Galeanu Mihai

The Bronte Amalthea Fund is a global long/short fund targeting double digit returns over the long term, managed by a performance orientated firm with a process and portfolio that we feel is genuinely different. Objectives include lowering the risk of permanent loss of capital and providing global diversification without the market/drawdown risks typical of long-only funds. We believe a highly diversified short book substantially reduces risk and enables profits to be made in tough markets

|

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

FYTD |

|

|

FY13 |

5.4% |

1.3% |

6.8% |

||||||||||

|

FY14 |

6.0% |

-2.5% |

0.4% |

3.6% |

5.7% |

4.3% |

-3.7% |

0.2% |

-2.6% |

0.9% |

3.4% |

-0.8% |

15.2% |

|

FY15 |

-0.9% |

-1.6% |

2.7% |

1.7% |

3.4% |

4.9% |

2.3% |

-0.1% |

1.7% |

-1.7% |

4.4% |

-1.7% |

15.6% |

|

FY16 |

6.1% |

0.9% |

-0.2% |

3.8% |

-1.3% |

-1.4% |

0.5% |

1.8% |

-4.1% |

-3.4% |

5.1% |

-3.4% |

3.8% |

|

FY17 |

2.5% |

-0.8% |

-2.5% |

-1.3% |

-1.5% |

6.1% |

-2.0% |

1.6% |

1.0% |

7.0% |

7.2% |

-3.7% |

13.6% |

|

FY18 |

-0.9% |

1.5% |

1.1% |

5.9% |

-1.3% |

-1.6% |

4.4% |

4.1% |

1.5% |

3.7% |

-2.0% |

2.9% |

20.8% |

|

FY19 |

0.1% |

3.8% |

-1.8% |

-0.4% |

-3.9% |

6.5% |

-3.6% |

3.4% |

0.0% |

2.2% |

0.1% |

0.7% |

7.1% |

|

FY20 |

1.5% |

-0.4% |

1.3% |

3.4% |

3.1% |

-2.1% |

4.3% |

4.2% |

11.0% |

-5.1% |

-0.1% |

-4.8% |

16.5% |

|

FY21 |

-0.1% |

-3.9% |

1.7% |

-0.7% |

-5.0% |

-5.7% |

-7.3% |

-3.7% |

8.2% |

5.5% |

3.2% |

-2.2% |

-10.7% |

|

FY22 |

9.7% |

3.0% |

-4.5% |

1.1% |

1.8% |

7.3% |

4.4% |

-5.6% |

-4.6% |

5.2% |

2.2% |

0.1% |

20.7% |

|

FY23 |

-0.7% |

-5.9% |

6.7% |

6.5% |

0.8% |

1.0% |

-1.8% |

4.3% |

4.9% |

2.9% |

-2.8% |

-1.4% |

14.7% |

|

FY24 |

2.9% |

7.3% |

-0.4% |

2.4% |

-1.2% |

-2.1% |

8.9% |

|

Fund Features |

Portfolio Analytics1 |

|||

|

Investment Objective |

Maximise risk-adjusted returns with high double-digit returns over 3- year periods. |

