bjdlzx

Investment Thesis

We previously covered Halliburton (NYSE:HAL) and recommended a hold on the stock. In a review of this thesis, we make a comparison between Halliburton and its rival Schlumberger (SLB) from not only a financial perspective but also its organic internal growth momentum. Although we commend hold for both, one has more upside potential than the other.

Organic Growth Comparison

Both Halliburton and Schlumberger boast strong credentials as products and service providers to the energy industry. The two companies are almost competing neck-to-neck in a lot of areas. However, they still differentiate in their corporate strategies and technological focuses.

– Traditional Technologies

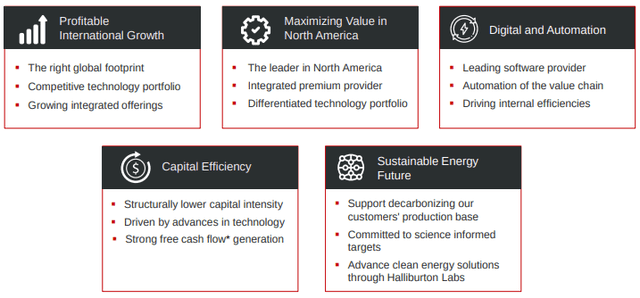

Halliburton’s operating revenue comes from two segments: Completion & Production and Drilling & Evaluation. The company focused on a balance of growth priorities in five areas, including growth in N. America and internationally, Digital and Automation, Capital Efficiency, and Sustainable Energy. Its international revenue has risen by 20% since Q1 of 2020, while its digital growth platforms in all areas of operation have become the foundation for further digitalization advantage. It has an intelligent system in Rotary Steerable (iCruise), Drilling & Logging (iStar), and Autonomous Drilling (LOGIX) with its core Zeus Fracturing system overlaid by an intelligent platform called “SmartFleet”. All the data collection has helped it to build a digital decision-making system called “DecisionSpace 365” that manages all aspects of the E&P services in the cloud. These services help its clients to better manage their operations based on Halliburton’s platform and in turn, attract more organic and internal growth from the same clients.

Halliburton: Growth Aspects (Company Presentation)

Schlumberger has the most considerable revenue contribution from Reservoir Performance, WeIl Construction, and Production Systems with digital integration for all services. The company has an overall approach that emphasizes its leading core technology and the integration of disruptive tech while maintaining its operating leverage and pricing advantages. Its digital and integration system called “Asset Performance Solution” It has started strategic initiatives since 2019, including exiting margin-dilutive, commoditized, and capital-intensive projects. In addition, the company sees the return of offshore drilling activities as the catalyst for near-term growth.

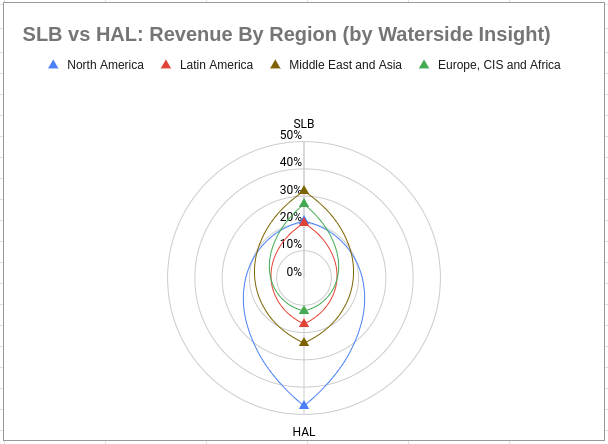

By the end of 2022, the two companies’ revenue contribution by region varies mostly in the North American region. Halliburton has almost 42% of its revenue from this region while Schlumberger only has 21%. SLB’s largest contribution came from the Middle East and Asia by 32%.

SLB vs HAL: Revenue by Region (Charted by Waterside Insight)

– Emerging Technologies

In addition to their traditional oilfield services, both company have made efforts to develop capacity in technologies that aims at transitioning targeting emission reduction, and other clean tech. For Halliburton, these would be in growing participation in carbon capture and storage, hydrogen, and geothermal, plus a clean-tech start-up acceleration lab called “Halliburton Labs”. This acceleration lab has 21 participating start-ups as of the end of last year and HAL sees it as a low-cost and low-risk way to tap into such efforts.

