Hispanolistic

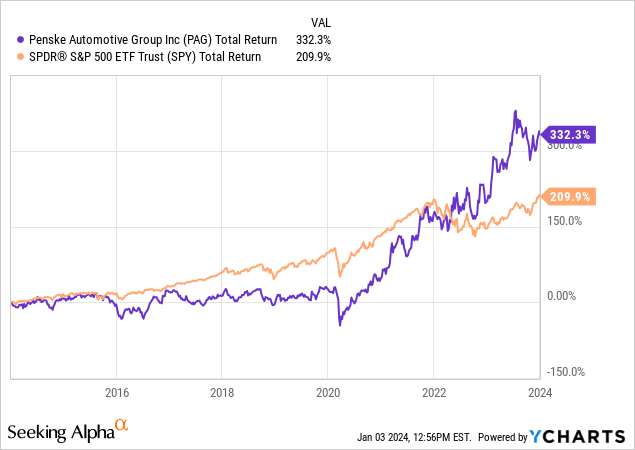

Penske Automotive Group, Inc (NYSE:PAG) has an impressive history of delivering results for shareholders. PAG has outperformed the S&P 500 over the past 1, 3, 5, 10, 15, and 20 year trailing periods. Over the past 10 years, PAG has delivered a total return of 332% compared to a total return of 210% delivered by the S&P 500.

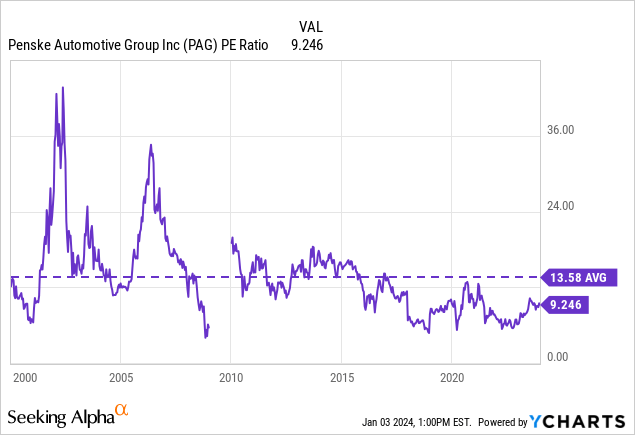

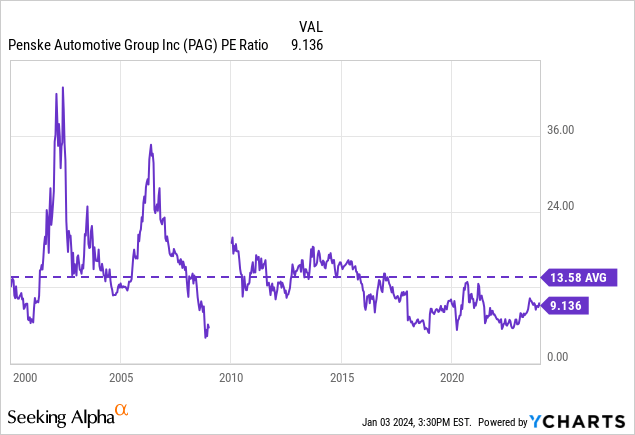

This outperformance has been driven primarily by earnings growth as the stock’s P/E ratio has generally moved lower over-time and is currently trading well below its long-run historical average.

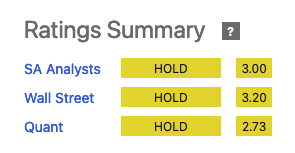

Currently, PAG is rated a Hold by Seeking Alpha and Wall Street analysts. There are five reasons why I disagree with this characterization and am bullish on the stock:

1. Industry consolidation story has a long way to go

2. Defensible moat due to state regulations

3. Business is highly diversified

4. Risks related to lower EV service costs are overstated

5. Attractive valuation relative to broader market and reasonable valuation vs peers

Seeking Alpha Y Charts

1. Industry consolidation story has a long way to go

Over the past 10 years, PAG has grown EPS at a 20.6% CAGR. This is extremely impressive given the high mature nature of the automobile industry. A major driver of the growth story for PAG has been acquisitions. For FYs 2018, 2019, 2021, and 2022 PAG spent $309 million, $327 million, $432 million, and $393 million respectively. Through September 30, 2023 PAG has spent $211 million on acquisitions. Thus, since 2018 PAG has spent a total of ~$1.7 billion on acquisitions. To put this number into context consider that today the company has a market cap of $10.8 billion. Prior to 2018, PAG also has a very long history of successful acquisitions.

