sarayut Thaneerat/Moment via Getty Images

Introduction

CF Industries Holdings, Inc. (NYSE:CF) is a large-cap stock keenly noted for its expertise in nitrogen products, which are primarily used by the agricultural sector. CF’s operations, like most other stocks from the material sector, remain susceptible to the cyclical hues that afflict its end markets. Yet still, it has remained resolute in its ability to dole out dividends, which it has been doing so, since it made its debut on the markets, back in August 2005.

We think the dividend facet of CF has been quite underappreciated by the role it has played in helping bring through a 1.4x differential between the stock’s price returns, and its total returns since it went public.

An Unappealing Financial Outlook

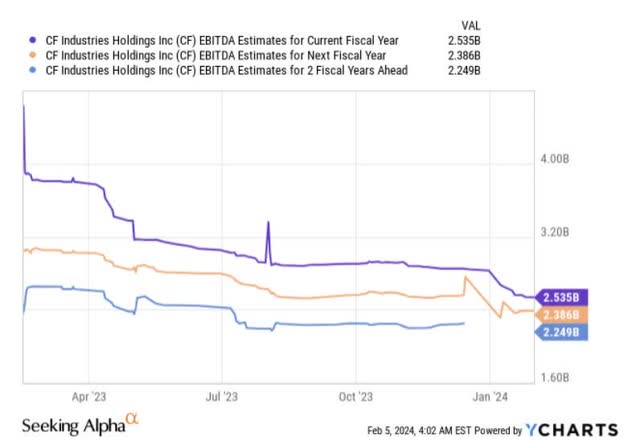

So far so good, but questions may certainly be asked about the sustainability of the dividend when the medium-term financial trajectory of CF appears to be on a slump. For context, note that after a +55% surge in the group EBITDA in FY22 to levels of $5.5bn, it looks all but certain that the company’s EBITDA in FY23 would drop substantially. As of 9M-23, it was already down by -50%, coming in at only $2.2bn. All in all, consensus is currently budgeting for a figure of only $2.54bn for FY23.

Crucially, the dip in the EBITDA profile is not expected to end there, and it could linger all the way to FY25, with an expected YoY decline of -6% in each successive year, going forward.

In light of this underwhelming operational scenario, how safe is the dividend?

How Safe Is CF’s Dividend Going Forward?

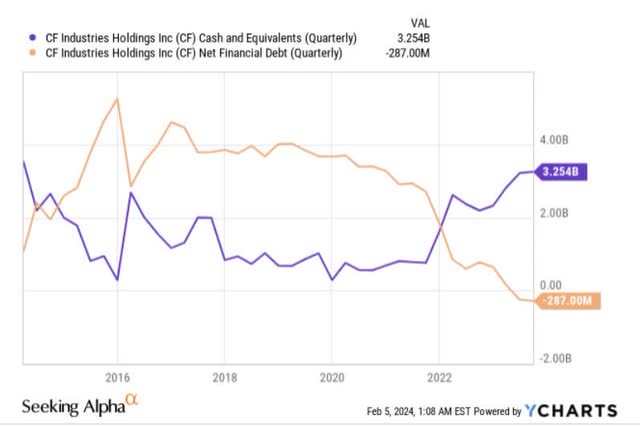

Well, one of the most encouraging features about the CF stock at the moment is its balance sheet. As you can see from the image below, the company’s cash balance has crept up to decade highs of $3.25bn, whilst we finally also have a net cash position of nearly $0.3bn (where the cash on books exceeds the total debt). However, the $3.25bn cash balance should not be taken for granted and will dip significantly when the Q4 results get published on the 14th of Feb.

We say this because the firm would likely have used around $1.25bn worth of cash to close the deal for the Waggaman Ammonia Production Facility in December. Nonetheless, that should still leave the business with $2bn of excess cash sitting on its books.

Note that management has previously stated that they remain very keen to indulge in opportunistic share purchases and we would expect a large chunk of the excess cash to be deployed towards this objective. For context, CF is currently in the midst of executing a mammoth $3bn buyback plan, that will account for 20% of its market cap.

Now, as of 9M-23, CF had only spent around $0.2bn towards its 2022 share buyback program (the rest of the buyback spend in 2023, around $0.38bn, deals with a 2021 program worth $1.5bn), but note that this program will lapse in less than 24 months (Dec 31, 2025). Now, assuming CF did a similar cadence of buybacks in Q4, as they did in Q3 and Q2 (roughly $150m per quarter), we’re basically looking at cash requirements of $2.65bn for the next two years, for CF to wrap up its repurchase targets by 2025 (on the Q3 call, management said they intended to fulfil this target).

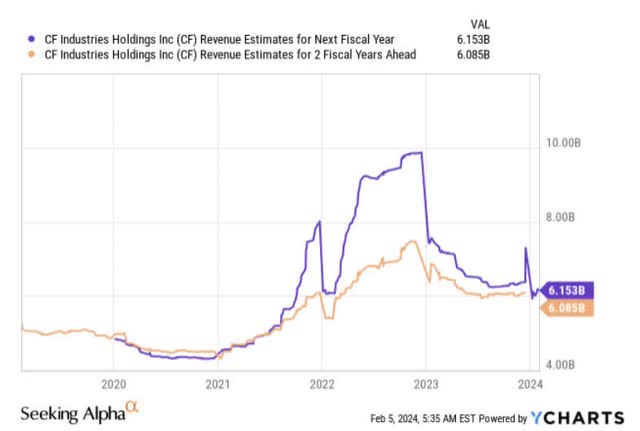

Whilst we have $2bn of cash on the books, note that CF also has displayed fairly competent cash-generation qualities over time. Like the EBITDA, CF’s topline over the next two years will be on a downward trajectory.

