Amorn Suriyan/iStock via Getty Images

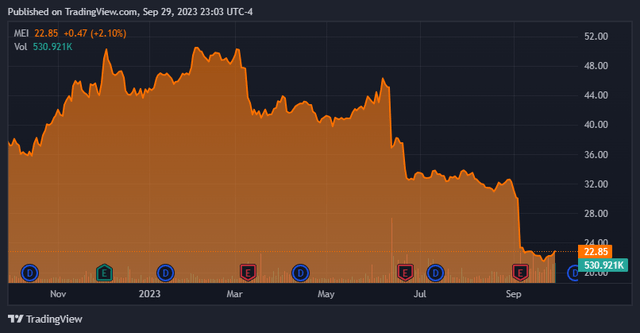

Methode Electronics, Inc. (NYSE:MEI) has made a notable move by acquiring Nordic Lights. While this acquisition has the potential to influence the company’s direction significantly, I believe certain aspects of MEI’s financial performance in FY 2023 warrant attention. Specifically, the post-acquisition figures indicate a decline in MEI’s EBIT margins and net sales. This raises questions about the integration challenges and the overall efficacy of the acquisition strategy. Furthermore, I find MEI’s capital allocation decisions somewhat perplexing, especially in light of the declining margins. I believe a more cautious approach to cash management would have been advisable. Instead, MEI has adopted a more aggressive stance, leading to decreased cash reserves and an uptick in debt post-acquisition. Based on my valuation model, it appears that MEI’s current valuation is close to being fairly priced. Given these observations and the inherent uncertainties, I would recommend a neutral stance on MEI for now.

Business Overview

Methode Electronics, Inc. (MEI) is a global company that designs and produces mechatronic products, catering to OEMs in sectors like automotive, aerospace, and medical devices. Organized into four segments – Automotive, Industrial, Interface, and Medical – they contribute 54.6%, 39.8%, 5.2%, and 0.4% to the total revenues, respectively. Specifically, the Automotive segment, spearheaded by the Methode Electronics Automotive Group, delivers user interfaces and power solutions, further enhanced by Methode Sensor Technologies’ sensor solutions. Grakon, a key player in the Industrial segment, specializes in custom lighting. The Interface segment boasts brands such as dataMate for data networking and TouchSensor for cutting-edge touch technologies. On the medical front, Dabir Surfaces Inc. innovates in medical device technologies, aiming to elevate patient outcomes.

I believe MEI’s diverse portfolio highlights its adaptability and provides a competitive edge in addressing a wide spectrum of OEM needs. This multifaceted strategy positions MEI for steady revenue inflow from various sectors. However, as I’ll explain, monitoring EBIT margins is crucial, especially in light of recent acquisitions.

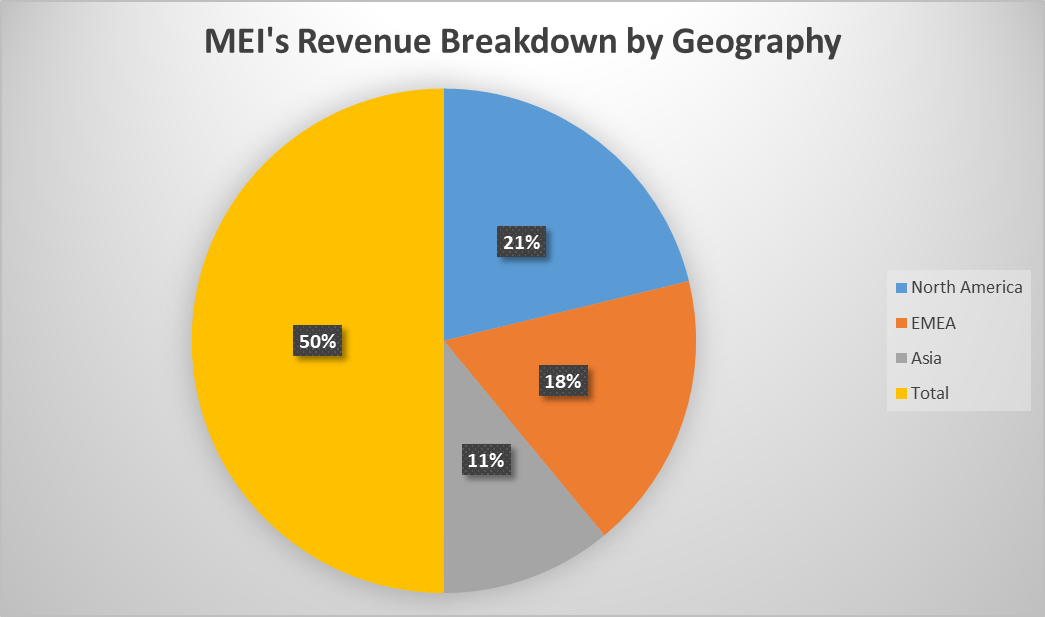

Author’s elaboration.