Metric |

Amalthea |

MSCI ACWI (in AUD) |

|

Min. initial investment |

$100,000 (for qualifying investors) |

Sharpe Ratio2 |

0.85 |

1.03 |

|

Min additional investment |

$50,000 |

Sortino Ratio |

1.55 |

1.76 |

|

Applications/redemptions |

Monthly |

Annualised Standard Deviation |

12.56% |

10.80% |

|

Distribution |

Annual |

Largest Monthly Loss |

-7.30% |

-8.00% |

|

Management fee |

1.5% |

Largest Drawdown |

-30.01% |

-15.97% |

|

Performance allocation |

20% |

Winning Month Ratio |

0.59 |

0.65 |

|

Administrator |

Citco Fund Services |

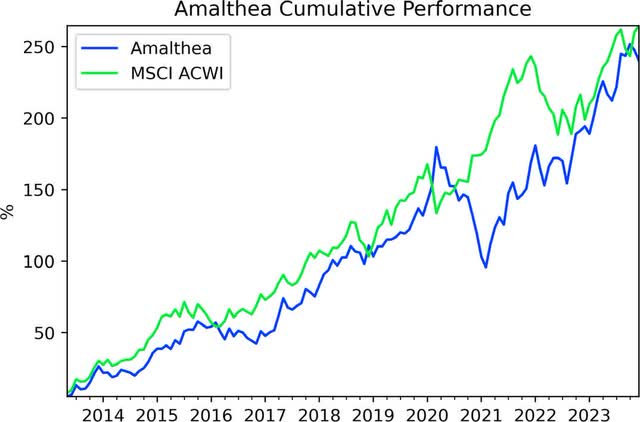

Cumulative return3 |

240.15% |

264.58% |

|

Auditor |

Ernst & Young |

1-year annualised return |

15.60% |

21.92% |

|

Custodians/PBs |

Fidelity, Morgan Stanley, JP Morgan |

3-year annualised return |

15.78% |

10.00% |

|

5-year annualised return |

10.03% |

12.39% |

||

|

Annual return since inception |

12.16% |

12.89% |

||

|

1Performance and analytics are provided only for Amalthea ordinary class units. Actual performance will differ for clients due to timing of their investment and the class of their units in the Amalthea fund 2Sharpe and Sortino ratios assume the Australian cash rate as the applicable risk-free rate 3Returns are net of all fees |

Amalthea lost -2.12% in December, -0.97% for the quarter and gained 15.60% for the calendar year. By comparison the globally diverse MSCI ACWI index’s movements (in $A) were gains of 1.28%, 4.63% and 21.92% over these periods. This quarter and in December in particular the market has been actively hostile to our strategy. There was a generalized squeeze in high-short interest names.

Given this our results have been satisfactory – achieved during a widespread short-squeeze and with a large and aggressively positioned short book.

In a month where many long-short funds were hurt badly we could just declare victory and move on. But we think we should explain our results in more detail.

To make the discussion easier all numbers and returns are reported in US dollars.

The obvious shorts were a very bad idea

If we had been mainly short obvious and highly shorted stocks, we would have been hurt badly. An index of the Russell 1000 most shorted stocks was up over 20 percent for the month and the most shorted REITs in the Russell were up almost 29 percent. Highly shorted interest rate sensitive stocks were up extremely sharply in the month.

Short sellers who get their ideas from the Wall Street gossip networks (and hence weighted towards the obvious and popular names) have been badly hurt.

Our process – having over 600 names and doing our own work on them has meant that our results were better (though still not good). The average stock we were short was up over 9 percent during December. This was less than the benchmarks we internally compare our short book to (either the Russell 2000 or the Russell 2000 growth). But it was still no fun.

Our general positioning did not help

The bulk of our short book is small cap stocks with a heavy North American bias. Our long book looks far more like the All-Countries World Index. This has been true for years at Bronte.

In December the Russell 2000 (the most popular index of American small cap stocks) was up 12.2 percent and the All-Countries World Index was only up 4.8 percent. With our bias towards short North American small caps and long global large caps we were fighting an uphill battle.

As stated, and obvious from the above, December was very hostile to our portfolio. The break-even results for the month are a result of thoughtful risk management, decent stock selection and some call-option protection we purchased for the portfolio. Break-even was a good result given the market backdrop.

Rising markets increase our leverage

We would like to say that nothing went wrong – but alas that is not true. As markets went up our longs went up and our shorts went up. The aggregate size of our positions went up, but the aggregate capital was roughly flat. We became more levered, and we hit our own internal (and conservative) risk limits and closed positions. Risk management remains our priority and we will not let our leverage grow beyond modest limits.

Despite our roughly flat results in December this has been the second worst squeeze event in the history of the firm. We have had to sell positions we like to buy back positions we think are worthless.

Junk-stock-rallies have been a feature of most bull markets throughout stock market history – but since 2015 the junk stock rallies have had an intensity which has surprised us. This one is intense (as those high-short-interest index moves attest). It not as intense (yet?) as January 2021 – the time when the most squeezy stocks went to “the moon”.

We described finding shorts in the first quarter of 2021 as like “shooting fish in a barrel” but caveated that by noting that the fish shot back. Finding shorts is again like shooting fish in a barrel and the fish are not quite so dangerous this time (though we remain wary).

Hopefully this positions us for future gains

Worthless and drossy stocks appreciating sharply is not good for our current performance. We are short stocks we think are worthless or wildly inflated.

However – and provided we are right about which stocks are worthless – a run in these stocks bodes well for our future performance. The drossy stocks should go down over time.

