THEPALMER

Investment Thesis

BRP Inc. (NASDAQ:DOOO) is an adventure sports vehicle manufacturer based in Valcourt, Canada. Since my last analysis, the stock price has corrected 15%. After analyzing its Q3 FY24 financial performance and its future growth prospects, I am updating my rating to Hold. In this thesis, I will be looking into the company’s third-quarter results and its valuation at current price levels. The past few quarters have been challenging for the company, with softened demand and macroeconomic headwinds impacting its revenues and profit margins. The situation is not expected to improve in the near future, and the revenues are expected to remain subdued.

Company Overview

DOOO is a leading manufacturer and distributor of multiple adventure sports vehicles and marine products. The company’s business can be segregated into four different segments: year-round products, seasonal products, Powersports PA&A and OEM engines, and the marine segment. The year-round products segment contributes the majority of the revenue at 48%, followed by seasonal products at 35%, Powersports PA&A and OEM engines at 13%, and the marine segment at 4%. The company operates under multiple brands to market products across different segments. They have a network of more than 3200 dealers globally, the majority of them located in the North American region.

Investor Relation DOOO

Q3 FY2024 Result

DOOO reported weak third-quarter results, missing the market Revenue estimates by 7.5%. The EPS was largely in line with the estimates. As per my analysis, the seasonal products segment primarily dragged the revenues down with a fall of 15% y-o-y. The Seasonal products segment was the worst performing in Q3, with its products like personal watercraft (PWC) witnessing a fall of 50% in units sold y-o-y. I believe the decline in the disposable income for clients from EMEA countries, especially due to higher energy costs and sky-high inflation, has resulted in a decline in demand for leisure products that DOOO has to offer. The revenues across all segments declined except for the Powersports PA&A and OEM engines segment, which saw an increase of 6% in revenues. The following amounts are in Canadian dollars (CAD).

It reported total revenue of $2.46 billion, down 9% compared to $2.7 billion in the same quarter last year. The year-round products segment revenues stood at $1.18 billion, down 7.8% compared to $1.28 billion in the same quarter last year. As per my analysis, the disruption in the supply chain across the US-Mexico border resulted in delayed order deliveries, negatively impacting revenues. The management has clarified that the issues relating to the border inspection that resulted in this supply disruption have now been resolved. I believe even if we take away the supply chain impact, the decline in demand for its premier product, 3WV, will continue to affect the revenue throughout FY24. As I mentioned earlier, the Seasonal products segment was the worst performing, with a 15% decline in revenues to $868 million, down 15% compared to $1020 million in the corresponding quarter last year. The decline in demand for PWC majorly contributed to this fall but was partially offset by a strong performance by snowmobiles, with a 70% increase in the units sold in Q3. The Powersports PA&A and OEM engines segment was an outlier, reporting a 6% increase in revenues at $314.5 million, compared to $298 million in the same quarter last year. However, if we analyze the numbers in detail, it becomes clear that the increase accounted for $5 million in foreign exchange gains, which clearly implies that organic growth was missing. The Marine segment revenues stood at $106.7 million, down 10.2% compared to $118.8 million in the same quarter last year. All products in the marine segment saw a decline in units sold, partially offset by the favorable price mix. The revenues across segments lacked organic growth. I believe weak demand will sustain itself even in the coming quarters, and investors should wait till there are clear signs of recovery from the US and EMEA countries.

The company reported gross margins of 25.4% for Q3, a slight improvement compared to 24.2% in the same period last year. The operational expenses, on the other hand, rose 14.7% to $309.6 million. The increased investment in research and development resulted in this increase. The research and development expenses stood at $114.4 million, up a significant 42% compared to $80.6 million in the corresponding quarter last year. The diluted EPS was reported at $0.81, down from $1.76 in the same period last year.

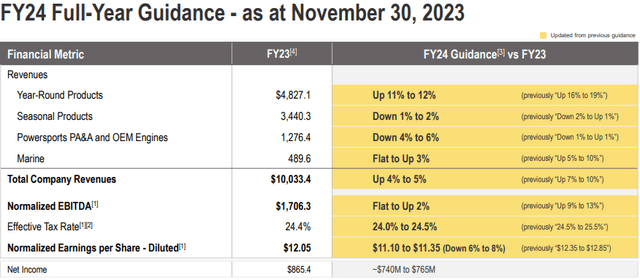

Investor Presentation DOOO

Overall, the company failed to impress on multiple parameters, including revenues and profits. The management’s future guidance doesn’t instill much confidence either. It updated its FY24 revenue guidance to $10 billion and diluted EPS in the range of $11.1-$11.35. Both the revenue and EPS guidance witnessed a cut due to the projection of a softer Q4 owing to economic headwinds. I believe the company is likely to experience weaker demand even in FY25 as the interest rates are not expected to go down anytime soon, and inflation is at an all-time high, leaving low disposable income in the hands of clients.

Valuation

DOOO is currently trading at a share price of $66.68, a YTD decline of 10.5%. It has a market cap of $4.98 billion. DOOO is trading at a forward P/E multiple of 7.8x, with an FY24 EPS estimate of $8.49($11.35 converted to USD). Comparing this to the sector P/E of 15.7x, I believe it is trading at a cheap valuation. DOOO is a market leader in the adventure sports industry and could trade at a premium valuation if its performance gets back on track. As of now, I would recommend existing shareholders hold the stock, but initiating a fresh buying position is not advisable.

Conclusion

The economic headwinds have resulted in weak demand across business segments. The revenue is witnessing a decline with no clear signs of organic growth. The updated FY24 guidance reflects that the revenues and earnings could remain muted in the near future. The stock is trading at a forward P/E multiple of 7.8x, significantly lower than the sector median. Considering all these factors, I am assigning a Hold rating for DOOO.