Analyzing the revenue distribution of MEI, it’s evident that the company has a significant market presence in North America, Europe, the Middle East & Africa (EMEA), and Asia. Specifically, North America contributed $122.8 million, EMEA added $103.3 million, and Asia accounted for $63.6 million of the total net sales, totaling $289.7 million. In my view, this distribution suggests that MEI has been successful in its strategic efforts to diversify its market exposure. The acquisition of Nordic Lights Group Corporation further supports this inference, indicating a deliberate move by MEI to expand its geographic footprint. This diversification is crucial as it mitigates risks associated with market concentration and positions the company to tap into emerging opportunities in different regions.

Recent Performance and Post-Acquisition Implications

Indeed, MEI’s acquisition of Nordic Lights Group Corporation is a significant highlight for MEI, enhancing LED lighting solutions, diversifying market exposure, extending its presence in industrial and non-auto transportation markets, and broadening its customer base and geographic reach. This aligns with a recent slight change in revenue distribution over the past three fiscal years, where the Automotive sector revenue declined while the Industrial sector’s share increased after Nordic Lights.

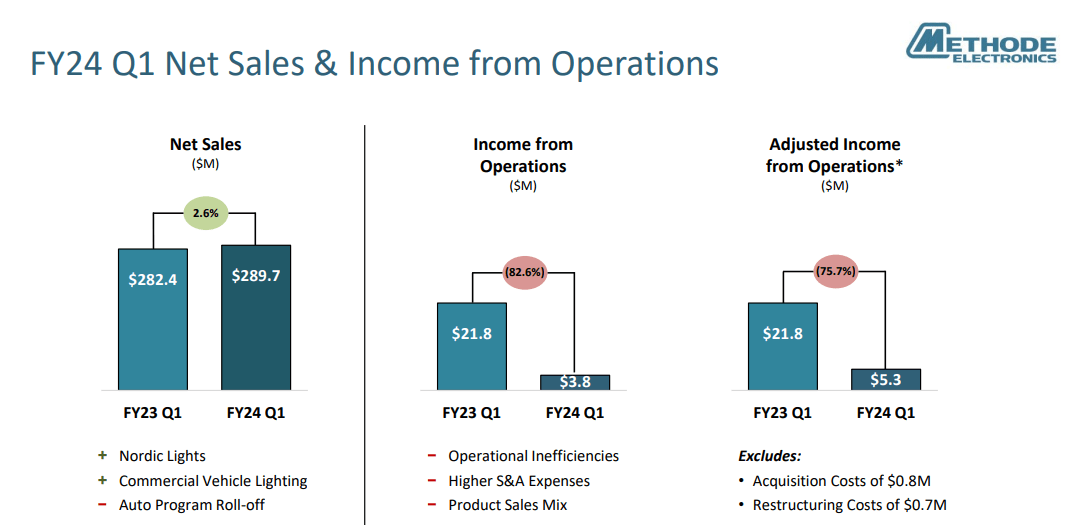

MEI’s latest earnings slides.

Moreover, MEI’s first quarter of 2023 saw its net sales rise by 2.6% to $289.7 million, primarily driven by the acquisition of Nordic Lights, which added $21.2 million. However, when isolating core operations by excluding such acquisitions and factors like foreign currency, sales saw a 1.5% dip. This indicates that while strategic purchases like Nordic Lights can enhance revenue streams, there might be underlying challenges in MEI’s primary market segments, underscored by the mention of a significant program roll-off in North America. I believe MEI’s decision to consolidate its ownership of Nordic Lights further suggests a targeted approach to harness synergies and streamline operations. Yet, a point of concern is the slight reduction in R&D expenditure from $37.1 million to $35.0 million over two fiscal years.

In FY 2023, MEI’s sectors perform differently due to global economic changes and strategies. Net sales slightly rose to $1,179.6 million. The Industrial segment grows by 21.0% to $384.9 million from digital infrastructure alignment. However, the Automotive segment dropped by 5.8% to $736.2 million due to geo-financial factors, hinting at challenges in North American markets. Interface and Medical segments see a sales dip, with the latter facing a $6.1 million operational loss.