The period after the January 2021 rally (starting on Valentines Day 2021) was excellent for Bronte. We hope for excellent results again when the drossy stocks deflate – though we will have to manage through the current squeeze.

Some individual problems

We peaked out at about 700 shorts. With 700 shorts we are always going to have problems. The biggest problems are in quasi-financials where the market is again assuming growth driven by cheap and readily available money. Highly shorted stocks with interest-rate sensitive businesses gave us the sharpest wounds in the month.

The stock that has annoyed us most this year is Carvana (CVNA). This is an old short – and was at one stage a 50bp short. We added to the short much of the way down. This was profitable.

When the stock got to about $10 (on the way down from above $200) we started covering. We left ourselves with a single basis point short – that is one one-hundredth of a percent of the fund short at $3. The stock recently traded over $60 – a twenty bagger from the bottom. Ouch.

We still think that bankruptcy is the most likely outcome. But we were unequivocally wrong to leave ourselves short any Carvana at the bottom. The leverage involved in an equity stub is way too high. Also, if money really is freely available for the next five plus years Carvana will survive and may even prosper. We have covered some at prices above $50 and we could easily be convinced to cover the lot. We did not play that well.

There are a few other quasi-financials where we have not got it right – and whilst there are no other twenty-baggers – there are individual shorts that have cost us more than 20 basis points of fund. Our biggest loser this quarter (Affirm Holdings) fits into this category. We are not committed to the short.

Even here we are being harsh on ourselves. We are short almost 700 names as of writing and thousands in total over the history of the fund. There are bound to be a few shockers in there – but our averages are pretty good (over time). Still, we like to analyze our mistakes because that is how we (a) manage risks and (b) get better. We look for mistakes that have natural and finite experiments to test in what way we are wrong. We discuss one of these (Karuna Therapeutics) below.

Modern media (especially social media) and short selling

We state above that since 2015 the nonsense stock rallies have had an intensity which has surprised us. The one in the middle of covid was wild – but the nonsense stock rally we are currently experiencing would have astonished us with its intensity had not the 2021 rally come first.

It is a cliché to suggest that social media encourages nonsense views. You can find someone on social media who will support or encourage any nonsensical view you might have. This applies in politics (we could point you to utterly insane social media on either side of major issues like greenhouse gasses, or whether Meghan Markle is a Russian spy). We mention the Meghan Markle thing only to explain just how broad and silly the internet and social media gets.

Just like there is a love-and-hate groups for Meghan Markle there are clubs for cult-stocks. Sometimes these cults are self-created. An extreme example is the shell of Bed Bath and Beyond (a bankrupt big-box home goods retailer). The stock originally had the BBBY ticker. When the company filed bankruptcy, the exchange kindly put a Q on the end (OTCPK:BBBYQ) to indicate the company was in bankruptcy. This stock was cancelled by the Bankruptcy Judge and has never traded again. It took some time for the ticker to be removed from accounts in internet brokerage – but cancellation literally means the stock does not exist. During the bankruptcy the brand-name was sold so the company renamed itself “DK Butterfly-1”. There is a plethora of people on Twitter who believe that they will receive shares in a new company called “Butterfly” and they will be rich. These people (thousands of them) identify themselves on twitter with a blue butterfly emoji. There is no way absent the internet that this cult could exist.

The blue butterfly cult is harmless. You can’t invest in BBBYQ stock. It does not trade because it does not exist. There is no way we know of to invest in (or short) DK Butterly-1.

But these clubs are not always harmless or self-created. There are clubs for literally hundreds of nonsense stocks – and in those clubs are promoters and true-believers. Large sums of money are trading hands and they feed on themselves with an intensity that is hard to imagine absent the internet. On the internet it is difficult to separate the promoters from the victims. They all look like true believers.

A lot of the ideas in these cults do not pass the “pub test”. If you went to your local pub and tried to convince people that you would be rich from a butterfly stock formed from the shell of a bankrupt big-box retailer people would think you were mad. If a local lawyer decided to look, they would quickly find the Judge’s order cancelling the stock. But the internet group is not the pub. It does not contain a group of locals with diverse interests and diverse world views. Instead, it contains a group of people selected from millions who share your own particular prejudices.

Covid was particularly wild because lockdown removed the “pub test” from peoples’ lives. They could live entirely in a self-selected internet world which nurtured their crazy belief.