For Schlumberger, it boasts long-term expertise in some of these emerging techs. SLB has over three decades of experience in Carbon Solutions, including carbon capture, utilization, and sequestration (“CCUS”). The company has such a strong suit in these practices that it is down to the business model optimization that is “going beyond subsurface characterization and well construction”. In addition, it also has mature technology capability in Hydrogen generation in partnership with the French Alternative Energies and Atomic Energy Commission (“CEA”), a Geothermal and Geoenergy unit called “Celsius Energy”, and it extracts critical minerals such as lithium as part of the application of its technological know-how. All this is part of the company’s strategic initiatives launched in 2019, and some of these emerging techs already worked their way into SLB’s core business model. Based on its emission reduction technologies, it has devised a comprehensive roadmap that addresses the entire oil and gas value chain, for which it is aiming at an ambitious net zero 2050 target.

Overall, Schlumberger seems to have more mature technological developments and bolder actions in green tech at this stage than Halliburton. The front-loaded investment in developing newer tech and practices could be large. But in the long term, these emerging technologies could tilt the edge for these companies.

In Summary, on the one hand, looking at the existing capacities. The spending moderation in North America, coming from the green transition initiatives, will impact HAL more than SLB, if only judging by the numbers. Since HAL has more revenue coming from this region. While SLB reported it is expecting 2023 to post the highest revenue from the Middle East, which is “witnessing record levels of upstream investment to deliver more gas production and a combined oil increment of 4 million barrels per day through 2030”. On the other hand, the future of the energy space hinges on the green transition added to digital and AI transformation. That means whoever is going to deliver more green tech capability and provide digital control for its clients in the long term will be able to better adapt to the changes.

Financial Overview Comparison

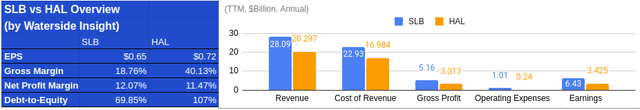

SLB vs HAL: Financial Overview (Calculated and charted by Waterside Insight)

More In-Depth Financials Comparison

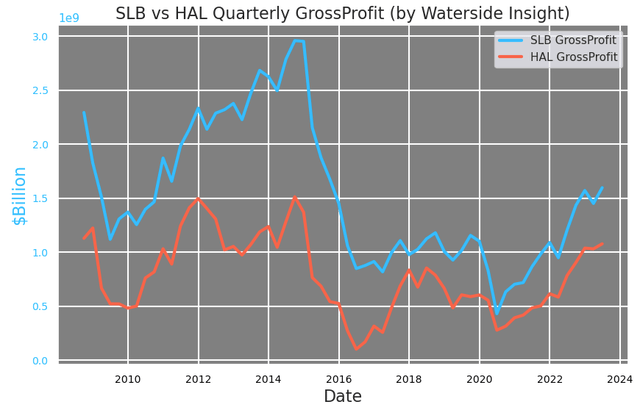

Halliburton’s gross profit in absolute value has always been less than Schlumberger’s. During 2020, their depressed gross profits were once almost the same, but SLB has since been increasingly pulling ahead of HAL.

SLB vs HAL: Gross Profit (Calculated and charted by Waterside Insight)

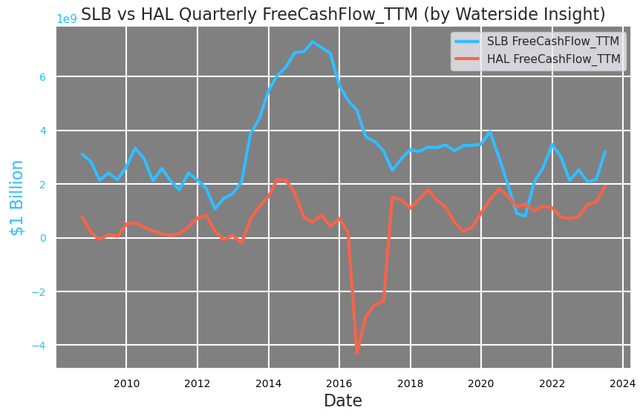

Comparing their free cash flow history shows something very different. Schlumberger is currently at its lower end of free cash flow generation, while Halliburton is at a level higher than its average, although the history of HAL is much more volatile towards the downside and SLB is the opposite.