Financial Analysis and Valuation

MEI’s EBIT witnessed a significant 82.6% decline, dropping to $3.8 million from $21.8 million in fiscal ’23. While acquisition and restructuring costs played a role, the adjusted figures still indicate a 75.7% decrease. Similarly, EBITDA decreased by 53.4% year-on-year. So, I believe MEI’s M&A growth approach is strategically apt, but operational inefficiencies, highlighted by falling EBIT margins, raise concerns. The EPS further emphasizes this, with a sharp 96.6% fall to just $0.02 per share. As management suggests, this decline stems from operational challenges, an unfavorable sales mix, and a lack of government support.

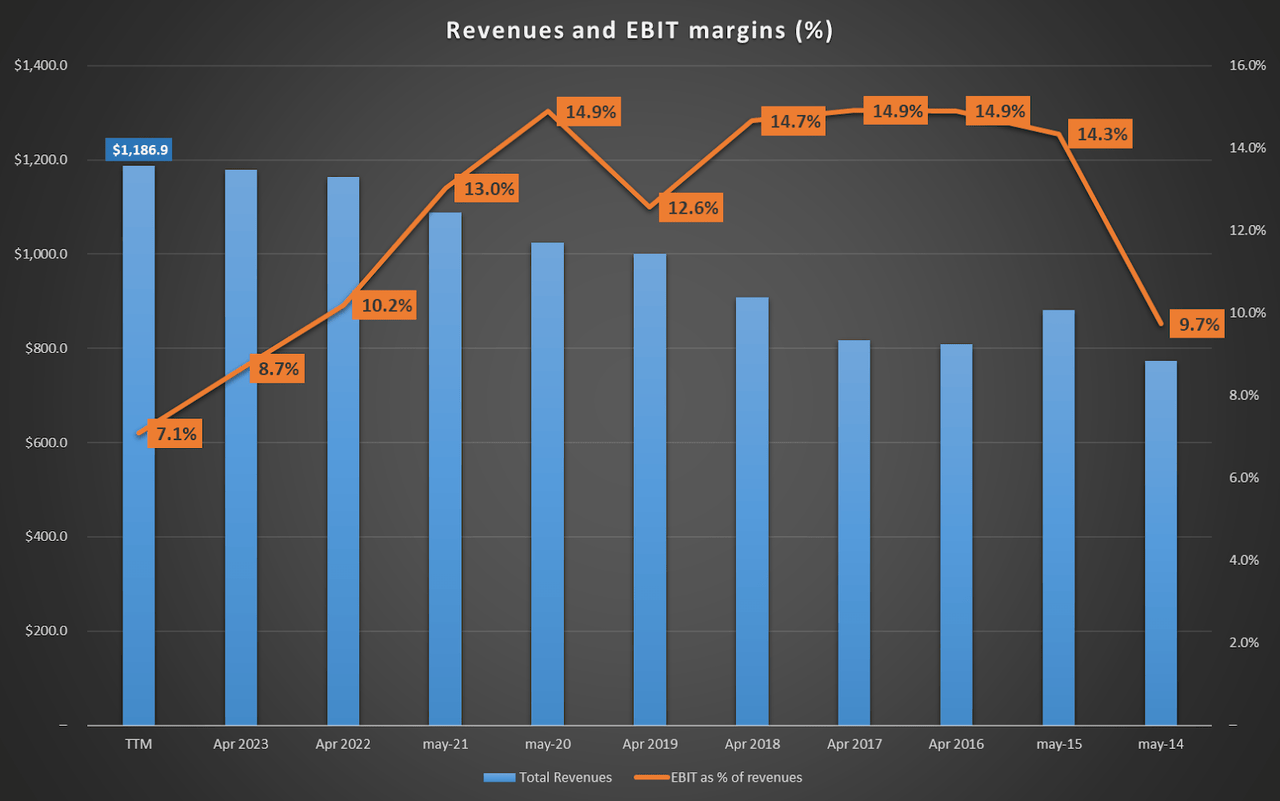

Seeking Alpha plus author’s elaboration.