Despite significant consolidation in recent years, the U.S. franchised automotive dealer industry remains highly fragmented. Total industry revenue is estimated at ~$1.2 trillion. Publicly held automobile retailers account for less than 10% of industry revenue while more than 90% of industry revenue remains in the hands of smaller independent dealers.

Benefits to scale in the auto retail industry include potential for cost savings in key areas such as advertising, purchasing, vehicle sourcing, and technology costs. It is estimated that larger dealership groups receive a 20-30% discount on costs from most vendors in the industry.

Moreover, further industrywide consolidation has the potential to drive decreased competition and better pricing power for remaining dealers.

Despite being one of the largest automobile dealers in the U.S., PAG is currently estimated to have just 0.9% of U.S. new car dealership revenue market share.

Given the highly fragmented nature of the industry I believe PAG will be able to achieve solid earnings growth through continued acquisitions for many more years. For this reason, over the long-term I believe PAG will be able to deliver EPS growth which is better than the expected 7.4% motor vehicle and parts industry growth rate.

On the company’s Q3 earnings call management noted that is has a potential acquisition pipeline of more than $2.5 billion under consideration.

2. Defensible moderate moat due to state regulations

It would not be appropriate to classify the automobile retail business as a wide moat business given the fact that it is fairly competitive. That said, I would classify the automobile franchise retail business as a moderate moat business.

Existing players in the automobile business benefit from franchise agreements which offer certain protections from competition in a geographic area. In many states, regulations have been put in place to protect smaller dealerships from extremely large manufactures. Moreover, franchise laws generally provide protection from termination by the manufacturer under most circumstances. This is mentioned in PAG’s 10K:

In the U.S., we benefit from the protection of numerous state franchise laws that generally provide that a manufacturer or distributor may not terminate or refuse to renew a franchise agreement unless it has first provided the dealer with written notice setting forth good cause and stating the grounds for termination or non-renewal. Some state franchise laws allow dealers to file protests or petitions or to attempt to comply with the manufacturer’s criteria within the notice period to avoid the termination or non-renewal.

Thus, while there is certainly competition in the automobile sale and service business the degree of competition is somewhat constrained in the U.S. due to regulations.

PAG’s business outside the U.S. also enjoys certain characteristics which provide some degree of a moat around this business. For example, PAG is the exclusive distributor of Western Star commercial trucks, MAN commercial trucks and busses, and Dennis Eagle refuse collection vehicles, in addition to associated parts, across Australia, New Zealand, and parts of the Pacific.

Warren Buffett, who favors high quality businesses with defensible moats, signaled his belief that the automotive retail business is attractive when he acquired Van Tuyl Group in 2015.

Further evidence for the existence of a medium sized moat around PAG’s business can be seen in the fact that is has been able to deliver very solid long-term results for shareholders driven by earnings growth despite being in a mature industry.

3. Business is highly diversified

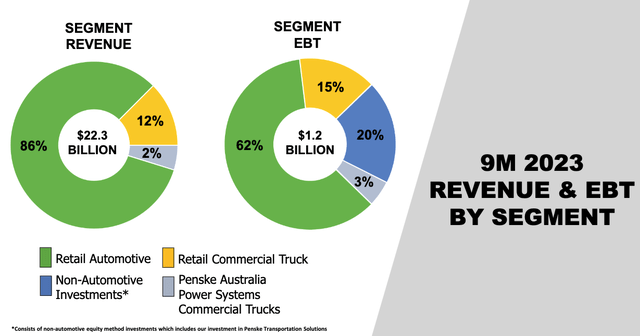

PAG is a highly diversified business. The company generates ~61% of revenue from the U.S., 31% from the U.K., and 8% from other countries.

The retail automotive business is PAG’s most important and accounts for ~62% of segment EBT. PAG ownership stake in Penske Transportation Services (which consists of a truck leasing business and a logistics business) contributes ~20% of EBT. The other major driver for PAG is the commercial truck dealership business which accounts for ~15% of segment EBT.