SLB vs HAL: Quarterly Free Cash Flow (Calculated and charted by Waterside Insight)

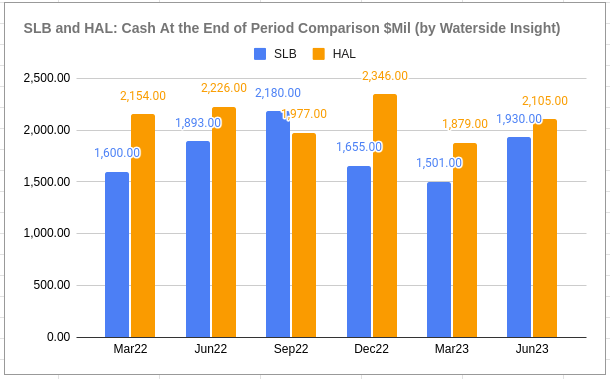

On the other hand, Schlumberger has had a larger decline in cash-at-end-of-period in the last two quarters. SLB has a decline of about a quarter of its cash-at-hand since Q3, while HAL has maintained similar levels during the same period.

SLB vs HAL: Cash-At-End-of-Period (Calculated and charted by Waterside Insight)

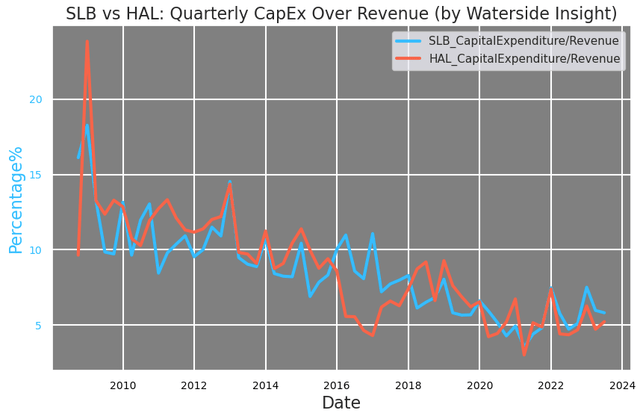

Both companies’ CapEx have very similar trends in percentage terms of revenue. This is in line with the energy industry, the energy industry’s, continuous growth in efficiency improvement. Currently, as ratios, their CapEx are both at about 5-6% of the revenue, highly efficient in maintaining their fixed assets.

SLB vs HAL: Capex Over Revenue (Calculated and charted by Waterside Insight)

Their costs of revenue and operating expenses are of similar ratios to their revenue. The cost of revenue is around 80% and operating expenses are around 5% of their revenue, respectively. The common theme is to cut down expenses and improve efficiency. Amongst the cost of revenue, HAL’s cost of services is three times the cost of product sales, while SLB is two times. That corresponds to HAL generating three times of services revenue compared to the sales of its products, while SLB generates only two times the same figures. This probably has to do with their customer base, HAL has a higher portion of customers in North America, who might be more willing to spend on the services related to the products while the overseas customers of SLB probably prefer to use their local experts to operate the equipment and products they bought from the company.

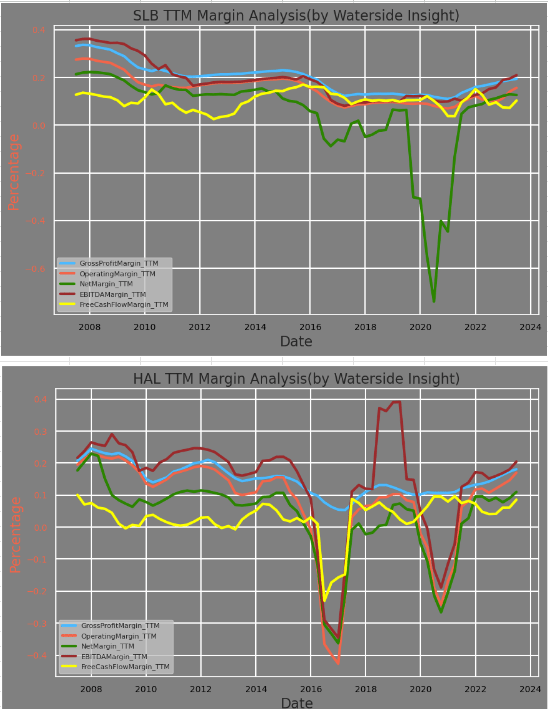

Their margins history suggested that Schlumberger weathered better during the 2016 energy sector downturn, while both companies were hit hard in 2020. During that downturn, both companies were able to keep their gross profit steady, but HAL’s rest of the margins were taken a large hit to the degree that was worse than the hit from 2020. In the meanwhile, both companies have been capable of maintaining a relatively stable gross margin, which oscillates in the mid-teens to 20%. HAL’s latest trend in TTM gross margin had a pop to the upside.

