vgajic/E+ via Getty Images

On September 12, 2023 I wrote a Seeking Alpha article entitled “Seagate And Western Digital: Benefiting From AI And Generative AI Storage Demand.” This article was followed two weeks later by a September 26, 2023 blog by Finis Conner was one of the founders of Seagate Technology in 1979 entitled “Could a Hard Drive Supply Chain Crisis Push AI and Digital Ads to the Breaking Point?”

As is one of the pioneers in modern storage technologies, it was encouraging that Finis had taken the time to read and reference my article, adding a comment in concert to my thesis:

“The AI conversation is mostly focused around processors and cloud storage, but cloud storage relies on HDDs, period. Solid-state flash drives are great, but they’re still too expensive. Tapes are being used, but only for legacy data. All of the new data being created by AI will need more hard disk drives to store it on. If they can’t increase HDD production exponentially when the need arises, cloud data storage and AI simply won’t be able to grow with the demand.”

Importantly, Seagate (NASDAQ:STX) anticipates volume production of 32 TB HAMR drives in the first half of 2024, with a subsequent increase throughout the year. The company aims to qualify HAMR technology at all major hyperscalers by the end of 2024. Ultimately, Seagate envisions transitioning its entire portfolio to HAMR, with a move to 40 TB in 2025. I expect one million HAMR drives shipped in 1H 2024.

HDD Metrics

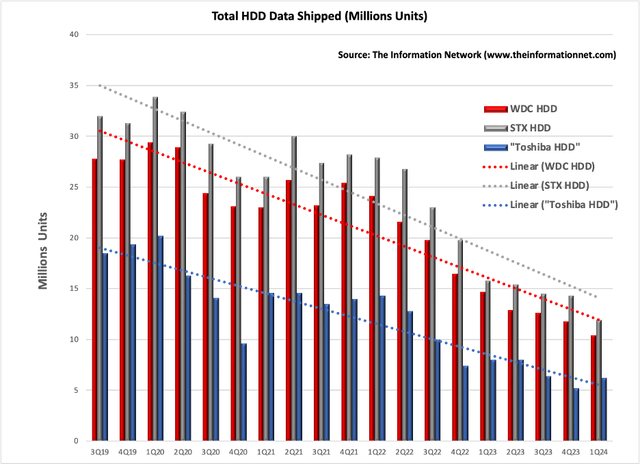

In Chart 1, I show HDD Unit Shipments for Western Digital (NASDAQ:WDC), STX, and Japan’s Toshiba. During Covid lockdowns, demand increased because of the need for increased data centers using HDDs, because of increased purchases of PCs, and the use of videoconferencing and on-line shopping. Following lockdowns, HDDs slowed from a drop in enterprise cloud storage business demand from inventory corrections.

Of note in Chart 1 is that revenues from all three companies dropped as a similar rate during the period, based on their trend lines (dotted lines).

Chart 1

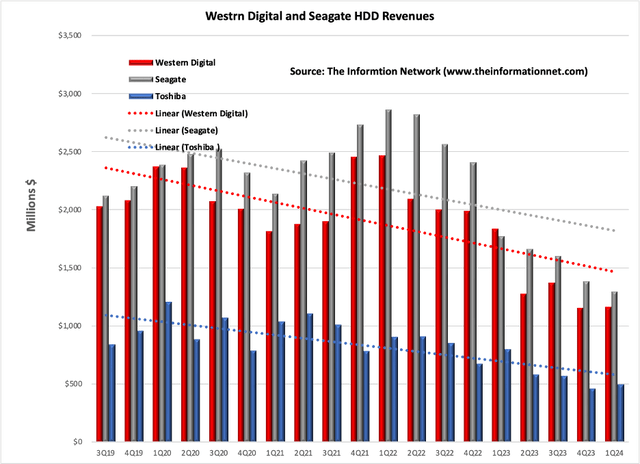

Chart 2 shows HDD Revenues for WDC, STX, and Toshiba. Here we see that revenues follow the same negative trend for all three companies during this timeframe.

Chart 2

While the above charts were data for overall HDD shipments, in principle there are three applications of HDDs – (1) Nearline datacenter, (2) Client or PCs, (3) Consumer.

