Joa_Souza

Introduction

Braskem (NYSE:BAK) is the largest plastic producer in the Americas. The company reported declining revenues and profits for the last few quarters. Despite that, it is an attractive investment but for a specific reason. It is an acquisition target.

A few companies have shown interest in BAK in the last several months. The company has been in a bear market for the previous two years and has reached a bottom. Usually, I do not invest in unprofitable businesses. However, BAK is a rare exception. The company offers upside potential with low downside risk due to a potential takeover from Abu Dhabi National Oil Company (ADNOC).

Braskem said ADNOC offered 10.5 billion reais ($2.14 billion), or BRL37.29 per share, for a Novonor’s stake in BAK. This is a premium of almost 100% over Braskem’s closing price yesterday of BRL 17.68. ADNOC offered to pay in two ways: half in cash at transaction closure and the other half through an ADNOC senior equity instrument that matures in seven years with a 7.25% annual interest rate.

ADNOC’s bid was also disclosed to Petrobras (PBR). It stated it would continue to evaluate the offer because any possible transaction would need a new shareholder agreement between PBR and BAK.

In addition, PBR has contractual rights to purchase Novonor’s share or use tag-along rights in case of a possible sale initiated by Novonor. Since July, PBR has been doing due diligence to determine its course of action.

The unknown variable is the tag-along rule applicable to the minority shareholders. The ADNOC proposal offers a 100% upside but remains uncertain if minor shareholders will get on the train, too. However, the uncertainty makes that opportunity available. I expect the tag-along rule to be implemented as stated in BAK by-laws, Article 6, fourth paragraph.

I assume completing the deal in 1Q24 will benefit all shareholders. I do not recommend investing long-term in BAK. It is a special situation trade with a few quarters’ horizon and 100% upside potential. I give BAK a buy rating.

Petrochemical industry at a glance

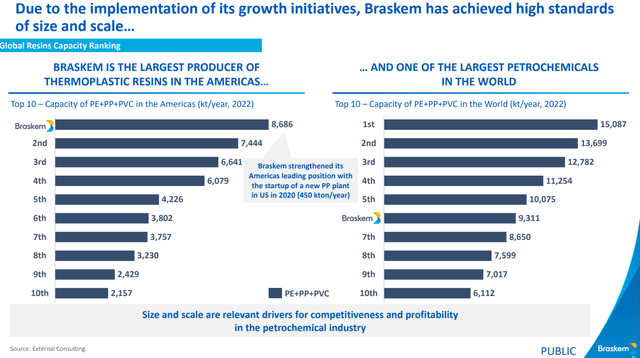

BAK is among the major players in the petrochemical industry. The chart below from the last company presentation shows BAK’s position among its peers.

BAK is the largest producer in the Americas and the sixth globally of polyethylene (PE), polyvinyl chloride (PVC), and polypropylene (PP). The capacity has increased to 8,686 kt/year after adding a new PP plant with 450 kt/year.

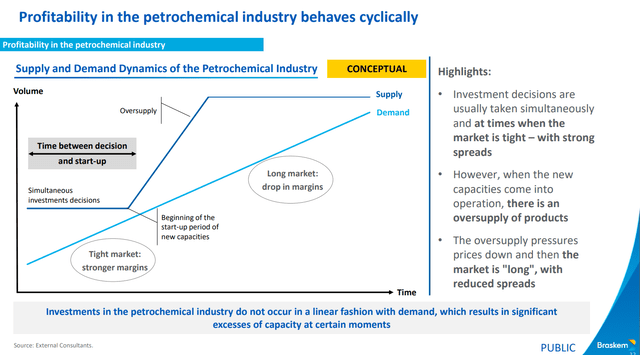

The petrochemical industry has pronounced cycles of oversupply following simultaneous investment decisions. The market is oversaturated at one point, pressing the chemical prices down and squeezing the petrochemical spreads.

The chart below from Braskem’s presentation illustrates where we are now in the industry cycle.

We are at the top right, where the demand and supply are balanced. At that point, the spreads are higher due to relatively low supply. In other words, we are exiting the bottom of the CAPEX cycle.