We think the Covid mania was sui generis. The wild intensity of January 2021 will not be repeated in our lives. (We could be wrong on that.) But social media is not going away – the political beliefs of people will veer towards the insanity of social media – and for the world that is not good. But wild gyrations in nonsense stocks will also continue. This should make our business more difficult – but more profitable. Mass insanity has its upsides.

Karuna Therapeutics – a rare mistake with a natural test of process

December gave us a natural test of our shorting process. We have been short Karuna Therapeutics (KRTX) for most of 2023. Karuna are developing a drug (which they have coined “KarXT”) for the treatment of schizophrenia. KarXT is a combination of a molecule abandoned by Eli Lilly because of severe side-effects (xanomeline) and a generic used to treat urinary incontinence (trospium).

The bull case – simply stated – is that drugs which are effective in mental illnesses such as schizophrenia are hard to find. Moreover, they can’t be tested/explored in animals as there is no realistic mouse-model of schizophrenia.

The Lilly drug (xanomeline) was thought to work but with intolerable side-effects. What Karuna sought was a drug that did not cross the blood-brain barrier and would neutralize the effect of xanomeline in the body but not in the brain. They chose trospium.

Karuna claim the drug has “compelling efficacy and a differentiated safety profile” compared to existing antipsychotics. When the company announced “positive” phase 3 results in August 2022, the company’s market cap rose to USD 9 billion. There are millions of people with schizophrenia in the US alone, so the opportunity for a better drug is massive.

We were not convinced by the phase 3 result. We thought that the trial design might have sharply understated the risk-profile of the combination (and/or overstated the performance of the drug), and that the FDA would identify these design issues in its review.

Alas important people with a lot of money think we are wrong. Bristol-Myers Squibb, a major global pharmaceutical company, has just bid 14 billion dollars in cash (substantially all borrowed) to buy Karuna prior to KarXT being approved. They believe the transaction brings “great science”, is a “clear strategic fit” and that KarXT will deliver “multibillion” dollars in sales at peak.

We think this is unlikely and Bristol Myers management will wind up regretting it badly. But hey – we have lost money on the short – so for the moment we look like idiots.

The FDA is currently reviewing the company’s New Drug Application, with a decision expected in the second half of 2024.

We will find out whether the “smart money” at Bristol Myers has torched 14 billion dollars or (more likely) we have fooled ourselves into believing we understand what an inadequate drug trial looks like. When it happens, we will follow up and report the lessons from this experience.

If we are right though – and the drug is rejected – we won’t recover the money we lost. As we have said before (about Wirecard) intellectual satisfaction is nice, but we would prefer a refund.

The ex-post analysis is – as explained – merely an intellectual game, uninteresting except to improve our process. It is however important to us. We seem quite often to find ways of making money or reducing risks when we analyze our losses. This may yet happen here. We hope to follow up with you late this year.

Hibbett (HIBB)

We will end with a long on which we are happy to disclose considerable detail.

Hibbett is a retailer of street wear (especially sneakers) and a small volume of sporting goods (shoes with cleats for instance).

It is an unusual position for Bronte, and we hold approximately 5 percent of the company. Our share of the company has been increasing as management bought back the stock.

It is not our intention to buy stakes in companies large enough to influence management – and we prefer keeping the ability to sell without an undue impact on the stock. This makes it unlikely we will buy more of the stock.

Hibbett is a small cap company. Our position is large in them – but it is relatively small for us. But because it is an unusual (and fun) position we are discussing it more detail than usual. Attached to this note is a stock-note of sorts. It explains how we wound up owning the stock (and why we like it). It also details the risks (some of which are difficult to manage).

Thanks again for the trust you have shown in us.

Bronte Capital

Hibbett – an informal stock note

Hibbett is originally a chain of sporting goods stores in the South of the USA (headquartered in Birmingham Alabama), and mostly in towns too small to have a Dicks Sporting Goods store. The company has been well managed for decades and has over the decades grown and repurchased shares. Between 2001 and 2020 the share count roughly halved and revenue went up five-fold. Even after all this it remained a relatively small business and with a market capitalization below half of a billion dollars.

Along the way it made a small acquisition of City Gear, a highly urban retailer of street clothing targeted at a mostly African American market. They paid $88 million in cash and up to $113 million including earn-outs. For reasons explained below this was an astonishingly good acquisition.

