andresr

Investment Thesis

CarGurus (NASDAQ:CARG) reported strong gains following the COVID-19 as a result of profuse growth within its CarOffer business driven by inventory shortage of new cars. The company has more than halved from the top as a result of a decline in used car sales which had rendered its once a growth engine, CarOffer business, loss making. However, with the relative stability in the average vehicle sales price of used cars as well as repricing initiatives has helped them drive improvement in revenue per paying dealer and stem some decline within the CarOffer business with positive gross margins. We believe there is still uncertainty in its CarOffer business with potential downside risks and believe the current multiple does not provide margin of safety. Initiate at Hold.

Company Background

CarGurus is an online automotive platform connecting buyers with various dealers for purchase and sale of cars through online or in-person shopping. Its platform has monthly unique users totalling over 45 mn with about 25k paying dealers with a wide range of listings across different models and makes and has presence across the US, Canada and the UK. . It also offers additional services including Finance in Advance (pre-qualification on vehicle financing for eligible buyers), Digital Deal (checking trade in value, financing options, mode of payment and insurance) and Area Boost (enabling dealer listing beyond its geographical radius). It acquired 51% stake in CarOffer in 2021 (with potential to acquire balance stake in 2024) which enables vehicle owners to sell their used cars directly to the dealers providing instant cash money advance to the vehicle owners.

Historical Track Record

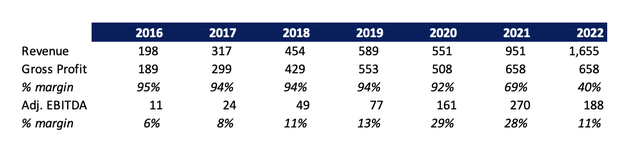

The company reported strong growth in revenues during the historical period with revenues growing at 42% CAGR during the 2017-22 period. The astounding growth was driven by a massive growth in its Instant Money Cash Offer (IMCO) transactions through CarOffer where in the product offering became available to over 90% of the US population. However, the margins within the IMCO business are razor thin which eventually led to a revenue growth at the cost of profitability.

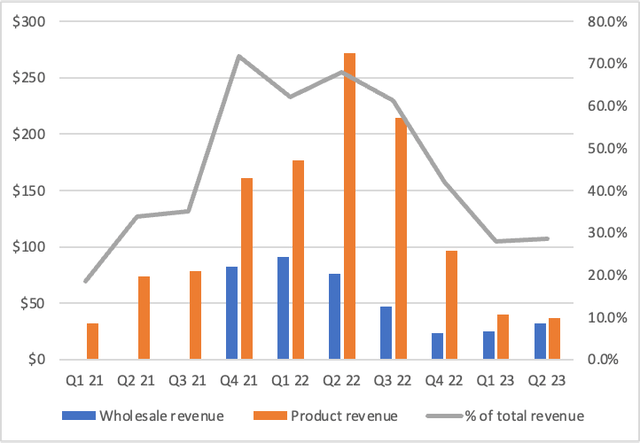

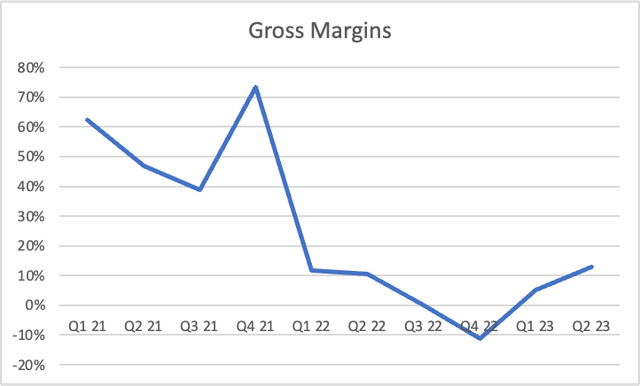

Its marketplace model remains robust which generated over 90% of gross margins, however, its growth within CarOffer’s IMCO business which generated a major part of the revenue in 2021 and 2022 led to an overall decline in consolidated gross margins. In addition, its CarOffer business reported operating losses in H2 2022 as a result of meltdown within average used car selling price as well as higher marketing spends to boost traffic for IMCO transactions.