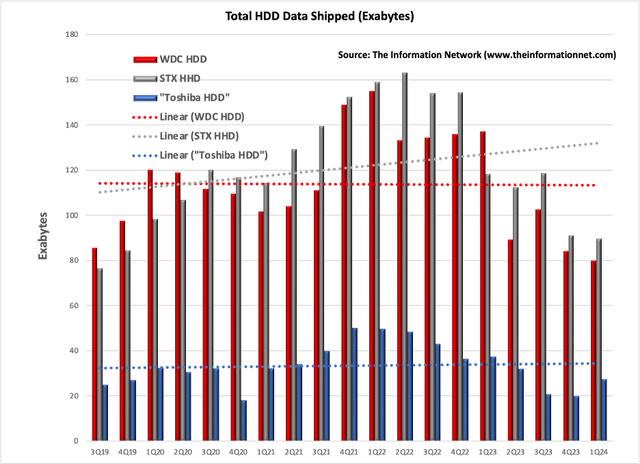

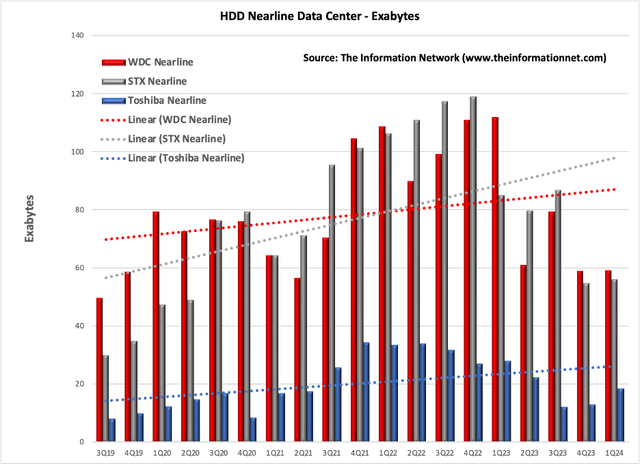

In Chart 3, I plot HDD Nearline Data Center shipments based on Exabytes of data. It shows a similar trend with data in Charts 1 and 2 above. But for the Data Center, all three companies show a positive trendline, and growth by STX is significantly greater than WDC or Toshiba.

Nearline HDDs are known for their high storage capacities. They are often used in data center environments and enterprise storage systems to store large amounts of data that doesn’t need to be accessed as frequently as data stored on SSDs.

On a percentage basis in the latest quarter, Data Center capacity in exabytes represented 74%, 62%, and 67% of Total Capacity of WDC, STX, and Toshiba.

According to The Information Network’s report

The Hard Disk Drive (HDD) and Solid State Drive (SSD) Industries: Market Analysis And Processing Trends, more than 90% of exabytes in cloud data centers are stored on HDDs, and the remaining 10% are stored on SSDs.

The Information Network

Chart 3

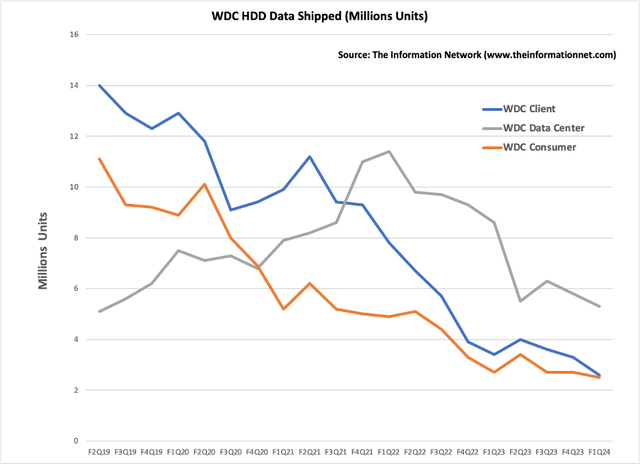

Shown in Chart 4 are Total HDD Shipped. On a percentage basis in the latest quarter, Data Center capacity in exabytes represented 74%, 62%, and 67% of Total Capacity of WDC, STX, and Toshiba.

Chart 4

While 3.5” HDDs are used in desktop PCs, they have been replaced in notebooks by SSDs (solid state drives). Chart 5 shows the drop in Client HDD shipments. In the latest quarter, WDC’s 2.6 million Client HDDs represented 25% of the company’s total HDDs.

Also shown for comparison purposes are Consumer and Data Center shipments.

