There was new data out of the U.K. on Wednesday morning, showing prices falling more than expected, further evidence that a global disinflationary trend is under way.

How far and how long inflation will last are the key questions now for a stock market that has thrived in 2023, with the S&P 500

SPX

surging 24%.

Analysts at 22V Research led by Dennis DeBusschere have set out a playbook on how the market will react. They note that the Fed expects core PCE — 3.5% year over year as of October, with new data out Friday — will fall to 2.4% by the end of 2024.

In the first scenario, growth remains above the 2% trend, wages take longer to disinflate and core PCE tracks a bit over 2.4%, but not above 2.75%.

In that setup, the Fed would still cut rates, perhaps not by three or four times, though, says 22V. That would favor deeper cyclicals — energy, materials, industrials — “or make them tougher shorts,” and also make it tough to short the U.S. dollar or bet on U.S. Treasury yields declining, they say.

A second scenario would see core inflation tracking above 3% — Treasury yields and the U.S. dollar

DXY

would move higher, and risk-off factors would benefit, they predict.

Under a third scenario, inflation would head to 2.4% well before the end of 2024. That would mean four to five Fed rate cuts, more downside risks to the dollar and Treasury yields and further easing in financial conditions.

“Stocks do very well assuming we move below 2.4% on core PCE WITHOUT an increase in the unemployment rate,” they say.

22V’s broader message though is that the companies that have lagged, like small caps, should continue to catch up.

“Into year end we are not concerned about a sharp pullback, but with the VIX

VIX

sub-13, credit spreads in their 18th %tile (very tight), the S&P [price/earnings] over 19.5 times, and investors sentiment (AAII) in its 98th percentile, the scope for further S&P gains is narrowing. Internals rotations remain a better way to play for gains into year end,” said DeBusschere and the team.

The markets

Stock futures

ES00,

NQ00,

are drifting south, with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

dropping and tracking U.K. yields

BX:TMBMKGB-10Y

after a sharper-than-forecast fall in inflation for that country. The pound

GBPUSD,

is taking a hit on that.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,768.37 | 2.68% | 5.07% | 24.19% | 24.77% |

| Nasdaq Composite | 15,003.22 | 3.23% | 5.66% | 43.35% | 42.25% |

| 10 year Treasury | 3.911 | -11.43 | -50.14 | 3.11 | 23.75 |

| Gold | 2,053.40 | 0.50% | 3.11% | 12.20% | 12.57% |

| Oil | 74.43 | 6.53% | -3.11% | -7.55% | -5.09% |

| Data: MarketWatch. Treasury yields change expressed in basis points. | |||||

The buzz

FedEx stock

FDX,

is dropping after the package-delivery giant cut its full-year sales forecast over worries about subdued demand for holiday shipping.

Tesla

TSLA,

has reportedly told some employees it will not grant merit stock awards this year.

Read: Investor who called year-end stock rally says ‘Magnificent 7’ may continue to lead in 2024

Alibaba

BABA,

CEO Eddie Wu will take over the Chinese internet group’s e-commerce business.

The NYSE is suspending Farfetch shares

FTCH

over a liquidation warning.

U.S. current account data for the third quarter is due at 8:30 a.m., existing home sales and consumer confidence are expected at 10 a.m.

A divided Colorado Supreme Court barred former President Donald Trump from the state’s presidential primary ballot citing an insurrection clause. Trump’s attorneys say they will appeal.

Best of the web

The hedge fund traders dominating a massive bet on bonds

Red Sea shipping attacks could undercut financial market’s prevailing theme of the new year

Cubicles are making a comeback.

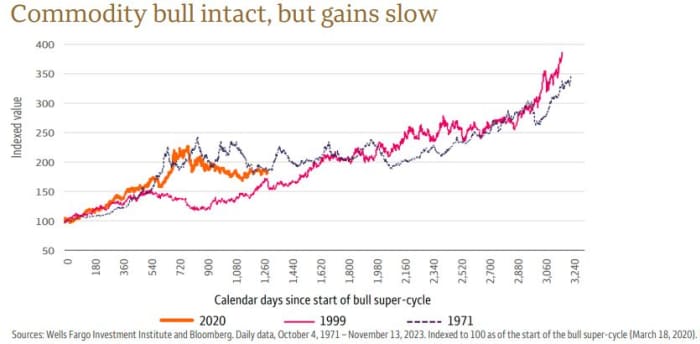

The chart

Three years on, with lots of commodity prices at decade highs, the commodity bull supercycle appears to have slowed, but Wells Fargo Investment Institute’s head of global real asset strategy John LaForge says investors should not give up on the asset class.

He provides the below chart:

“These long cycles have typically experienced periods of consolidation as persistently rising prices have led to added supply or slow demand, and they are often followed by a reassertion of the bull super-cycle,” LaForge tells clients. Any pullback is a buying opportunity, and while he likes energy and precious metals, suggests investors stay diversified and not stick to just one part of the space.

Top tickers

These were the top-searched stock market tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

MARA, |

Marathon Digital |

|

BABA, |

Alibaba |

|

AAPL, |

Apple |

|

PLTR, |

Palantir |

|

COIN, |

Coinbase Global |

Random reads

Woman gets a potato as a bonus — and is taxed on it.

Microsculpter’s nativity scene features an eyelash.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.