Algul/iStock via Getty Images

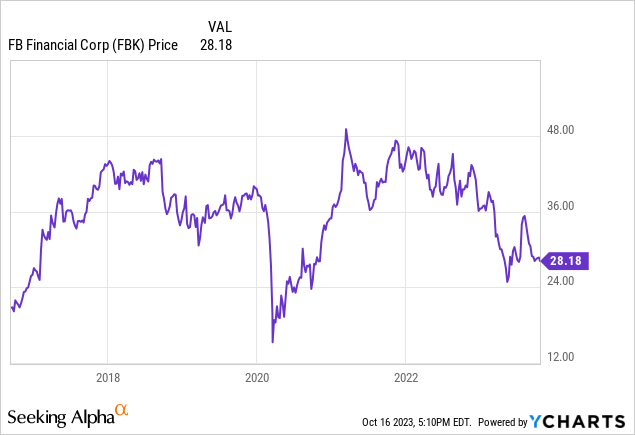

We were just asked about FB Financial (NYSE:FBK) earnings. We have not checked in on the bank since the spring, but we believe shares remain a hold/market perform. There are issues the bank is facing that are similar to countless other regionals. With that said, shares of many bank stocks have been in selloff mode for many months, and rightfully so with the pressure on margins due to the higher cost of funds, as well as anxiety over future loan demand in a softening economy. While the higher interest rate initially boosted net interest margins as loan yields were up, the cost banks are paying for deposits has surged, and we are well past peak margins. However, we continue to believe that margins are going to trough next quarter overall, and mileage will vary, but we see 2024 as a better year. This is because we believe rate increases will cease, so cost of funds will stabilize, while future loans will be issued at higher rates, thereby starting an another expansion of margins. FB Financial is now trading below adjusted tangible book value of $28.04 (adjusted), but the stock is down as earnings power is down. There really is not any yield protection here, due to a relatively paltry dividend. Loan demand itself is starting to cool as well. In this column, we continue our regional bank coverage with the just reported FBK Q3 earnings.

The stock is going to dip after this earnings report in our belief, and we think shares are entering a buy zone.

The play

Target entry 1: $27-$27.50 (40% of position)

Target entry 2: $24.90-$25.25 (60%) of position)

Stop $21

Target exit: $31

Note: This is the style of trades at BAD BEAT Investing. Options suggestions are recommended for most trades but are not shared publicly, however, we encourage options approaches for entry and cash generation.

Discussion

FB Financial is a bank in the Southeast, headquartered in Nashville, TN. The bank stock has been nailed along with much of the sector, and you can see the ramifications of the rising rate environment on earnings as represented by the 10-year chart above. While there is a lot to like here, the one thing that may keep income investors away is that the stock only offers a small 2.2% yield. We do like the consistent dividend hikes the last few years, but bonds and money markets continue to offer a far superior yield without the equity risk. With that said, the stock in our opinion is approaching a buy as operational performance troughs out.

Headline performance

We saw mixed results in the third quarter. The bank reported top line that fell 18.7% to $109.0 million versus last year, missing consensus estimates by $13.8 million. The decrease in revenues comes despite more loans being held for investment as well as an increase in tangible book value. It was solely the result of compressed margins as the cost to acquire deposits has increased dramatically. Overall, FB Financial reported net income of $19.2 million for the quarter. On a per share basis, this was $0.71 this quarter adjusted, down from $0.77 last quarter, but up from $0.68 last year. This is one of the few regional banks that saw an EPS increase, and this was a beat by $0.02 versus estimates. What about loans and deposits?

Loans and deposits grew at FB Financial

While there is a plethora of macro pressures, loans held for sale are up from the start of the year and from a year ago. Total assets are $12.49 billion, which rose from $12.26 billion a year ago, but did dip from the sequential quarter by $0.4 billion. Total loans held were $9.29 billion, rising from $9.10 billion a year ago, but ticked down slightly from the sequential quarter’s $9.32 billion. Total deposits were strong as total deposits came in at $10.64 billion at quarter-end, up from $10.01 billion a year ago. Overall, this is solid progress, and the slight declines from the sequential quarter could have been much worse, all things considered. But as we mentioned, margins were nailed.

Net interest margin

FB Financial Corporation cost of funds (basically what they pay for deposits) rose this quarter. Total cost of funds increased to 2.58% from 2.38% in Q3 2023, and the cost of interest-bearing deposits increased to 3.33% from 3.06%. That is a serious increase and really tells the story on earnings potential, and subsequently the stock. The yield on loans increased to 6.32% from 6.16% for the previous quarter. Net interest income was $101.8 million, a very slight decrease from $102.4 million in Q2. We think the trough is coming for net interest income in Q4, and thanks to stabilization in rates, the Fed hiking campaign about done, and future loans issued at higher yields, margins will start to expand again, and take the stock higher.

FB Financial’s return metrics

Obviously with the decline in margins and revenues. the return on average assets and equity fell. In Q3 the return on assets dipped to 1.05% from 1.12% in Q2 (adjusted), but is about flat from 1.06% last year. The return on average equity narrowed to 11.8% from 13.1%% in Q2 adjusted. However, we believe that given our thesis of margin troughing, these return metrics will improve in 2024.

FB Financial’s asset quality mixed

This bank’s asset quality is strong. There was a provision for loan loss expense of $6.0 million during Q3 but there was a notable provision reverse of $3.2 million on unfunded loan commitments, so there was a net provision expense of $2.8 million which dragged earnings down some. Nonperforming assets softened in Q3 as well, adding to the pressure on the stock. Nonperforming assets rose to 0.71% of all assets which was up from 0.59% in Q2. President and CEO Christopher Holmes made a key point on the increase. It was from one customer that was downgraded:

“The allowance for credit losses moved higher in the quarter as we increased our reserves related to the downgrade of a single relationship. Our net charge-offs remain low and have been at or below three basis points of average loans HFI for the last five consecutive quarters. Other credit metrics remain consistent with prior quarters.”

The allowance for credit losses, however, increased to 1.57% of all loans from 1.51% of all loans in Q2. Net charge-offs were down slightly at 0.02% of loans from 0.3%. Overall, it is mixed, but the loan portfolio continues to exhibit strong credit quality metrics on an overall basis, despite all of the uncertainty in the macro environment

Take home

Our buy thesis is based on the setup on the ten-year chart, and our belief that margins are troughing and will improve in 2024. Asset quality as a whole is strong. While the dividend and its increases are routine each year, the yield is currently low. However, into our buy zone, you will be pushing 3%, so long-term investors thirsty for capital appreciation and future income increases can consider this stock. So long as rates are done rising, we see higher yields on future loans. We also like the price of the stock relative to tangible book.