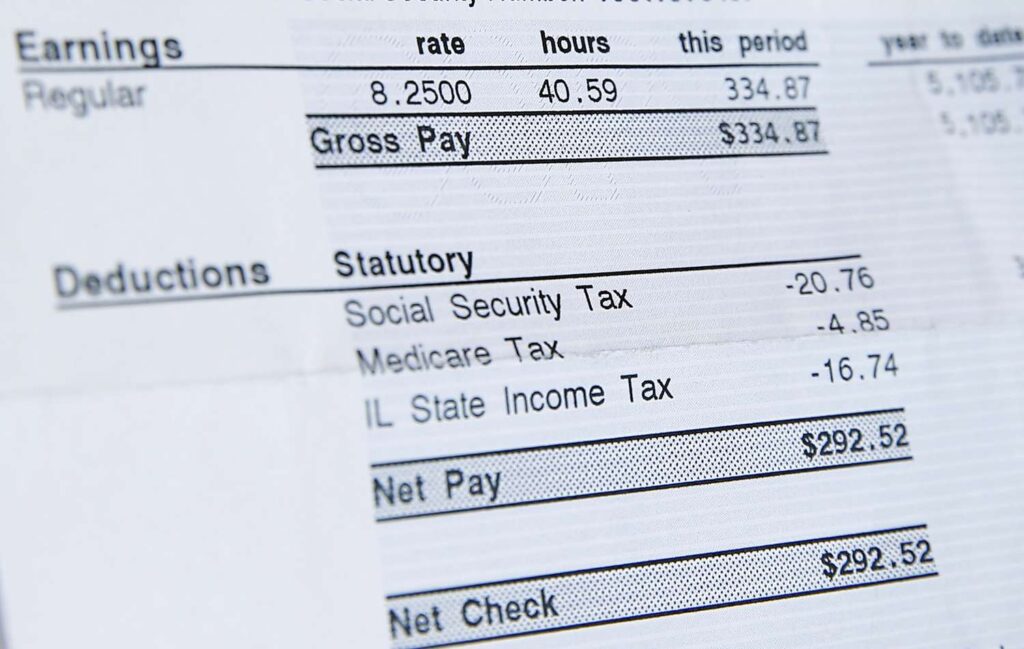

Your paycheck and pay stubs contain a variety of information about your income and the amounts your employer deducts from it, such as for taxes and insurance coverage. One item you may notice is group term life insurance or GTL for short. If you see GTL or a similar reference to group term life on your paycheck, that means it’s included as part of your employee benefits package. Though your employer may pay the premiums for the insurance, you could owe tax on it depending on the amount of coverage you’re provided.

Key Takeaways

- Group term life insurance (GTL) is a common benefit provided by employers.

- Coverage can also be extended to employees’ spouses or dependents.

- Your employer may pay the premiums for this coverage, rather than passing them on to you.

- Group term life insurance becomes a taxable benefit when the coverage amount exceeds $50,000.

- Group term life insurance does not have a cash value component, nor is it permanent.

What Is Group Term Life Insurance?

Group term life insurance is essentially what it sounds like: a life insurance policy that covers a group of people. This type of life insurance is often offered as part of an employee benefits package.

As with other types of life insurance, you can choose one or more beneficiaries. The amount of coverage your employer provides may be a multiple of your annual salary, such as one or two times what you make. You may also have the option to buy additional coverage at your own expense.

Because this is term life insurance, your coverage isn’t permanent. Instead, it remains in place as long as you’re working for that employer or up to a specified term set by the policy. If you decide to leave your job, you may have the option of converting to an individual term life policy.

How Group Term Life Insurance Is Taxed

Group term life insurance is tax-free for the employee up to a certain amount. Specifically, if employer-provided coverage is greater than $50,000, the excess amount is considered a non-cash fringe benefit, and the premiums for that extra coverage become taxable income for the employee.

There can also be tax implications if employer-provided group term life insurance is offered for an employee’s spouse or dependents. If the amount of coverage is $2,000 or less, then it’s not taxable to the employee. The premiums on coverage for spouses or dependents over that amount, however, could be treated as taxable income for the employee. If coverage exceeds $2,000, then the entire amount of the premium is considered taxable.

The amount shown on your paycheck or pay stub for group term life insurance represents the taxable benefit.

When you receive a W-2 form from your employer at the end of the year, it will report the total cost of any group insurance you received that was in excess of $50,000 and thus taxable. That amount will appear in box 12c of your W-2 and also be included in your income for boxes 1, 3, and 5.

How Your Taxable Premiums Are Calculated

The IRS has a table in its “Publication 15-B: Employer’s Tax Guide to Fringe Benefits,” that employers can use to determine the cost of excess coverage, based on the worker’s age.

For example, if you’re 45 years old, your premiums would be calculated at 15 cents per month (or $1.80 a year) for every $1,000 in coverage. The first $50,000 of coverage isn’t taxed, so if you had $200,000 in total coverage, you’d be taxed on the cost of $150,000 in coverage, or $270 for the full year ($1.80 x $150,000).

However, you may already have paid at least some of that cost through payroll deductions. If, for example, you’d paid a total of $100 over the course of the year, only the remaining $170 would be included in your taxable income.

Group Term Life Insurance Pros and Cons

Group term life insurance can be used as part of an employee benefits package to attract and retain talent. There are advantages and disadvantages to having this type of coverage through your employer.

Pros

- It is guaranteed, which can make it easier to get even if you’re older or not in perfect health.

- It may be more affordable than buying a life insurance policy on your own, especially when your employer pays part of the premiums.

- Having term life insurance at work can offer some financial security if you don’t have other life insurance.

Cons

- The premiums for any group term life insurance over $50,000 are considered taxable income.

- The non-taxable amount of $50,000 in life insurance may not be adequate if you have a family or other financial dependents.

- You can’t take it with you if you leave your job or if you are fired.

Why Is GTL on My Paycheck?

GTL stands for group term life insurance, which is available via your employer, who also pays the premiums on the life insurance.

What Does GTL Mean in Benefits?

Group life insurance (GTL) is a form of term life insurance, usually offered by the employer tax-free for up to $50,000.

Is GTL an Earning or Deduction?

Group term life insurance is referred to as a non-cash earning on your paystub.

What Taxes Are GTL Subject To?

Group term life insurance is taxed after the first $50,000.

Can I Opt Out of Group Term Life Insurance?

Some companies allow employees to opt-out of group term life insurance, others do not. Because it is offered as a no-cost benefit to the employee, it may not make sense to opt-out of the insurance.

The Bottom Line

If your employer offers group term life insurance, you won’t be taxed on the first $50,000 of coverage, so there is no downside in taking it. If you need more insurance than that, adding to your employer coverage may mean paying some tax, but it could still be a relatively inexpensive way to get the insurance you need.