Love Employee/iStock via Getty Images

Topline Summary

Immix Biopharma (NASDAQ:IMMX) is a biotech company focused on development of novel CAR-T and other cell-based therapies for cancers and heme disorders. They are joining a growing group of companies using natural killer cell-based immunotherapy, which remains promising but unproven. Still, IMMX has a bit more data than some of the other companies, giving us a better look (though still early) of what the future might hold. This presents an opportunity that sides a bit closer to actionable than some of their peers, in my opinion.

Pipeline Overview

NXC-201

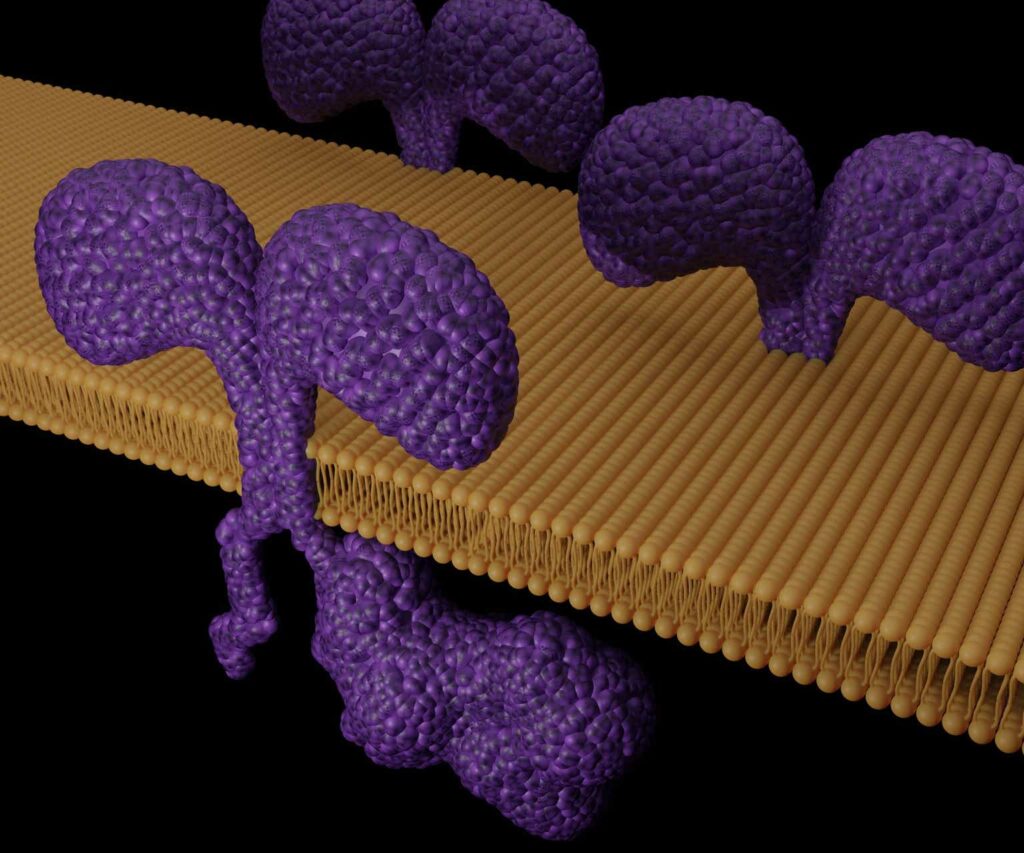

The most advanced project IMMX has developed so far is NXC-201, a BCMA-targeted CAR-T natural killer cell therapy. Unsurprisingly, the first important frontier in cancer medicine for this product candidate is in multiple myeloma, where they have Orphan Drug Designation for NXC-201.

NXC-201 will be the subject of an ASH presentation, focusing on the first 63 treated patients with relapsed/refractory multiple myeloma. In the press release regarding these findings, IMMX touts a 95% overall response rate among patients with no prior BCMA-targeted therapy exposure.

IMMX also has Orphan Drug Designation for NXC-201 for the management of light-chain amyloidosis, a challenging heme disorder that can lead to disability and higher risk of cardiac complications. IMMX announced that the FDA has approved an IND to expand human studies in this setting into the United States last month. They will also be presenting preliminary findings of NXC-201 in AL-amyloidosis at ASH next week. To date, the company has shown data for 9 patients, all of whom have achieved a response, and 6 of whom achieved a complete response despite being heavily pretreated.

iMX-110

The next project that IMMX focuses on is the so-called “tissue-specific” platform. Rather than targeting the tumor, the treatment approach is geared toward treating the entire diseased tissue, attempting to repair the metabolic pathways that contribute to immune resistance around the tumor, suppress inflammation, and ultimately aid in generating disease responses.

IMMX’s first shot on goal with this platform is iMX-110, which is being assessed in early-stage studies for sarcoma and colorectal cancer, the latter in combination with Beigene’s anti-PD1 antibody tislelizumab. To date, few results from these studies have been divulged, other than some nominal safety data. The company did report on a second interim analysis back in July showing tumor shrinkage in 3 of 4 evaluable patients with metastatic colorectal cancer.

Financial Overview

At the end of Q3 2023, IMMX held $22.3 million in total current assets, with $19.6 million of this being cash and equivalents. Their total operating loss was $4.5 million, brought to $4.3 million net loss after accounting for interest income.

At this burn rate, IMMX has between 4 and 5 quarters of cash on hand to fund operations, although this comes with the big caveat that their costs can’t grow too quickly. As they look to advance their studies, I don’t think this is likely.

Strengths and Risks

IMMX is shooting for the fences with big, largely untapped markets like amyloidosis. And they’re one of a few companies with these NK cell-based therapies that have actually demonstrated something with promise as far as data go. They currently guide that they hope to submit a BLA to treat patients with NXC-201 by the second half of 2025 after they’ve treated 100 patients in the clinical trial context. This might be optimistic, but you can definitely say the company has a plan and a vision for their market potential.

That said, I can’t look at their cash pool and feel particularly good for the very near term. They’re currently riding a wave of hype likely based mostly on some high-profile M&A activity. This is not something I’m willing to base an investment on, to be honest.

The optimistic picture for IMMX right now looks something like 1) generating promising data, and 2) raising a large-enough amount of cash to push their runway out by a year or two. Partnerships are always a possibility, but this company doesn’t have a track record of collaborative agreements that include funding.

The pessimistic picture would be that IMMX is unable to generate enough excitement to get into a position of strength, and they’re forced into subpar financing arrangements. It’s very likely they’ll find some way to keep the lights on, but that may not look so great for common shareholders.

Bottom-Line Summary

For me, IMMX presents an interesting thesis for a speculative buy, with a huge caveat about watching how their financial picture is developing. They have massive market potential, but they do not currently have the resources to even come close to realizing that. If they can definitively resolve their cash concerns, then it will be all about the data. That could be from a partnership, or a favorable equity raise. The fact that we don’t have clarity on that makes this a very risky venture, no matter how good the early data look.

But there is something compelling here from a scientific perspective, and that alone is worthy of my attention. Take this “buy” rating with a very discerning eye.