Our interest in Hibbett came about in an unusual way. In 2014 Nike was trading at 3.5 times sales, Adidas was trading at 0.8 times sales and Puma was trading at 0.5 times sales. These companies look like they are in the same business (sneakers) and valuation and profitability differences like this attract our eye.

We were visiting Germany and Adidas and Puma are both headquartered in Herzogenaurach, a small German town outside Nuremberg. The companies are located together because they were founded by brothers.

We learned a lot about the business.

At the risk of extreme simplification, the marketing of athletics shoes and street shoes is done by getting the shoes onto the feet of the right influencer – and then having people copy that influencer and then people copy people etc. The influencers of choice are mostly sports stars but musicians (especially hip-hop and rap) and Instagram influencers (like the Kardashians) matter.

When we went to Herzogenaurach Puma was a mess. The most important sports star they had contracted was Usain Bolt. His likeness, ten metres high, towered over us as we walked through their building. Usain Bolt is of course one of the greatest athletes to ever put on spikes, and he exudes Jamaican cool. He should be a great ambassador for the shoes. And he probably was. But there is a problem – he came out once every four years, ran for less than ten seconds and that was so fast that you could barely see him. Running a 9.6 second 100 metres does not make it easy to identify the shoes.

By contrast Lionel Messi (sponsored by Adidas) is a great shoe ambassador. He is also cool and he comes out every weekend. Moreover, what he does looks achievable even though it is clearly not. Kids want to be Lionel Messi.

Adidas were clear about what they were good at and what they were not. We will never forget what they said.

They said that in Europe football (soccer) was the entry ticket to the shoe industry and they were level-pegging Nike both in sales and in access to influencers. There were certain football players who were more important in shoe marketing than others. Paul Pogba was particularly important as young people thought he was hot. [The Adidas advertisement ” I am here to create” is a true gem showing how Adidas wanted to link Paul Pogba to the shoes a kid might wear.]

Then they told us their story about why Nike was beating them. They said that there is a path in footwear in the world – which is from American Basketball to African American kids to white American kids to Chinese kids. The core sport in their business wasn’t European football, it was American basketball.

So, we asked them the obvious question – if we gave you five billion dollars and said to go out and find all the young kids that will one day be NBA stars, and their coaches, and their parents, and the college athletes and start sponsoring them all could you solve this problem?

They said no. And that they had blown several billion dollars trying.

They laid out an alternative strategy. They said that they could get to African American and to white children through their music. And they laid out a proof of this. They told us that they were always stronger in the music business than Nike going back to the days of RunDMC and My Adidas. They said they were much stronger than Nike in shoes designed to be worn without laces. They told us (and we have since checked) that if you see kids in Beijing wearing sneakers designed to be worn without laces they are most likely wearing Adidas.

Being terminally unhip, we did not get the cultural reference. Hip-hop stars wear shoes without laces as a nod to prison culture where laces are taken out to prevent inmates hanging themselves. American kids copy the musicians, Chinese kids copy the American kids.

Here is RunDMC wearing Adidas Superstar sneakers without laces:

Adidas told us that they were going to go after the American market through their music.

This was before they signed Kanye West to design for them and before the mega-hit that was Yeezy sneakers. It was well before Kanye decided to go all “mad artiste” and before he tweeted he was “going death con 3 On JEWISH PEOPLE”. It was before Rolling Stone magazine could write an article about how long Kanye had admired Hitler.

That said – before it ended in recriminations – the Kanye partnership sold a lot of shoes – including to Chinese kids who have never listened to Kanye’s classic “My Beautiful Dark Twisted Fantasy”.

Nike of change of strategy

Fast forward a few years and Nike has had a change of strategy that was an Exocet to shoe industry retailers. Nike (who do not sell on Amazon) decided (accurately) that they had the hot product and wanted to drive sales through their own (mostly online) channels. They wanted to capture the retail margin.

Nike used to have 30,000 wholesale arrangements (retailers who sold their product). They cut this number sharply, down to 3000 and told people they were going to 1800. Small shoe retailers lost their core brand. Many failed.

Further they had a spat where they sharply reduced support to the giant of sneaker retailing (Foot Locker). The shoe retailers traded down to four times earnings. Consensus was that most would fail – and that Footlocker was in a very difficult position if not complete toast.

Hibbett traded to sub five times earnings too. We bought quite a lot. Our logic was simple. Hibbett owned City Gear and City Gear was a core retailer to a core demographic and Nike was not going to reduce support to Hibbett like they would to Foot Locker.