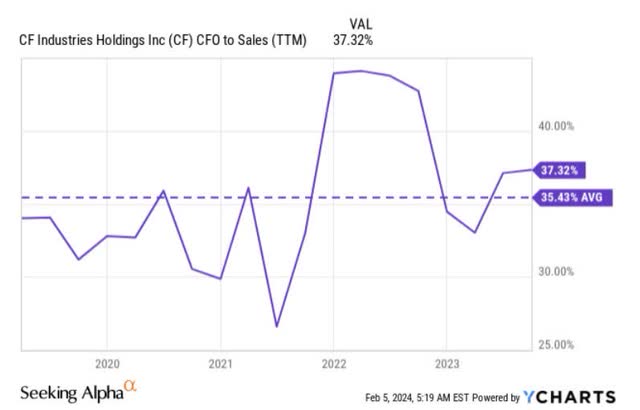

When the topline of a business is slowing, there also usually tends to be a dip in working capital investments, so much so that the sales to operating cash flow conversion goes up. Over the last 5 years, CF’s CFO to sales margin has averaged a little over 35%, and we could be reasonably hopeful this improves, but to be on the conservative side we’ve gone with the same ballpark figure of 35% for the next two years.

Using consensus revenue numbers for the next two years, that translates to expected aggregate operating cash flows of around $4.28bn ($2.15bn in FY23, and $2.13bn in FY24). CF management has also suggested that CAPEX commitments will likely be capped at $500m p.a, so effectively one is left with $3.28bn of expected free cash that could easily cover the gap left by the cash on books used to buyback stock (a gap of around $0.65bn).

All in all, CF is left with $2.63bn of aggregate cash that could be deployed towards covering the dividend over the next two years. For context, CF spent over $0.3bn of cash towards its dividends on a TTM basis, and with a recent 25% hike in its quarterly dividends, you could be looking at a ball-park figure of $0.4bn of divi payments or $0.8bn for both years (this could potentially be a lot less given that CF has been reducing its share count by approximately 2% every year, and will likely continue to do so, given the expected step up in buybacks). All in all, we think CF could comfortably meet its dividend, and still have around $1.83bn of excess cash on its books.

Closing Thoughts – Technical And Valuation Commentary

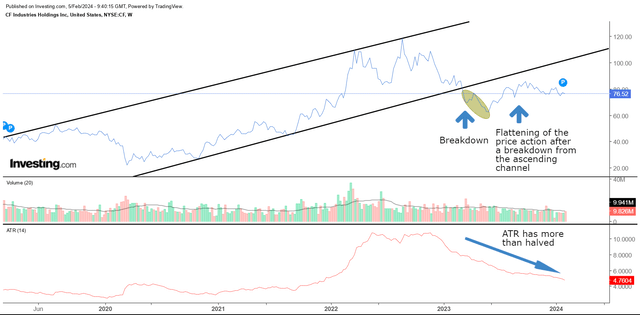

When we look at CF’s standalone weekly chart, we see both good and bad developments which imply that a neutral positioning would be preferable. The chart shows us that from the second half of 2020, until around Feb last year, CF had been trending up rather resolutely within a certain ascending channel (demarcated by the two black lines).

Bullish momentum appeared to have topped out in August 2022, and in the ensuing months, we also saw the stock fall out of this channel. Typically, the breakdown from the multi-week channel boundary should’ve emboldened the bears to go for the jugular and facilitate another leg lower in the share price, but encouragingly since June last year, the stock has benefited from bargain hunting support and flattened out.

Whilst bearish conditions appeared to have waned, the stock certainly hasn’t done enough to recoup its old channel either. All in all, what we’re seeing is a long bout of volatility contraction, which typically takes place before a big move happens (the volatility contraction thesis is augmented by substantially lower ATR readings which have more than halved from what was seen in late 2022).

Now, one could’ve been open-minded about a long position here, if the CF stock had looked oversold versus its peers from the broad agribusiness universe (betting on a case of mean-reversion basically). However, that is hardly the case with the CF stock’s current relative strength ratio (versus other agribusiness stocks), trading around 33% higher than the mid-point of its long-term range.

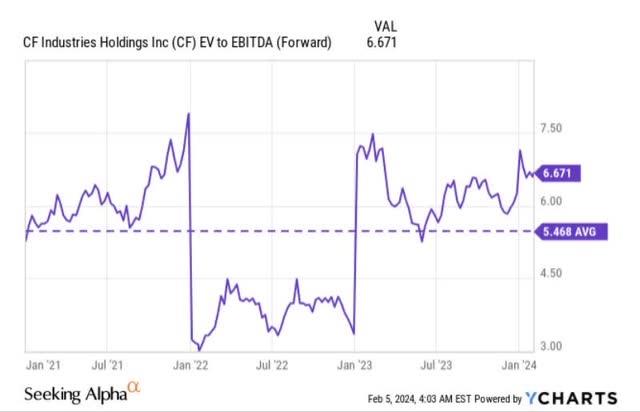

Finally, as touched upon earlier, CF’s EBITDA trajectory for the foreseeable future suggests an ongoing contraction through FY25. In light of a slumping EBITDA base, we don’t believe it makes a great deal of sense to shed out a forward EV/EBITDA multiple of 6.67x, which translates to a 22% premium over the stock’s 5-year average of 5.47x.