AscentXmedia

It’s been some time since we covered Norsk Hydro (OTCQX:NHYDY). The company remains an impressive specimen in terms of its low cost assets and durable competitive advantages. The issues are the undermining of the CO2 compensation schemes in Norway, despite a labour government, and just the general pressure on construction and automotive markets, although China overperforms on EVs. Overall, with some positive EV and automotive increments, we think the next 6 months could promise something better for Norsk Hydro on an operating basis, but we take issue with the current multiple and still worry about cyclical exposures.

Q3 Breakdown

Remember that Norsk Hydro is a vertically integrated producer of basic aluminium materials as well as some processed ones, using its massive hydro assets. It is a low cost, low input volatility producer that outcompetes the majority of the aluminium supply globally, a major competitive advantage since there is convexity in results when times are tough, as less competitive production goes offline.

There is some evidence that there is a deficit of products in China, which no one really expected considering their disastrous real estate situation. Some things to note are that while the important construction market has been terrible there, automotive and EV end-markets, both intensive in aluminium, have been performing well.

And it is in China that, contrary to the lack of conviction, we have seen demand performing stronger than expected, driven by strong demand in the renewables and electrical vehicle segments. While building and construction has been struggling for some time now in China, the boom in solar production has led to a strong increase in demand.

We can also comment on the changes in the CO2 compensation schemes in Norway which have reduced the benefits to low-carbon producers of aluminium compared to higher carbon producers. This is a little uncharacteristic for Norway, which is very green, but may reflect the fact that NH is already very competitive, and the economics of hydropower in terms of capacity factors and how they’re deployed in Norway, don’t really put this energy source at a disadvantage compared to dirtier energy production methods. The government will probably not grow more sympathetic to NH’s “plight” in this regard. The terms could worsen as time passes in Norway just because it’s already a given that any energy produced in Norway is from hydropower.

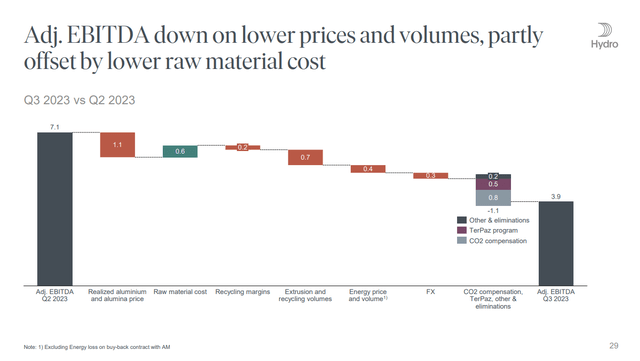

Otherwise, other markets, including Europe, have been seeing struggles in terms of construction demand which affects extrusions in particular. The UAW strikes in the US have also had a negative impact on the aluminium markets in the US. Generally, the industry is highly cyclical, and the declines in prices and volumes on rising inventories and slower demand are having a pretty major hit on even the adjusted EBITDA figures for Norsk Hydro.

There are some positive increments. China’s real estate situation could continue to deteriorate, but the EV secular tailwinds are helping offset things, and in the US we are seeing the tentative end to the UAW strikes which should revive this otherwise pretty resilient market for aluminium.

The other somewhat positive news is selling a stake in the Hydro Rein operation to Macquarie, whose asset management businesses are leaders in infrastructure. Hydro Rein is the solar and wind development business of NH. They don’t contain the hydropower assets. The valuation is decent and values NH’s equity in the business at $333 million (less than 3% of market cap). The only trouble is that as far as the Norwegian assets go, wind is under pretty heavy scrutiny. Norwegians hate wind turbines being visible in their nature, and it has led to legislation of taxes on wind assets. It essentially makes wind development in Norway a prohibitively non-economical prospect, putting a virtual end to it. Norwegians have no need for wind assets as hydro powers the whole country, but with greater electricity export since the installation of undersea powerlines, this has irritated developers and investors of these assets. They are able to continue developments elsewhere, but any pipeline in Norway will have been impaired by these changes for Hydro Rein.

Bottom Line

The company continues to adopt a pretty healthy shareholder-facing attitude and is maintaining its commitments for high yield substantially through buybacks, which they are continuing with a new programme targeting another 1.6% shares for the current quarter. Transplanting last year’s dividend forward gives us around a 9% yield, but it is likely that the dividend will come down this year proportionate to the almost 50% decline in EBITDA.

The multiple is around 9x EV/EBITDA on an annualised EBITDA basis from run-rate figures. We think there are positive increments coming in from resumed activity in US automotive, and further tailwinds from EV, but ultimately the business is highly cyclical. While its low cost assets make it a sector champion, the multiple is too high to pay for a company that is still struggling with down-cycle forces, with no end to the high interest rate environment in sight, there are still risks that currently resilient segments like automotive, which outside of the UAW hiccup is recovering nicely from semi-shortage lows, could crack.

It is still possible to buy growing businesses with less risk and for lower multiples than that so we pass on NH, but we will monitor the stock further. EBITDA is depressed, and it is somewhat normal and bullish to see lifting multiple in cyclical stocks at the bottom of their cycles. We just don’t think the full effects on its cyclical end-markets of the rate hike regimes globally have been demonstrated yet.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.