aquaArts studio

March 19th ended up being a fantastic day for shareholders of Core & Main, Inc. (NYSE:CNM). Shares closed up 7.5% after management reported financial results for the final quarter of the company’s 2023 fiscal year. Although the business fell short of analysts’ expectations when it came to earnings per share, revenue exceeded forecasts and management came out with strong sales guidance for 2024.

While not everything is great, the picture does seem to be pointing toward continued expansion. But if you have been a long-time investor in the company, you are probably used to this. Between robust financial results achieved from organic growth, and acquisition-based growth, sales, profits, and cash flows have long been climbing. And the stock price has reflected that. Year to date, units are up 37.6%. And over the past year, the stock has climbed 157.9%.

This is all, without a doubt, positive. But the sad truth is that shares of a company can only justify so much upside before further upside is unwarranted. And while I will admit that there might be some additional upside from this point on, it certainly won’t be easy to achieve. If anything, given how shares are priced, I think we are looking at a company that is fairly valued or awfully close to it. So given these thoughts, and in spite of the massive ascent that shares have seen recently, I believe that a “hold” rating is likely appropriate at this time.

A look at Core & Main

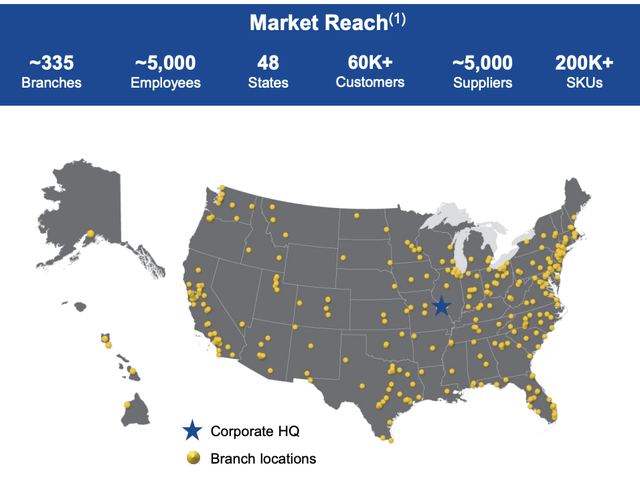

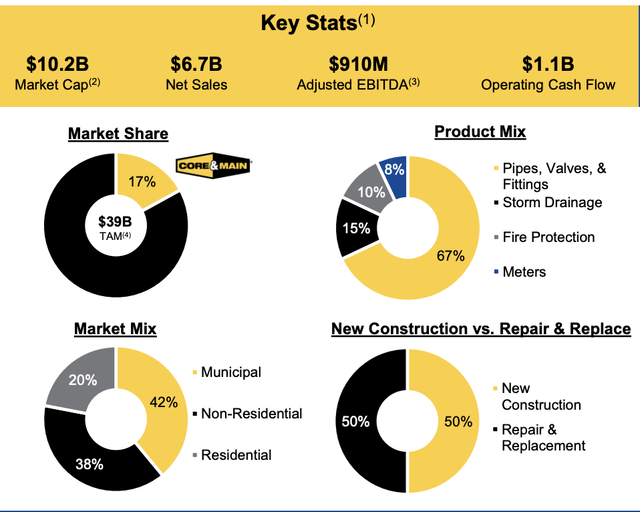

Most people have likely never heard of Core & Main despite it being a fairly sizable company with a market capitalization of $11.24 billion as of this writing. Because of this, a bit of a dive into exactly what it does and how it operates is in store. For starters, the company was founded back in 1874. And between organic growth and a series of mergers and acquisitions, it ultimately expanded into the giant that it is today. Its network consists of 335 branch locations spread across 48 different states. Through these branches, the company works with around 5,000 suppliers to service approximately 60,000 customers with an estimated portfolio of 200,000 SKUs (stock keeping units).

The products in question include, but are not limited to, pipes, valves and fittings, storm drainage products, fire protection products, and more. It even provides smart metering products and offers various services such as those related to fabrication. Its largest area of emphasis when it comes to customers that it serves would be the municipal construction sector, which was responsible for 42% of its revenue during its latest completed fiscal year. The non-residential construction sector accounts for another 38% of revenue, while 20% involves the residential construction sector.

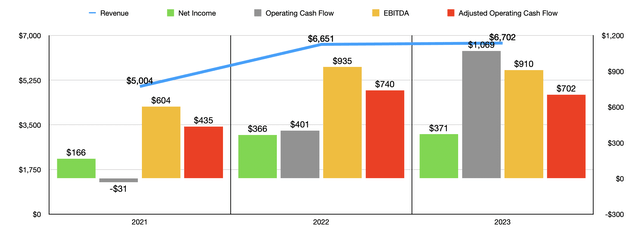

Operationally speaking, things have been quite positive for the company in recent years. Revenue has grown from $5 billion in 2021 to $6.70 billion in 2023. About 97% of the growth that the enterprise achieved during this three-year window of time came from its 2021 to 2022 fiscal window. Higher selling prices were responsible for around 75% of the sales increase the company saw during that time frame, while volume growth and acquisitions accounted for the rest.