This was a non-consensus thesis. Foot Locker is long-running super-champion of the sneaker retailing industry. Hibbett by contrast is an afterthought. The Wall Street (correct) view is that most of the time you are better off owning the dominant player in any industry. Small players have worse economics.

In this case we thought (and still think) that Footlocker is long-term problematic and Hibbett is very well positioned.

But for that we need to describe City Gear.

The typical City Gear store is in a strip mall with very low rent (typically say $40 thousand per annum) in a part of town where the population is 90 percent African American. An example we visited was on Gallatin Pike, Nashville. This store is pictured below.

9

As you can see the store had bars obscuring the window displays and other things to stop it being robbed, but inside it was a well-presented street fashion store full of brands that were unfamiliar to us. The brands however fit the story (for instance Billionaire Boys Club and Icecream do clothes associated with the musician Pharell Williams). The clientele was entirely African American so when us white guys came in it was thought we were looking for trendy sneakers you could not buy elsewhere.

We bought the sneakers and chatted to the sales staff about the company, the culture, why they worked there, the music played in the store and all the things that they liked and disliked about City Gear. This store was – from the perspective of the Adidas management we had spoken to years prior – a dream. It was exactly the market Adidas had craved.

We asked some customers why they did not buy the sneakers online. The answer varied from location to location – but we were often told that they would be stolen. They would buy them online if they could pick them up in the shop (which they now can).

This was a comment as much on the sneakers as the neighborhood. The sneakers were hot and were a target of theft. There have been multiple robberies at City Gear stores for the sneakers – and in the worst case a store manager was murdered.

At about 10.30 AM on a Saturday a long queue formed outside the Nashville store. There was a sneaker drop – some limited-edition shoes from Nike. Each store had its own Instagram account and they advertised what they were getting in – and queues formed to buy it.

We thought there was no way that Nike was going to abandon City Gear. Indeed, we thought it much better than that because Nike was busy closing all the competition. You could no longer buy Nike sneakers anywhere within three miles except at City Gear. There was nowhere that had a range commensurate with City Gear.

The market thought Nike was going to kill Hibbett/City Gear. We thought that Nike was going to kill their competition. This disconnect was why we bought the stock.

Management were excellent too. The company had effectively been taken over by City Gear management. There are only 200 City Gear stores and about 900 Hibbett stores and the Hibbett stores were becoming cool.

Around Birmingham for instance (and presumably over much of the rest of the country) they were turning Hibbett from a sporting good company to a street gear company. They still sold cleats for the football season – but they occupied less than a metre of shelf space. The shops were becoming fashion, more specifically African American fashion with a slight lag.

We met a regional manager, a thirty something African American woman who had started as an entry level employee at City Gear and was now in charge of 180 Hibbett stores. She was street smart and sassy, and way more on trend than we will ever be.

And it showed too. In the sneaker world City Gear shops have the best stock. They had one- off drops of retro Jordans for instance. Hibbett stock wasn’t quite as on-trend – but it was darn good. And Foot Locker was boring. You go to Foot Locker to buy Nike Monarchs which are famously the “dad shoe”. If you want to know what Monarchs are you can’t go past the Team Monarch Instagram page (which is actually run by Nike and doesn’t shy from how uncool this stuff is).

The business is working out. Nike has several times called Hibbett out as an important partner. We asked them once why they thought Hibbett was such an important partner and they pointed to the “urban market”. This is odd because Hibbett is largely a small-town and rural brand – but then of course “urban” is code for “African American” and it becomes clear to us that they value City Gear for the reasons we do.

In the last quarterly conference call (a call where Nike guided sales down) Nike labelled Dicks, JD Sports and Hibbett as their important North American partners. They did not mention Foot Locker. And that is deeply confirmatory because Dicks is huge ($12.7 billion in sales). Foot Locker (who are on the outer) is even larger in shoes. Hibbett is less than 10 percent as large in shoes – but is mentioned by name.

We also (randomly) met a Nike executive on the train from Amsterdam to Paris. His responsibility was small distributors in a largish part of Europe. His remit was clear – he was to kill any retailer who was not additive to Nike’s brand – and he was to shower with love a retailer who was additive to the brand. He could organize one-off drops of rare shoes for a special retailer. What he wanted was a retailer that approached important and style-setting niche markets – and his example would be say a skateboard shop that ran skateboard lessons for both elite skaters and 15-year-old girls.