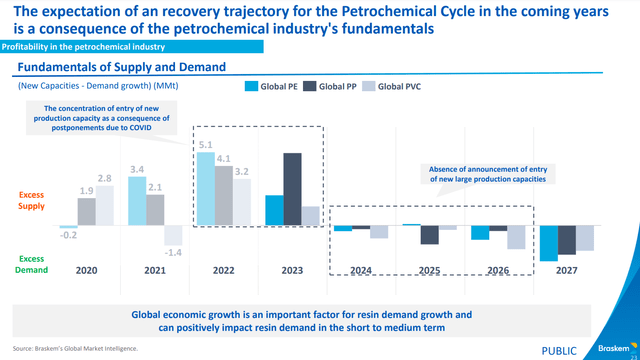

This provides a glimpse of demand in global supply dynamics in PE, PP, and PVC.

2023 seems to be the last year in the current cycle with sufficient supply. In the following year, the demand might exceed the supply. Following the tendency of oil majors to return to the petrochemical business and the expected excess demand, the BAK deal might progress till completion.

The players: Novonor, Petrobras, Braskem

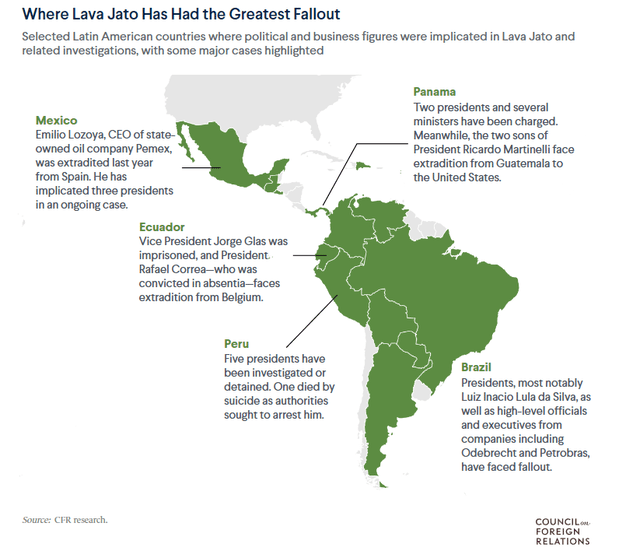

Novonor owns 38.3% of the capital and 51% of the voting rights. PBR owns 36.1% of the capital and 47% of the voting rights. The latter is the reincarnation of Odebrecht, the notorious company involved in Brazil’s Lava Jato (Car Wash) scandal from 2014 to 2021.

The scandal involved multiple high-ranking state officials and corporate executives in Latin America. The scandal has shaken the region and the corporations involved in the scheme. PBR and Odebrecht were in the eye of the hurricane.

2015 was a challenging year for PBR. The company released financial statements that revealed $2.1 billion in bribes and nearly $17 billion in write-downs because of graft and overvalued assets. PBR had postponed releasing its annual financial results for 2014. Moreover, it stopped paying dividends in 2015. The company was compelled to reduce capital expenditures and declare that it would sell $13.7 billion in assets over the next two years, partly due to the scandal’s effects, debt burden, and the declining oil price.

Following its involvement in Brazil’s Car Wash scandal in 2015, Odebrecht, now Novonor, filed for bankruptcy four years later. The company pledged its stake in BAK as collateral for the debts owed to five Brazilian banks: Brazilian Development Bank, Itau Unibanco (ITAU), Banco Bradesco (BBD), Banco Santander (BSBR), and Banco do Brasil (OTCPK:BDORY).

I assume Novonor’s management is pressured to liquidate its BAK shares to cover its debt obligations to the mentioned banks. ADNOC’s offer is not the first one. Previous proposed deals have included a nonbinding offer from Apollo Global (APO) last year and a binding one from LYB in 2019.

Three other offers have advanced during the previous months. ADNOC offered to pay BRL37.29 per share. The proposed deal is half in cash upon closing the deal and the other half via ADNOC senior equity instruments. Earlier this year, Unipar Carbocloro made a cash offer to pay BRL36.50 per share. With the offer, Novonor would retain 4% of the voting shares and get a value of BRL 10 billion. The final bidder, J&F Investimentos, offered BRL10 billion for the whole Novonor stake.