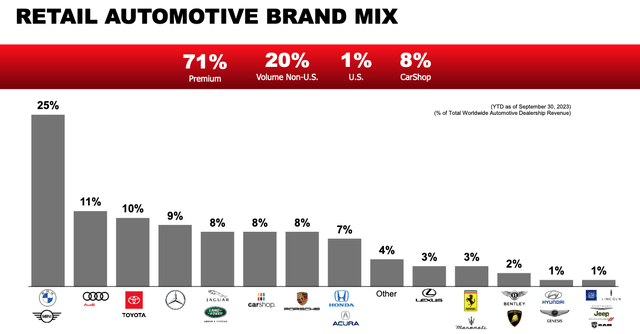

In terms of brands, PAG is also diversified. BMW is the company’s largest brand and accounts for 25% of dealership revenue.

While most of PAG’s publicly traded peers such as Group 1 Automotive (GPI), AutoNation (AN), and Lithia Motors (LAD) are diversified in terms of brand exposure they do not have a significant international, commercial, or logistics presence.

The diversified nature of PAG’s business is a positive as it reduces exposure to any one specific brand or market segment. I believe this reduces risk relative to pure play automobile retail companies. Q3 2023 results highlight the advantage due to diversification. During the quarter, retail automotive revenue increased 9% while commercial truck revenue decreased 9% both on a year-over-year basis. Earnings from Penske Transportation Segment decreased by 38% on a year-over-year basis due primarily to higher interest and maintenance costs.

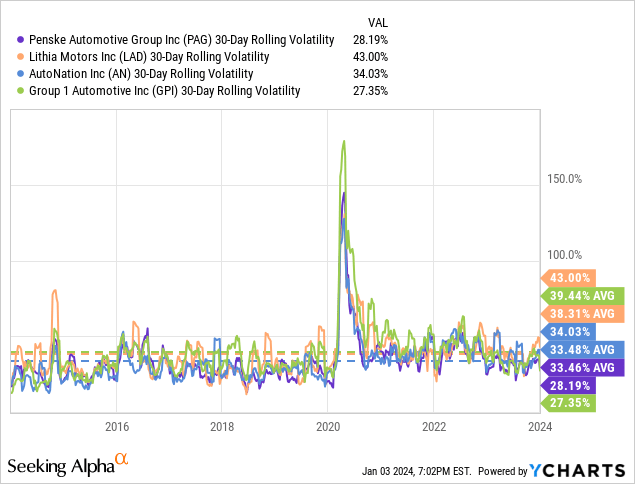

Benefits related to diversification can be seen in the fact that PAG shares have historically exhibited volatility towards the lower part of its peer group.

Additionally, I believe the company’s international presence is a key positive as it provides additional growth opportunities and some degree of economic cycle diversification.

PAG Investor Presentation PAG Investor Presentation

4. Risks related to lower EV service costs are overstated

One of the reasons why some other analysts are currently cautious on PAG is related to the risk that a shift towards EVs is likely to result in lower service revenues for dealerships. EV’s are generally believed to have lower maintenance costs relative to gas powered cars due to the fact that EVs have fewer parts. However, given the recent adoption of EV’s the actual cost difference is still a topic of debate.

A 2020 consumer reports survey suggested that EV owners can expect to save $4,600 in repair and maintenance costs over the list of the vehicle compared to gas powered cars.

However, recent research conducted by Kelley Blue Book suggests that the EVs have five year maintenance costs of $4,246 compared to $4,583 for gas powered cars. Additionally, over a five year period EVs have an average repair cost of $1,712 vs $1,695 for gas powered cars.

While EV’s may, on average, have somewhat lower total service costs it is important to note that much of the savings is related to routine low-margin maintenance such as oil changes. McKinsey has noted that even though EVs typically require less maintenance work than gas powered vehicles each maintenance visit may actually generate increased revenue per service hour:

Even though EVs typically require less maintenance work than ICE vehicles, with less frequent service touchpoints, servicing EVs requires specialized capabilities, as the tasks involved are more complex. Because of this, each maintenance visit may necessitate more billable service hours and generate increased revenue per hour. And dealers might offer new service offerings. For example, an increasing penetration of advanced driver-assistance systems (ADAS) means that more vehicles may need to go through a typically lengthy and complex sensor-calibration process.

Increased adoption of EVs also has the potential to provide dealerships a competitive advantage over do-it-yourself and independent service shops due to the special tools, training, and access to software which is needed to complete more complex.

One interesting data point to note in the fact that EVs now account for 10% of the global auto market but growth appears to be slowing. During 2023 in the UK, which is a key market for PAG, EV’s accounted for ~16.5% of new vehicles sold in 2023 down from 16.6% during 2022. Ford, General Motors, and Audi have recently announced EV production cuts. Thus, these changes suggest the shift to EVs may be slower and less dramatic than initially anticipated.