Challenges in CarOffer

CarOffer’s proposition has been solid for the consumers elimination the uncertainty on the amount they will get from trade-in, ease of convenience, 24×7 availability and instant source of cash generation. Post the acquisition by CARG, CarOffer witnessed significant growth during 2021 and 2022 as a result of significant decline in inventory due to supply chain issues which lead to dealers acquiring the used cars aggressively. However, given its limited track record given its founding in 2019, it had not witnessed a period with a decline in average vehicle sales price.

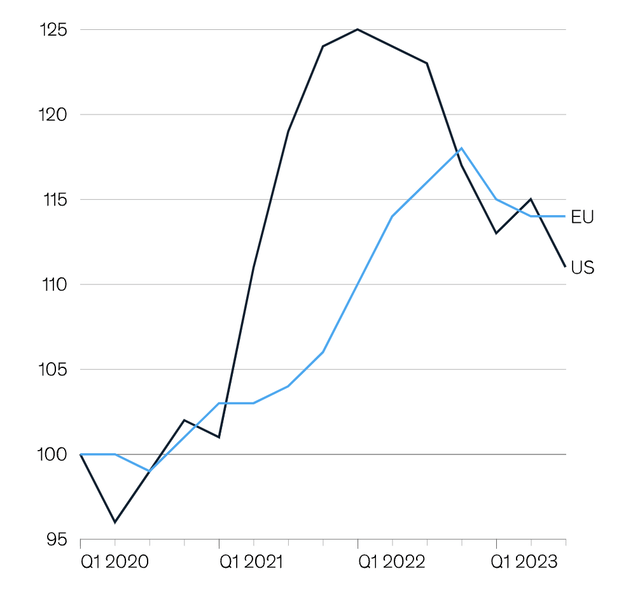

Declining Prices of Used Cars

At its peak, CarOffer contributed over 70% of the total revenue which declined significantly over the past few quarters as a result of higher inventory of new vehicles leading to a decline in prices of used vehicles.

In addition, Dealers soon realised that given every car is different with different vehicle age, usage, make and model, it is difficult to ascertain the amount of work required at the dealer’s end to get the car ready for a sale. And with the decline in prices, the business became unprofitable.

Autotrader in the UK has a similar program but it can leverage from its dominant position within the market as it forms about 75% market share of the total online automotive market. However, competition in the US is significant from other online players as well as offline mode from independent dealers and franchised dealers. Under the terms of the acquisition agreement, CARG must acquire the remaining CarOffer business in H2 2024 at 12x LTM EBITDA. Currently, LTM EBITDA for CarOffer business remains negative, but recent quarters had positive EBITDA which could lead to cash outflow in the next year. However, the company has strong balance sheet with over $450 mn in cash and no debt which would not have any material impact on the balance sheet.

Earnings Preview

Management estimates Q3 2023 revenues to decline 51% to $211 mn (at mid-point of its guidance) driven by a 90% decline in revenues within the CarOffer business. On sequential basis as well, the company expects the CarOffer business to decline by about 50% at the midpoint highlighting the significant uncertainties within the business. It expects consolidated Adj. EBITDA to be ~19% marginally improving sequentially as a result of continued repricing initiatives along with normalization of marketing spends. We believe the estimates appears reasonable driven by an improvement in its marketplace model which is likely to report mid-single digit growth as a result of growth in value added services along with pricing initiatives leading to higher average revenue per dealer. In addition, EBITDA margins of the marketplace model has been relatively resilient and strong organic traffic growth along with cross selling/ upselling of value added services is likely to aid EBITDA margin expansion.