ADNOC’s offer is the most compelling for the Brazilian government. The reason is the plans for a joint venture between ADNOC and PBR, which would control BAK. A quote from the Market Insider article on PBR intentions and deal expect time frame (translation is mine):

The president of Petrobras, Jean-Paul Prates, said on Monday evening (2. Oct.2023) that he expects the process of selling control of Braskem to Novonor (formerly Odebrecht) to be completed by January or February 2024. The statement was made in an interview with TV Cultura’s Roda Viva program.

A minority shareholder in the company with 36.1% of the total capital, Petrobras has the right first to refuse the transaction, an idea that the government has defended. Prates stated that this decision has not yet been made but defended a process of verticalizing the state-owned company to return to the petrochemical sector – which he classified as a worldwide trend.

Knowing PBR’s interest in the deal and its position as a minor shareholder, I expect the tag-along rule to apply, benefiting all shareholders.

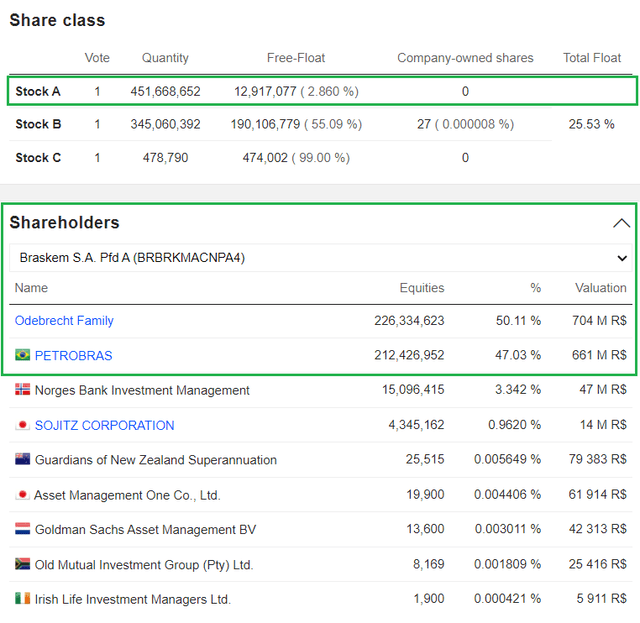

Before I close that section, let`s look at BAK shareholder’s structure. BAK has issued shares distributed in three classes. The table below shows class A shareholders.

Here are the big dogs, Novonor and Petrobras. The bid offered by ADNOC considers those shares. As minor shareholders, we trade sponsored ADR`s class listed at NYSE under the BAK ticker. The current ADR price is $7.25 or BRL36.25, almost identical to ADNOC`s bid. Where is the upside? That`s why respecting the tag-along rule is beneficial for us. If implemented, the ADRs will be repriced with 100%, along with Pfd A shares.

Company financials

I am planning a short-term special-situation position, and company profitability, dividends, and other efficiency metrics are not decisive factors. The most important is the company`s balance sheet if it has enough funds to weather a potential difficulty while waiting for my thesis to materialize.

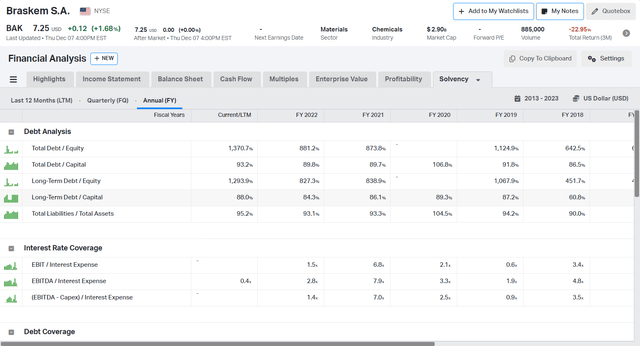

Let’s look first at company capital structure and interest coverage.