This is not to say that acquisitions have not been significant for the company. They certainly have. In 2022, for instance, the company made two major acquisitions for a combined $70 million. Other smaller acquisitions, all combined, cost shareholders another $54 million. And from 2020 through 2021, the company spent $401 million on the purchase of various other firms. During the 2023 fiscal year, the company made 10 different acquisitions for a combined $244 million. Naturally, all of these have added to its top line.

The bottom line for the enterprise has also grown as time has gone on. The business went from generating profits of $166 million in 2021 to generating $371 million in profit in 2023. Other profitability metrics followed suit. Operating cash flow skyrocketed from negative $31 million to positive $1.07 billion. Though if we adjust for changes in working capital, we get a more modest increase from $435 million to $702 million. Meanwhile, EBITDA for the business grew from $604 million to $910 million.

It is important to note that while revenue and profits increased consistently from year to year, there was a bit of a decline in adjusted operating cash flow and EBITDA from 2022 to 2023. So, it has not been a straight line in every respect.

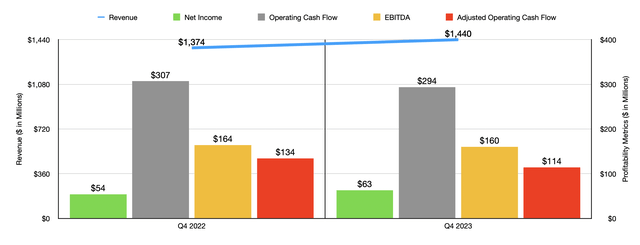

The most recent data provided by management, data covering the final quarter of the 2023 fiscal year, was actually just announced on March 19th. Sales totaled $1.44 billion. In addition to representing an increase of 4.8% over the $1.37 billion generated one year earlier, the revenue reported by management was $10 million higher than what analysts were expecting. Unlike in prior years, when higher pricing was what contributed mostly to upside, pricing actually had a negative impact when it came to some of the company’s sales categories for the quarter. Its fire protection products, for instance, saw some weakness associated with lower selling prices for steel pipe. For the most part, though, the increase was attributable to higher sales volumes, as well as the aforementioned acquisitions.

On the bottom line, the company saw growth, but not to the extent that analysts were hoping for. Earnings per share came in at $0.34. While this was up from the $0.31 per share reported one year earlier, it did fall short of analysts’ expectations by $0.01. Even with that slight miss, it’s nice to see net profits inch up from $54 million to $63 million. Without that growth, we would not have seen 2023 results exceed 2022 results from a net profit perspective.

Other profitability metrics, on the other hand, were not so lucky. Operating cash flow dipped from $307 million to $294 million. On an adjusted basis, it fell from $134 million to $114 million. And lastly, EBITDA pulled back from $164 million to $160 million. There were multiple factors behind these changes.

But the two most notable were selling, general, and administrative costs, as well as higher interest expense. The former reported an 8% rise because of higher facility and distribution costs associated with inflation and acquisitions, and because of a $10 million impact associated with personnel expenses. Interest expense, meanwhile, inched up from $20 million to $22 million.

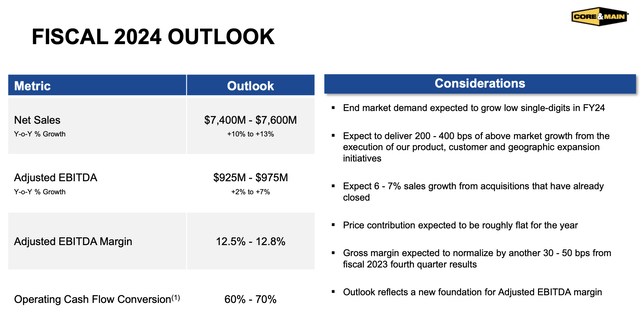

When it comes to the 2024 fiscal year, management is forecasting some rather significant revenue growth. They believe that sales will be between $7.40 billion and $7.60 billion. At the midpoint, that would represent an 11.9% rise in revenue. When discussing this, management said that they expect end market volumes to improve year over year. They also anticipate that mergers and acquisitions activities completed during and after the year will contribute between 6% and 7% to sales growth in 2024. Prices, on the other hand, are expected to be more or less flat.

On the bottom line, the company has provided some guidance. They anticipate EBITDA of between $925 million and $975 million. While this is great to see, since it would be higher than the $910 million reported for 2023, they anticipate that operating cash flow will only be between 60% and 70% of this figure. If we use midpoint estimates, we end up with a reading of $617.5 million. That’s well below the $1.07 billion reported for 2023 and it’s even below the $702 million that I calculated on an adjusted basis.