SLB vs HAL: Margin Analysis (Calculated and charted by Waterside Insight)

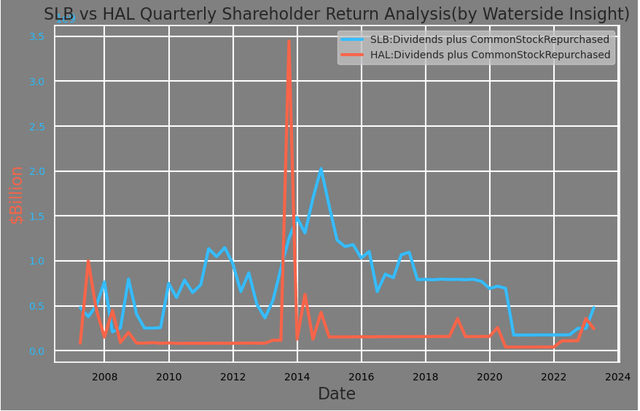

Last but not least, their history of dividend plus stock buyback shows a strong commitment to reward shareholders. But Schlumberger has a more regular payout, while Halliburton touts a large lump sum during the peak of the last energy boom.

SLB vs HAL: Shareholder Return Analysis (Calculated and charted by Waterside Insight)

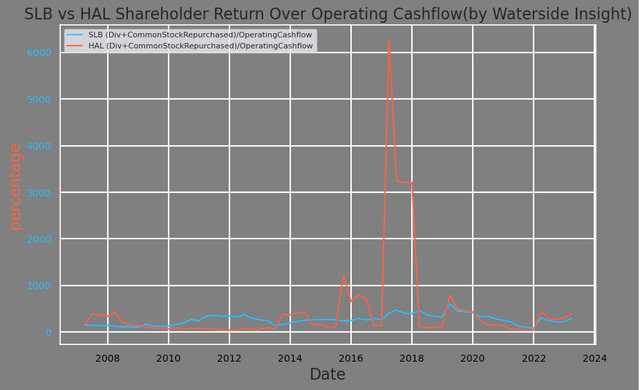

In comparison, Schlumberger’s shareholder return put less pressure on its operating cash flow and was easier to maintain for the company than Halliburton’s during times of stress, such as in ’15 and ’16. HAL had negative operating cash flow during that time.

SLB vs HAL: Shareholder Return over Operating Cash Flow (Calculated and charted by Waterside Insight)

Overall, Halliburton has a stronger gross profit margin and operating profit margin growth lately and , while Schlumberger maintains a lead in both traditional and emerging technologies due to its long history of development.

Sector Trend and Performance

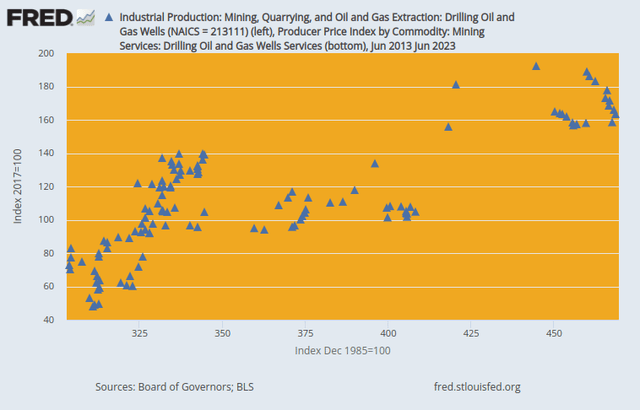

The oil and gas extraction industry as a whole has become more efficient in utilizing its capital. The chart below shows that although the capital utilization rate is at the top range, the corresponding production has reached almost 40% more than where it was during the previous peak for the industry in 2015-2016. As a secular trend, this will continue for the energy industry’s work to become lean and efficient. In effect, service companies such as Halliburton and Schlumberger are going in the same direction with stronger output and deliveries under capital efficiency constraints.

Valuation Comparison

– Past Results

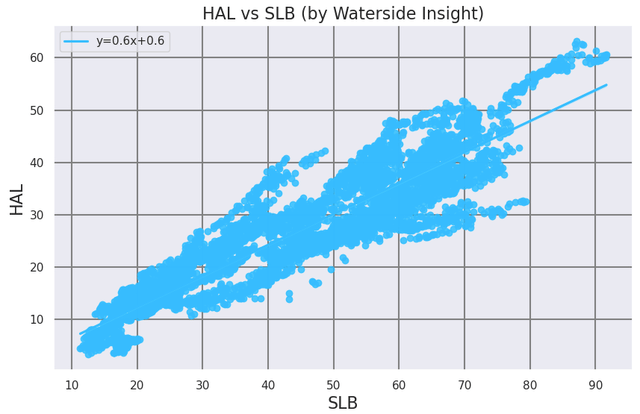

The two stocks’ prices are highly correlated with each other, not surprisingly, due to similar areas of where their work and applicable markets lie.

