Girts Ragelis/iStock Editorial via Getty Images

Investment Thesis

Poor Q1 FY3/2024 results highlighted Sony’s (NYSE:SONY) challenging outlook into the key festive season for its hardware-related activities. With a muted outlook for the global economy, we believe discretionary consumer spending will weaken YoY, lowering earnings visibility for the company. We downgrade our previous Buy rating to Sell.

Quick Primer

Sony provides digital entertainment, consumer electronics, specialty hardware, and financial services (domestic life insurance, non-life, and online banking business). The company fully consolidated its financial services (Sony Financial) business in FY3/2021. Assets in its equity portfolio include a 58.7% stake in M3 (OTCPK:MTHRF), a 5% stake in Bilibili (BILI), a 100% stake in game developer Bungie (acquired in July 2022), and an undisclosed minority stake in the game software publisher Epic Games.

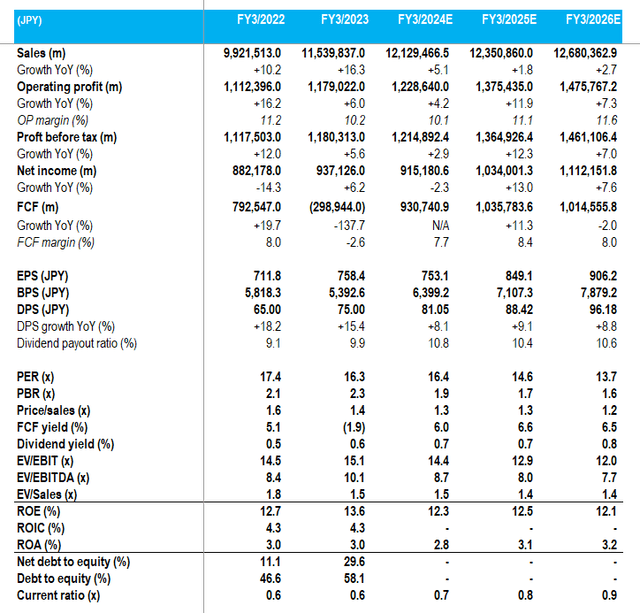

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

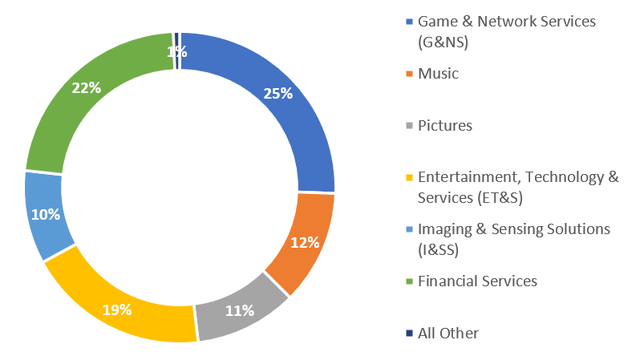

Sales split by segment – Q1 FY3/2024

Sales split by segment – Q1 FY3/2024 (Company)

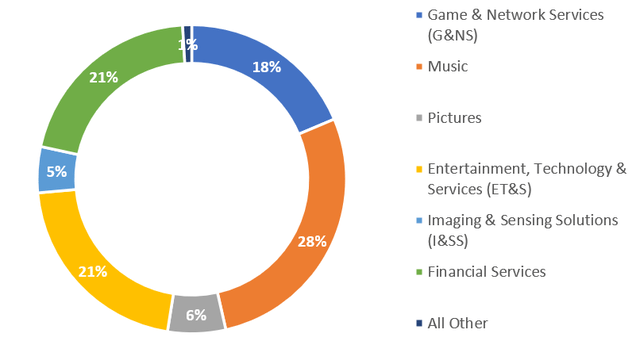

Operating profit split by segment – Q1 FY3/2024

Operating profit split by segment – Q1 FY3/2024 (Company)

Updating our View as the Company Faces a Challenging FY3/2024

We’re updating our Buy rating from January 2023, where we felt the outlook was positive given the company’s stable earnings growth with a diversified business aligned to secular growth trends such as gaming and EVs.

We previously had concerns over a slower-than-expected performance in the gaming division (Game & Network Services). The PlayStation 5 franchise continues to scale, but hardware sales reached only 3.3 million units in Q1 FY3/2024 – this showed 38% growth YoY (page 9), but was a slow start compared to the FY target of 25 million units.