Chart 5

Investor Takeaway

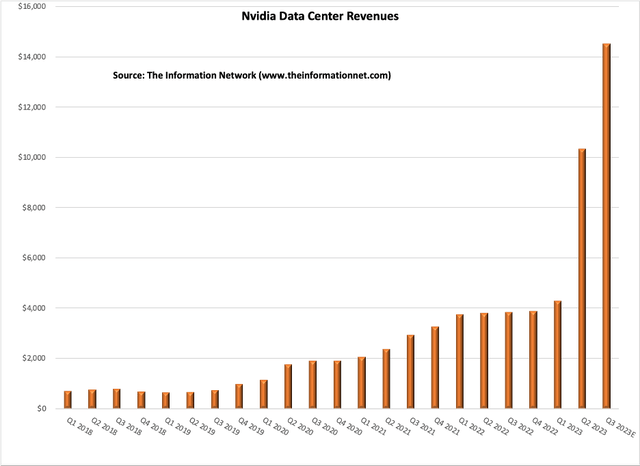

Nvidia’s (NVDA) third-quarter Data Center revenue of $14.51 billion, which was up 41% from the previous quarter and up 279% from a year ago, as illustrated in Chart 6. The strong gains in the past two quarters are yet to be realized at the data center for HDDs.

Chart 6

Also, while data shown in Charts 1-4 above show a drop in HDDs, this drop is most noticeable in 2022, which has been marked by a slowdown in data centers from a weak cloud capex spend in 2023, which I estimate was down 3% YoY globally on inventory overhang. But 2023 was significantly worse in China, where capex spend will be down 17% YoY.

For 2024, the combination of a reduction in inventory to normal levels and the demand for AI by hyperscalers will push cloud capex to a 20% YoY growth. That would result in a significant recover in the nearline data center HDD market.

HDDs continue to offer approximately five times better cost efficiency per bit compared to equivalent flash solutions, and we anticipate this difference to persist through the end of the decade.

Looking ahead, HDDs are expected to maintain market share, thanks in part to advances that continue to increase capacities while maintaining performance. I forecast that HDDs are well-positioned to dominate data centers for the next 10 years.

For example, Seagate’s HAMR (Heat-Assisted Magnetic Recording) and WDC’s MAMR (Microwave-Assisted Magnetic Recording) are advanced technologies designed to enhance the storage capacity and performance of hard disk drives (HDDs), a type of data storage device that uses spinning disks to store information magnetically. Both HAMR and MAMR aim to overcome the limitations imposed by the superparamagnetic effect, which becomes significant as data bits are packed more densely on HDD platters.

Chart 7 shows that since the beginning of 2023, there has been a bifurcation in share price between Nvidia, Seagate, and Western Digital. This disconnect in share price will get smaller as demand for storage products will be strong. Chart 7 shows share price changes for a 1-year period. I added the S&P Technology Select Sector Index (IXT) as a check for performance of STX and WDC.

YCharts

Chart7

The two U.S. HDD vendors, Western Digital and Seagate reported YoY HDD revenue drops of 38% and 27%, respectively. The Street is giving different signals. Nvidia share price is up 197% YoY in concert with its strong earnings, but WDC and STX shares are up as well, +26% and +42% for the year, respectively, despite revenue drops.

In response to its continued drop in Revenues (Chart 2) Seagate in its F1Q23 call noted that weak economic trends in China, soft demand in the legacy markets and continued inventory digestion by clients affected the top-line performance. The company added that cautious IT spending trends remain concerning, especially for the Enterprise Systems market.

The downturn in the HDD sector has had its fallout in recent weeks:

- Aside from revenues and other HDD metrics, which I discuss in this article, from a business standpoint the merger between WDC and Japan’s Kioxia was called off at the end of October 2023. I anticipated this and alerted readers in a June 22, 2023 Seeking Alpha article entitled “Is The Western Digital And Kioxia Merger Dead?”

- Resonac Holdings Corporation announced on September 18, 2023 that its subsidiary, Resonac Corporation, has decided to terminate a hard disk media business in Taiwan. Resonac is cutting staff in three waves and is fully closing its Hsinchu factory which used to employ nearly 600.

Clearly, any company with an “AI” in the title or business plan has been performing strongly YTD. It was my contention that STX and WDC have a symbiotic relationship with NVDA and AI, and I expect share prices to start ramping once investors are made aware of this.