We believe the marketplace model is likely to achieve mid-single digit growth in the near term driven by modest improvement in pricing and expect 2024 revenue to be around $725 mn on top of a ~$700 mn expected revenue in 2023. However, we believe the wholesale business may not be able to recover fully and the lower adoption will entail the revenues to be flat to negative vis-a-vis 2023 expected revenues at ~$225 mn. However, we expect stable gross margins of ~8% within the wholesale business going forward, as seen during the recent quarters and expect it to eke out marginal operating profits.

Valuation

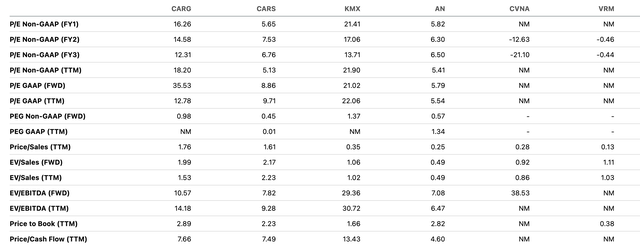

We compare CARG vis-a-vis other listed peers with a focus on new and used car vehicle sales. while Cars.com (CARS) and AutoNation (AN) focuses on both new and used vehicle sales, CarMax (KMX), Carvana (CVNA) and Vroom (VRM) primarily focuses on used vehicles.

Despite the multiples derating, CARG trades at 10.6x EV/ Fwd EBITDA compared to CARS and AN (which has mature marketplace business) which trades at <8x EV/ Fwd EBITDA. Comparing with used car vehicle businesses, the company trades at 14.5x P/ FY2025 Earnings compared to 17x of CarMax while Carvana and Vroom are expected to unprofitable. We value CARG’s marketplace business at 9x EV/ Fwd EBITDA in line with our expectation for CARS as highlighted in my article and ascribe a value of 1.3x EV/ Fwd Sales to its used car business, at a premium compared with the other used car vehicle peers (KMX, CVNA and VRM) on the back of better operating margins and strong network characteristics.

| Particulars | Valuation Methodology | Enterprise Value ($ mn) |

| Marketplace business | 9.0x 2024E EBITDA | $1,958 mn |

| CarOffer business | 1.0x 2024E Sales | $225 mn |

| Cash Balance | $453 mn | |

| Equity Value | $1,797 mn | |

| Implied Share Value | ~$15.9 |

Seeking Alpha’s Valuation Grade ascribes a ‘D+’ rating as a result of expensive valuations. We believe while the overall automotive market appears well poised for growth in the near term as a result of improving inventory levels due to easing supply chain, the used car vehicle market appears gloomy. However, the ongoing UAW strikes against the three Detroit makers can cause a supply chain shortage of cars in case it is prolonged, which can in turn provide a fillip to the used car market as dealers would look to improve their inventory levels.

Risks to Rating

1) Continued decline in used vehicle prices can lead to operating losses within its CarOffer business

2) Lower adoption by the dealers for its CarOffer product as a result of uncertainty for the amount of work required to get the car ready to sell could lead to declining revenues

3) Inability to monetize its pricing initiatives can impact its revenue growth

4) Upside risks include better than anticipated pricing initiatives, recovery within its CarOffer business and flexible balance sheet enabling capital allocation

Final Thoughts

CarGurus has had volatile few years since the pandemic as COVID-19 and supply chain issues led to production delays for the new cars, which in turn boosted the used car business. Its acquisition of CarOffer in 2021 was viewed as visionary as it had a phenomenal run within 1 year of acquisition leveraging CarGurus’ strong and wide network reach and soon became the growth engine for the company (generating over 70% of consolidated revenues at its peak). However, the meltdown in used car prices soon made the business unprofitable and the company has been struggling to recover the business. It made some positive strides with its repricing efforts, starting with the bottom 20% which had been most underpriced, and has led to an improvement in average revenue per dealership. However, we believe there are potential downside risks given significant uncertainties around its CarOffer business and we remain on the sidelines. Initiate at Neutral.