Ultimately, the impact of increased EV adoption on dealer profitability is not easy to predict based on current data points. However, I believe any negatives related to the EV shift such as lower total service costs will be offset by benefits such as higher margin servicing visits and increased preference for dealership servicing vs independent shops.

5. Attractive valuation relative to broader market and reasonable valuation vs. peers

Currently, PAG trades at 10.3x consensus FY 2024 earnings. I view this valuation at highly attractive relative to the 21x forward earnings multiple of the S&P 500. While PAG earnings are likely to exhibit more volatility than the broader market, I believe PAG will be able to grow earnings at least inline with the broader market over the long-term. That said, near-term earnings growth may be slower due to a boom in the automobile market post COVID which has created challenging comps over the past few years. Over the next 10 years, I would not be surprised to see PAG grow EPS at a rate well above the broader market given the potential growth related to further M&A.

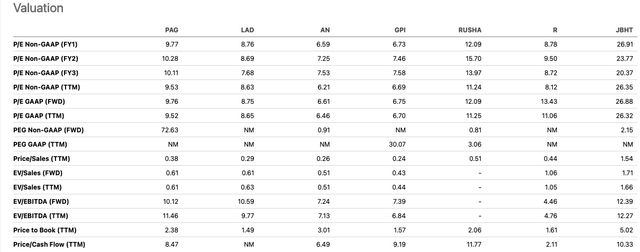

PAG trades at a modest premium to retail focused automobile dealership companies such as LAD, AN, and GPI which trade at ~8x FY 2024 earnings. One of the reasons for this is that PAG is more diversified and has exposure to the commercial dealership business is viewed as being a higher quality business.

The largest commercial dealership in the U.S., Rush Enterprises (RUSHA) trades at 15.7x consensus FY 2024 earnings. PAG also has exposure to the truck leasing business and logistics business through its stake in Penske Transportation Solutions (“PTS”) which accounts for ~20% of segment EBT. I believe this business can be proxied by looking at Ryder (R) which is focused primarily on leasing and fleet management and J.B. Hunt (JBHT) which is focused more on logistics. PTS has exposure to both of these business thus I believe the average forward multiple of 16.6x is reasonable.

Thus, taken together based on these metrics and the breakdown of PAG earnings I believe a reasonable valuation for PAG based on peers is ~10.9x.

Historically, PAG has traded at an average P/E ratio of 13.6x and thus I believe the stock’s current valuation is also reasonable relative to historical norms.

PAG also has an active repurchase program in place. During Q3 2023, the company repurchased 81,253 shares in the open market at an average price of $161.55 per share. Currently, PAG has a remaining buyback authorization of $233.1 million.

Recent purchases were above the current market price which suggests that management views the stock as attractive at current levels.

Seeking Alpha

Key Risk to Consider

One key risk to consider with PAG is the potential for a sharp economic slowdown. While PAG’s large servicing business tends to be less sensitive to economic conditions, the company’s new vehicles sales and logistics businesses are much more economically sensitive. A sharp economic downturn is likely to lead to much lower earnings than are currently expected. While this is not my base case, I believe the company is well positioned to weather an economic storm. PAG currently has leverage ratio of just 1x and has reduced long-term debt to $1.7 billion from $2.4 billion in 2019. While an economic downturn might lead to lower near-term earnings, PAG benefit over the long-term as an economic downturn may create attractive acquisition opportunities as it is harder for small dealership chains to ride out an economic storm.

Conclusion

PAG has an impressive history of delivering solid shareholder returns that have exceeded the broad stock market indexes.

One of the key drivers of the company’s long-term success has been an aggressive acquisition strategy. Despite recent consolidation the automobile retail industry remains highly fragmented. I believe this will allow PAG to continue benefiting from a strong M&A strategy.

While the automobile and commercial retail business is not a wide moat business, I do believe it is characterized by a medium moat. Franchise agreements limit the amount of competition that incumbent dealers face in each market. I view PAG’s strong historical performance as an additional data point which suggests that a moderate defensible moat exists in its business.

PAG benefits from diversification as the company is exposed to different end markets which are not perfectly correlated. While EVs may offer lower total service costs, I believe this will be offset by higher margin servicing and an increased preference for dealer servicing compared to independent shops.

I view PAG’s current valuation as highly attractive vs the broader market and reasonable vs its peers and own historical valuation history.

For these reasons, I am initiating PAG with a buy rating and would consider upgrading the stock to a strong buy if the valuation were to become more attractive.