framework is only a matter of time, and the effects it will have on Bitcoin’s price are unknown. For example, in the United States, cryptocurrency rulings delivered by the Securities and Exchange Commission (SEC) can impact bitcoin’s price. In October 2021, the price of bitcoin surged to $69,000 a few weeks after the SEC approved the first U.S. bitcoin-linked ETF: the ProShares Bitcoin Strategy ETF (BITO). However, a few months after reaching that price, bitcoin’s price was hovering around $40,000.

China’s bitcoin trading and transaction ban in September 2021 affected the cryptocurrency’s supply and demand. Mining farms in China were forced to pack up and move to cryptocurrency-friendly countries. Prices fell from around $51,000 at the beginning of September to about $41,000 at the end of the month, then quickly regained and surpassed previous price levels as operations picked back up.

Social media postings from well-known people or celebrities can effect how investors feel about on bitcoin, which affects its price.

Bitcoin’s Price and the Media

In an attempt to keep investors and interested parties informed, the media and news coverage work both for and against bitcoin’s price. Changes in any of the factors previously discussed are quickly published and disseminated to the masses. As a result, good news for cryptocurrency investors tends to send bitcoin’s price up, while bad news sends it down.

Are Bitcoins a Good Investment?

Bitcoin has been very volatile in its short time as an investment asset. It’s best to speak to a finance and investment professional about your specific situation before investing in bitcoin.

What Is Bitcoin’s Current Stock Price?

There isn’t a bitcoin stock, but you can purchase shares of companies that invest in blockchain technology or cryptocurrency.

Are Bitcoins Illegal?

Bitcoins are recognized as a form of currency in many countries, but only one considers them legal tender. Outright bans exist in China, Algeria, Bangladesh, Egypt, Iraq, Morocco, Nepal, Qatar, and Tunisia.

Is It Worth Buying $100 of Bitcoin?

Bitcoin’s price is volatile, so the $100 you spend on portions of a bitcoin today may not be worth $100 tomorrow or even in the next 30 minutes. However, your bitcoin may be worth more. If you’re buying it as an investment, you should consult a finance and investment professional about your specific financial circumstances.

The Bottom Line

The combination of supply, demand, production costs, competition, regulatory developments, and the media coverage that follows influences investor outlook, which is one of the most significant factors affecting cryptocurrency prices.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes online. Read our warranty and liability disclaimer for more info. As of the date this article was written, the author does not own cryptocurrency.