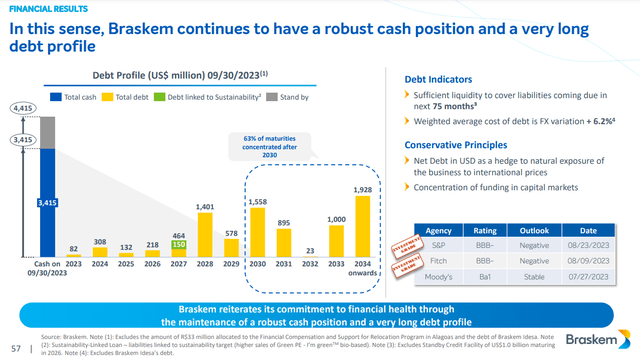

At first glance, BAK seems uninvestable, seeing 1,239% Long-term debt/Equity. However, the company has enough liquidity to cover its debt obligations. The company has $3.68 billion cash, $11.94 billion total debt, and $10.69 billion long-term debt. Now, let`s see BAK`s debt structure.

The company must pay $658 million in the next three years. 63% of the maturities are concentrated after 2030. As I mentioned, this is a short-term play, and given BAK’s sufficient liquidity, I am confident the company will be fine till the takeover is complete.

Talking debt, let`s discuss the company`s credit rating. BAK canceled its credit rating services. It was announced a few days ago in a notice on the market.

That fact might mean many things. A credit rating might be withdrawn if the company is expected to be dissolved or merged with another entity. Of course, this statement does not mean ADNOC (or whoever) will compete in the deal with BAK. It might be something else—for example, the issue in Maceio.

The company must pay a $13.5 million fine. The fine was imposed on December 05, 2023, by the Environment Institute of the State of Alagoas. BAK is charged for profound damage caused by its rock salt mine operations.

However, I believe Maceio’s issues and their consequences for BAK have been reflected in its share price. Moreover, the company’s management and credit rating agencies have been well aware of the persistent issues in Maceio. I am not 100% confident that the credit rating was withdrawn due to an imminent takeover, but with a high degree of certainty, I assume the reason is not the Macio issue.

Valuation

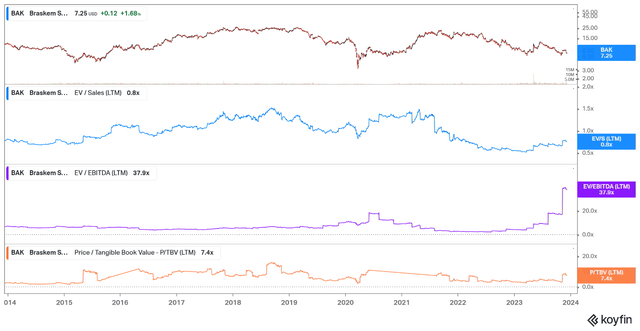

If the ADNOC offer is accepted and the tagalong rule is applied, that means a 100% gain for minor shareholders. However, let`s see how the market prices BAK using EV/Sales, EV/EBITDA, and P/TBV.

BAK trades at EV/Sales below the 10Y average, although EV/EBITDA is record high. The reason is the disappointing results in the last few quarters, squeezing the company`s EBITDA and resulting in high EBITDA multiples. P/TBV is below its historical peaks, though slightly higher than the 10Y average.

Let`s compare BAK with some of the majors in the industry:

- BAK trades at 0.77 EV/Sales, 127 EV/EBITDA, 2.87 Price/Book

- Methanex Corporation (MEOH) trades at 1.48 EV/Sales, 10.49 EV/EBITDA, and 1.43 Price/Book

- LYB trades at 0.96 EV/Sales, 8.21 EV/EBITDA, and 2.26 Price/Book

- Ultrapar Participações S.A. (UGP) trades at 0.29 EV/Sales, 8.85 EV/EBITDA, and 2.24 Price/Book

Measured with EV/Sales, BAK is the second cheapest next to UGP. Due to poor last quarters, EV/EBITDA is the highest among the group. BAK`s Price/Book multiple is the highest, too.

BAK`s relative valuation is unfavorable but not the leading variable. The takeover bids are the decisive factor in my BAK`s thesis. ADNOC`s offer put the take profit on BAK`s share in the $14-$15 range, giving 100% upside potential.