MEI’s guidance for fiscal ’24 and ’25 is a mixed bag. While Fiscal ’24’s net sales projections are lowered, fiscal ’25 offers a brighter outlook with anticipated organic sales growth. However, the diluted EPS for fiscal year 2024 is notably reduced due to operational issues in North America and a sensor business slowdown. In my view, the Nordic Lights acquisition may be causing operational inefficiencies. Thus, MEI must successfully integrate it to justify its current valuation. Moreover, juxtaposed with a $20.8 million rise in administrative expenses and a $15.0 million cash decline post-acquisition, further underscored the need for prudent cash management. This, combined with the decision to initiate a $48.1 million Share Buyback Program amidst a net income fall to $77.1 million, raises potential capital allocation concerns. Naturally, after these puzzling cash management moves, it’s no surprise that debt increased by $33.4 million, ending the quarter at $369.4 million.

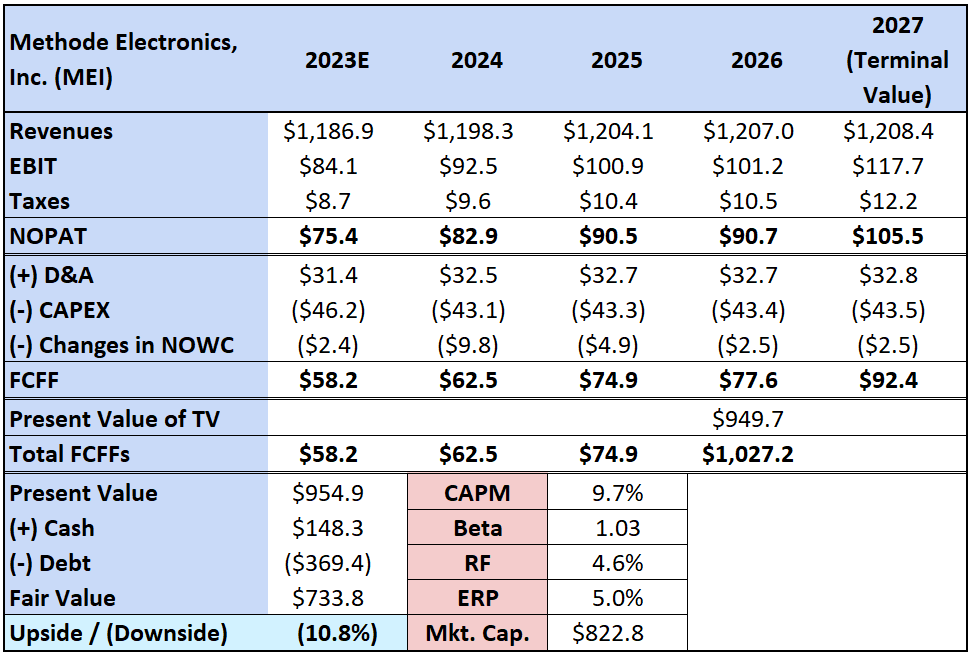

Thus, as a whole, I think MEI is facing challenges in integrating Nordic Lights effectively, which raises concerns from a valuation standpoint. I’ve been operating under the assumption that EBIT margins won’t continue their recent contraction trend. While I’m optimistic that MEI will eventually integrate Nordic Lights and enhance its margins, the recent cash management decisions introduce an element of uncertainty. However, I believe it’s prudent to anticipate modest growth and some EBIT margin recovery for my valuation model. I’ve relied on historical averages relative to total revenues to project MEI’s D&A, CAPEX, and NOWC. Utilizing the CAPM’s suggested 9.7% discount rate, I’ve formulated my DCF using the FCFF approach.

Seeking Alpha plus author’s elaboration.

As you can see, my valuation estimates the company’s fair value at approximately $733.8 million, considering its cash and debt positions. When juxtaposed with its current market cap of $822.8 million, there’s a potential downside of 10.8%. However, given that this valuation is closely aligned with its present market cap, I believe MEI is reasonably valued at the moment. Considering MEI’s qualitative attributes, potential challenges with acquisition integration, EBIT margin risks, and my valuation insights, I’d recommend MEI as a “hold” currently.

Conclusion

Methode Electronics has made a notable strategic decision with the acquisition of Nordic Lights. While this move offers potential for diversification and expanding market presence, it also brings forth challenges related to integration and operations, as indicated by the FY 2023 financial figures. In examining the company’s financial performance, particularly the fluctuations in EBIT and revenues, it becomes evident that MEI needs to integrate Nordic to improve its margins. According to my valuation model, there appears to be a potential downside of 10.8% compared to MEI’s current market capitalization. This suggests that MEI is trading close to its fair value, especially considering the challenges associated with the Nordic Lights acquisition and the uncertainties surrounding EBIT margins. Given these factors and my valuation, I believe it’s prudent to rate MEI as a “hold” for now.