SLB vs HAL: Stock Prices (Calculated and charted by Waterside Insight)

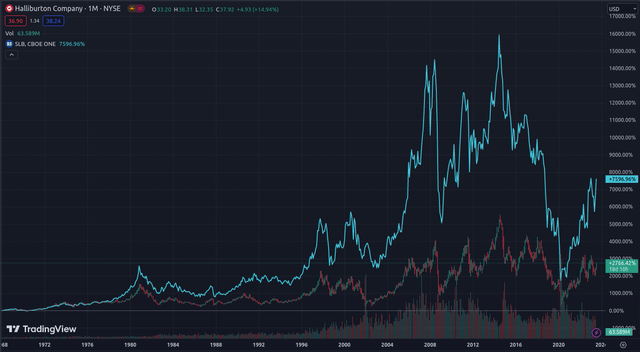

Looking at the entire stock history, SLB has solidly outperformed HAL by a long shot.

SLB vs HAL: Stock Prices (TradingView)

– Look Forward

Our analysis above shows that the largest difference between the two companies lies in their core business operations, revenue demographics, and clean tech initiatives.

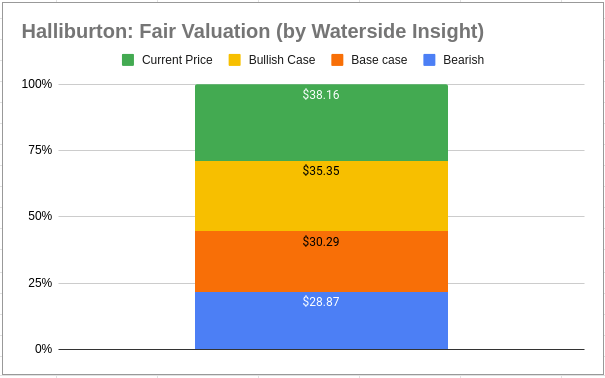

We previously assessed Halliburton’s price in March as overvalued and recommended a hold when the price was $37.85. The price has fallen by 11% from $33.63, and within a month, it is back up to $39.81. The market is still trying to find direction and this V-shape turn hasn’t changed our assessment. We maintain the same valuation that the price is overvalued and should not be bought.

Halliburton: Fair Valuation (Calculated and charted by Waterside Insight)

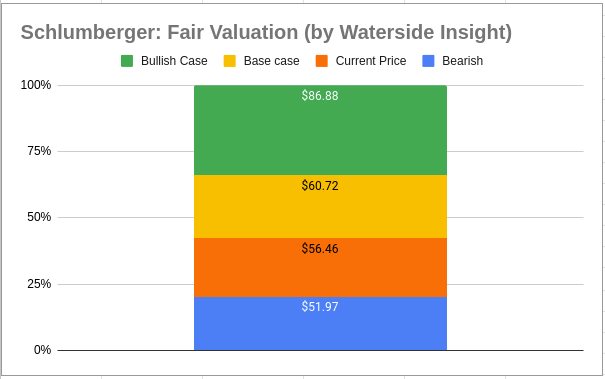

For Schlumberger, we assume its cost of equity to be 5.97% and WACC to be 6.92%. In the base case, we assume steady and single-digit growth for the next few years with some downside later due to the transition from traditional energy; it was priced at $60.72. In the bullish case, the company has stronger near-term growth due to the revival of offshore drilling that spurs its growth into higher gear; it was priced at $86.88. In the bearish case, the long-term transition has a larger downside impact on its growth trajectory; it was priced at $51.97. The price currently is a bit above the base case, but still has room to grow if the bullish scenario is realized.

Schlumberger: Fair Valuation (Calculated and charted by Waterside Insight)

Conclusion

Both Schlumberger and Halliburton are strong service providers to the energy industry. They have a lot of similarities and overlaps in their services and markets, but Schlumberger stood out as a more consistent player with the better edge in emerging technologies, while Halliburton has become more stable in the last few quarters with the help of the integration of its parts into a whole. Schlumberger has more steady growth and stronger balance sheet management than Halliburton. Through our valuations, we find Schlumberger has more upside potential while Halliburton has topped its near-term upper estimate. However due to upcoming economic uncertainty, we recommend a hold for both.