Price Action

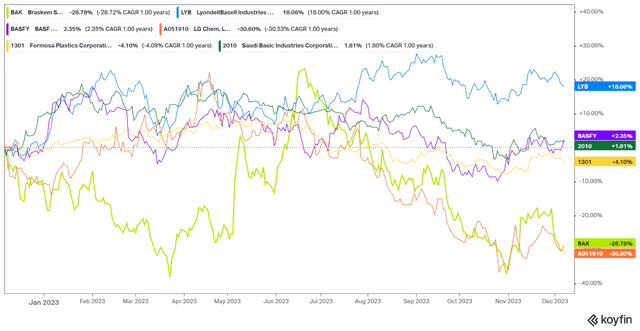

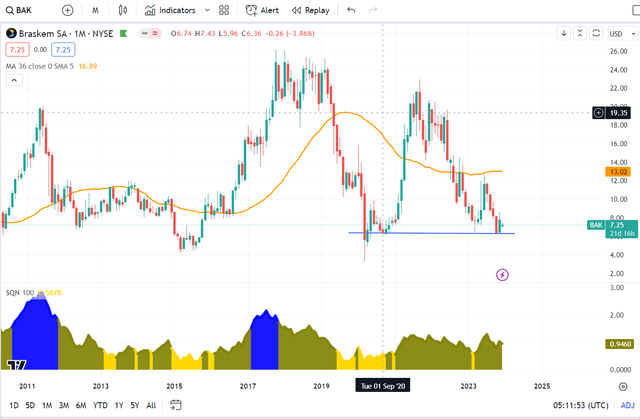

Let’s see where BAK is compared to other chemical majors.

BAK has bottomed together with South Korean LG Chemical. LyondellBasell (LYB) is the top dog in the group, delivering 18.06% to its shareholders YTD. BAK price action has been very adverse, though the prices seemingly found their bottom.

November monthly candle closed above a significant price level, transforming it into support. SQN indicator is in a bull-quiet regime despite the bear trend, which generally supports upward moves. Since BAK is a special situation trade, price action does not predetermine my decision. Nevertheless, it`s always good when the tape supports my thesis.

Risks and what the market is missing

The most pronounced risk in the BAK thesis is failure to complete the deal next year. If that happens, the most probable reason will be political. However, I consider the probability of such an event relatively low due to the political alignment between Brazil and UAE. The former will join OPEC+ countries in January 2024, while the latter is among the founding members of OPEC. In the worst case, if that risk materializes, it will annul my thesis, and BAK will continue scrapping the bottom.

Another risk is not respecting tag-along rules. That means all minor shareholders do not get the upside of the deal. I expect the takeover to include a tag-along rule, benefiting the minor shareholders.

In summary, the bear case scenario is if the deal fails due to political mismanagement, or the tagalong rules are not respected. The market will react severely in such a situation, resulting in much lower prices than now. Testing the bottoms from 2015 and 2020 will not come as a surprise.

BAK has a negative image due to the Maceio disaster and Novonor and PBR’s involvement in the Car Wash scandal. This keeps BAK share prices depressed. The market participants tend to overreact to negative information, ignoring the big picture, thus resulting in significant mispricing. I believe we have negative sentiment, creating a gap between company fundamentals and investors’ expectations. This is an excellent opportunity for investors seeking short-term specials situation play.

Investors takeaway

BAK is a special situation trade due to a potential takeover by ADNOC. The deal might be complete due to supportive political tailwinds and industry dynamics. BAK has adequate liquidity to handle its debt obligations until my thesis materializes. ADNOC`s bid offers at BRL 37.29 mean a 100% gain from the current BAK share price. The two most pronounced risks are either side’s refusal to complete the takeover and failure to apply the tag-along rule. In my opinion, both risks are plausible but not probable. As a significant side of the deal, PBR has no interest in sabotaging the takeover. My BAK thesis is short-term and based solely on the ADNOC takeover. If the latter fails for whatever reason, I am out. My verdict is a buy rating, considering the deal’s upside potential and tailwinds.