Where we can be wrong

It is worth thinking where we can be wrong. The most obvious place is that we have bought a sneaker retailer at the height of sneaker culture and maybe we will look back and wonder why people obsessed over one-off drops of unusual Dunk SBs cobranded with the Seattle group Skate like a Girl.

If we come back in 15 years and sneakers are not important in the culture, we will not make money.

Nike guided down sales in the last quarter. Maybe this slight hiccup in sneaker volumes is a sign that the future will be far less rosy.

The second way we can be wrong is Nike and Adidas (the most important brands) do an end-run around retailers. For reasons we explained above we think this is less likely for Hibbett. We also note Adidas and other shoe retailers would crave the space at Hibbett (far more so than they might crave space in at Foot Locker).

The third risk is that Nike (especially) with its exceptional power could use that power to squeeze Hibbett margins to the benefit of Nike. Hibbett margins (as shown in the valuation comments below) have been lower in the past.

We think this risk is low. Nike has been destocking the competitors – and that has driven Hibbett margins up. We have heard (more than once) that the path of Nike management is to shower in love retailers who are additive to their brand and kill retailers who are not. We think Hibbett/City Gear is additive to Nike – and crushing their profitability is not showering them in love.

The fourth way we could be wrong is that management changes for the worse or becomes venal. One jarring thing about management is that the senior management were entirely white and mostly came to Hibbett from Autozone via their stint as managers/investors in City Gear. The middle management were almost entirely African American, mixed race or Hispanic.

If you want to motivate your best staff you have to show them that there is a way to progress – maybe to the very top. That was not obviously visible.

That said – the middle management we met were very good – and we figure the company should be able to promote from within. We think and hope they intend to.

Some valuation metrics

It is a Bronte view that a stock note (for a long) should be 15 pages on the business (in this case only 5), one page on management and one sentence on valuation. We are more detailed here.

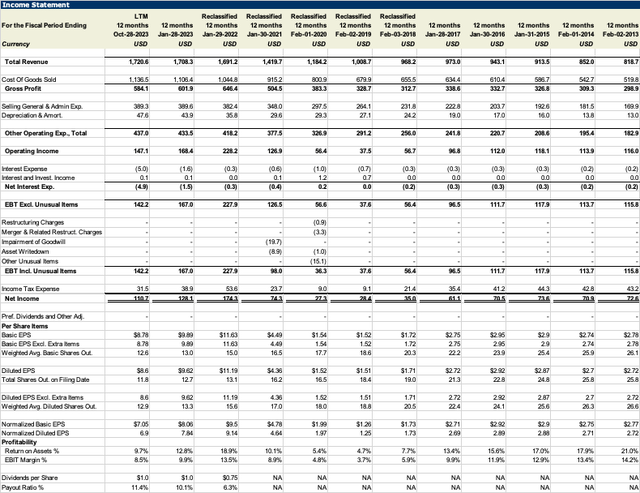

Here are the last ten years earnings for Hibbett (courtesy of Capital IQ).

A decent part of the profits went to buying back shares – so I have included a share count.

Note the margin was typically (up to 2016) comfortably double-digit. That margin was not sustained. They were a sporting good shop in small towns selling baseball bats and mitts in competition with Amazon. This was a losing proposition.

The great purchase of City Gear came with some restructuring expenses – but sales took off and have remained elevated. Margins are typically about 9 percent.

If we are right and the City Gear shift was the reason for the improvement and that reason is sustained, then the stock should be fine. Earnings should be above $8 per share and will increase over time. The stock is – at writing – about $70. At our best purchase it was below $40. This stock could go very right.

But we could be wrong. This might be another internet challenged retailer and this could all be driven by “peak sneaker”. In that case the margin collapse in 2018 and 2019 is a harbinger of bad things to come. We doubt it though. There is no commensurate expansion in sales and margin at Footlocker. We think that City Gear – and Hibbett – really is different.

|

Disclaimer This report has been prepared by Bronte Capital Management Pty Limited. This report is for distribution only under such circumstances as may be permitted by applicable law. It has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. It is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the report. The report should not be regarded by recipients as a substitute for the exercise of their own judgement. Any opinions expressed in this report are subject to change without notice. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. Bronte Capital Management Pty Limited is under no obligation to update or keep current the information contained herein. Past performance is not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realised. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.