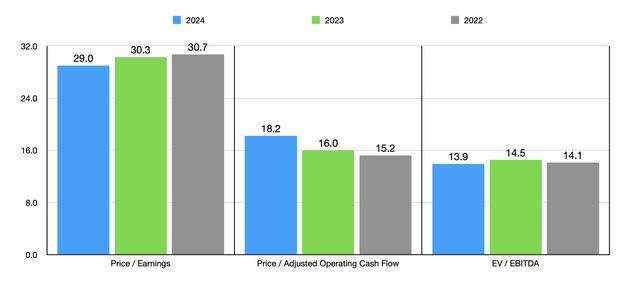

Using these figures and relying on the assumption that net profits will rise at the same rate that EBITDA should, i was able to value the company as shown in the chart above. The first thing I noticed when calculating these numbers is how pricey the stock looks relative to earnings. But when you look at the cash flow picture, things don’t look so bad.

The first thing that crosses my mind is that we are likely looking at a business that is more or less fairly valued. And when I decided to compare it to five similar firms as shown in the table below, that thought became reinforced. When using the price to earnings approach or the EV to EBITDA approach, I found that three of the five businesses ended up being cheaper than Core & Main. But when we use the price to operating cash flow approach, only one of the five ended up being cheaper than it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Core & Main | 30.3 | 16.0 | 14.5 |

| WESCO International (WCC) | 12.1 | 17.4 | 8.3 |

| SiteOne Landscape Supply (SITE) | 46.4 | 26.8 | 21.1 |

| Applied Industrial Technologies (AIT) | 20.4 | 18.1 | 13.9 |

| Watsco (WSO) | 30.7 | 27.0 | 19.9 |

| Beacon Roofing Supply (BECN) | 15.3 | 7.6 | 8.8 |

There are other considerations when deciding whether or not to buy shares of Core & Main. For starters, management has a long history of buying back stock. In 2023 alone, the firm allocated around $1.3 billion toward repurchasing and retiring 45 million shares. That’s a large amount of capital for a business of this size. Personally, I would prefer that capital be allocated toward growth. I especially feel that way when looking at how shares are priced. But buying back stock in general is not the worst thing the business could be doing.

Core & Main

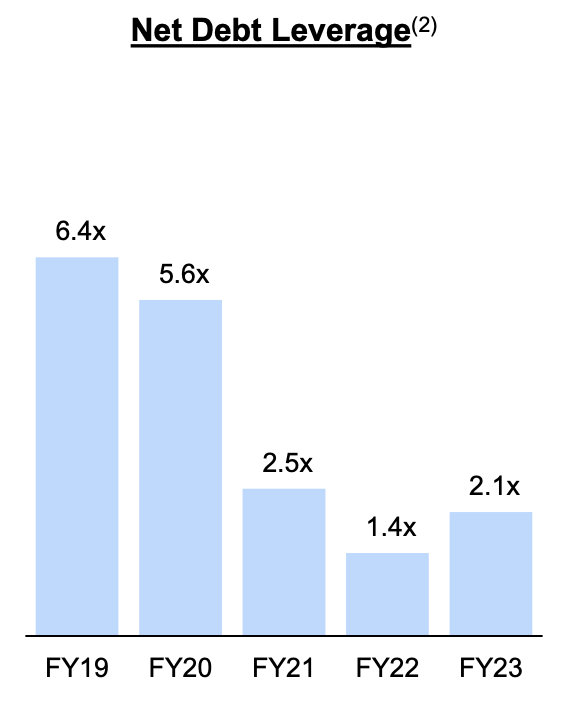

This does not mean that the company has not been paying down debt. While the firm’s net leverage ratio did increase in 2023 relative to 2022, at 2.1, it’s still well below the 6.4 that it was back in 2019. And frankly, a reading of between 1.5 and 2.5 is probably quite healthy. There’s also the fact that we are dealing with a high-quality player that is a giant in its markets. According to management, the markets in which the business operates is estimated to be worth around $39 billion. This gives the company a 17% stake in that space. While this does limit upside, it also suggests that further growth is certainly on the table.

Takeaway

Based on the data provided, I must say that I am fairly impressed with the fundamental performance achieved by the management team at Core & Main, Inc. The company has, for the most part, earned the upside it has seen with its shares over the last year.

But this doesn’t mean that additional upside is warranted for Core & Main, Inc. stock. Based on my own views, particularly when it comes to how the company is valued on an absolute basis and on a relative basis, and when you consider some signs of weakening from a cash flow perspective, a more reasonable assessment regarding the health of the business would place it as a solid “hold” candidate.