Q1 FY3/2024 results were disappointing overall, with operating profit declining 31% YoY despite sales growth of 33% YoY. This was primarily due to a change in accounting treatment for the insurance business; if we take away this impact, the end result still remains quite disappointing at a 10% decline in operating profit YoY. The company revised its FY guidance, upwardly adjusting sales by 6% primarily to incorporate a weaker Japanese yen; there was no change to operating profit, and net income was raised by only 2%.

We want to assess whether the company can drive the business forward towards the critical festive season.

Challenges are Beginning to Mount

Management commented that the business is being currently run with an emphasis on risk management (Q1 deck, page 23). Hardware sales are still a major driver of the business in three key business segments (ET&S – digital cameras and consumer electronics, I&SS – image sensors currently used primarily in smartphones, and G&NS – the PlayStation platform business), and the company is wary over the slow economic recovery in China, limited demand for smartphones and televisions, and what appears to be an industry-wide slowdown in the core game sector – Microsoft (MSFT) experienced a decline in Xbox with Q4 FY6/2023 hardware sales falling 13% YoY; however, Nintendo (OTCPK:NTDOY) saw hardware sales grow 14% YoY (Nintendo report, page 10) in the same period with its wider audience.

Dealing with hardware is important due to the working capital requirements and inventory risk. There is critical seasonality for the business with the game industry and consumer electronics, and the company is aware of the economic slowdown in Europe and the US. Although guidance is said to have incorporated these conditions into account, we are skeptical – Sony has already experienced slow PS5 demand in the UK (page 4 of Sony’s Q1 deck), and we do not expect to see a recovery into H2 FY3/2024. Overall, we believe there is downside risk in H2 FY3/2024 for hardware-related sales.

Longer-Term Prospects Remain Bright but Could See Delays

Sony is planning to disclose a new medium-term plan which will commence in FY3/2025, and has mentioned expectations of a potential market recovery. Whilst we have no edge over forecasting macroeconomic conditions for the medium term, our view is that consumer confidence will remain fragile for the next 2-3 years given inflation driving the rise in the cost of living, the fall in real estate valuations, and geopolitical risks. As a provider of consumer discretionary products and services, we do not see conditions as being positive for Sony’s business.

Entertainment and image sensors are cited as long-term growth drivers for the business, and we agree with this view. However, given the current demand for EVs falling YoY on a global basis and continued pressure on spending, we believe Sony’s push into auto parts will not see a material impact on earnings for a while yet. Diversification into autos is a positive, but the earnings trajectory for the business is unlikely to be material – and current consensus forecasts which imply low single-digit sales growth reflect limited expectations.

Sony has focused on building up its digital content business via M&A, but with long lead times for development, these efforts are expected to yield long-term strategic benefits. With Activision Blizzard’s (ATVI) acquisition deal due to close in October 2023, we believe that Sony’s market position will be under greater threat from Microsoft.

We do not see major upside potential for Sony’s earnings in the medium term.

Valuation

On consensus forecasts, the shares are trading on PER FY3/2025 14.6x, which is not a demanding multiple. However, we can see multiple factors as to why the shares should trade at a low multiple – an uninspiring dividend yield of 0.7%, a conglomerate discount, and a key hardware slant to the business model.

Upside Risks and Downside Catalysts

The gaming business is driven by successful content, and key releases for the PS5 will drive demand – the company has high hopes for ‘Spider-Man 2’, as well as other third-party titles. Continued depreciation of the Japanese yen will act as a tailwind for earnings.

Consumer sentiment may remain low, dampening shopping activity in the crucial festive season, which will place FY3/2024 company guidance under threat. Whilst Sony’s relationship with China has been a relatively neutral one, the recent move to ban Apple phones highlights geopolitical tensions that could impact future Chinese customer demand.

Conclusion

We believe the current economic slowdown will have a negative impact primarily on Sony’s hardware-focused activities. Whilst financial services will remain relatively unaffected, we now anticipate downside risk to the company’s earnings outlook for H2 FY3/2024. Moreover, we believe management will find it difficult to present a positive outlook in its new medium-term plan from FY3/2025 which may act as a negative market event. Valuations are undemanding, but with no reason to invest, we downgrade our rating from a buy to a sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.