Editor’s note: Seeking Alpha is proud to welcome Amphion Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Wongsakorn Dulyavit

I like to find businesses that are simple, durable, predictable with a strong moat, and capable management.

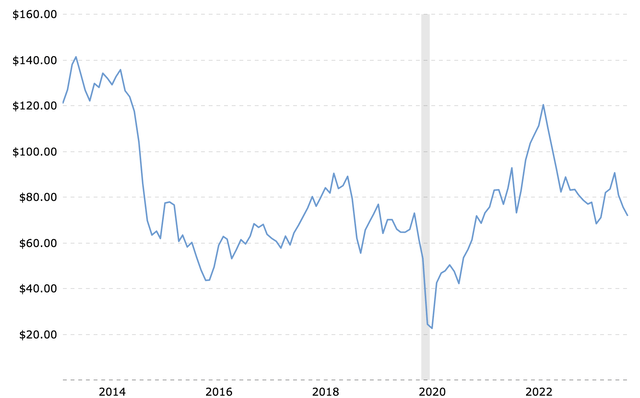

Mohawk Industries (NYSE:MHK) ticks most of these boxes for me. While it may not be as predictable due to its operating in a cyclical industry, Mohawk stands out as more resilient than most businesses in this category. Remarkably, it has not experienced a negative operating cash flow year in the past three decades.

While some past articles have harboured negative sentiment towards MHK, I see signs of improvement in what is now a great business at an inflexion point. Therefore, I rate the stock a buy.

Main Thesis Points

1. The market is underappreciating the FCF generative ability of MHK as this was hidden by their aggressive M&A activities and catch-up investments, the latter is no longer the case.

2. MHK’s true Operating Income margins are hidden behind the macro woes of the past few years.

3. The market is underestimating Mohawk’s growth potential in Emerging Markets.

4. We are entering a new renovation and construction upcycle.

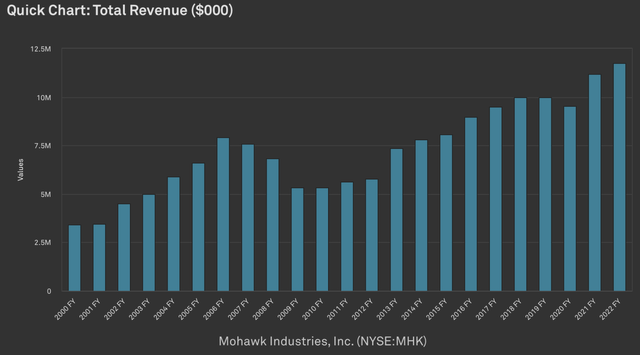

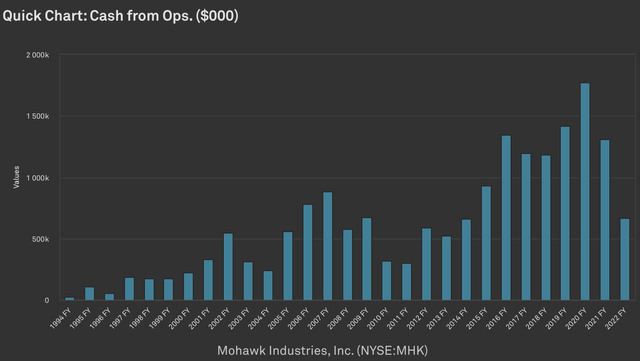

Historical Operating Cash Flow (Capital IQ)

Business and Industry Overview

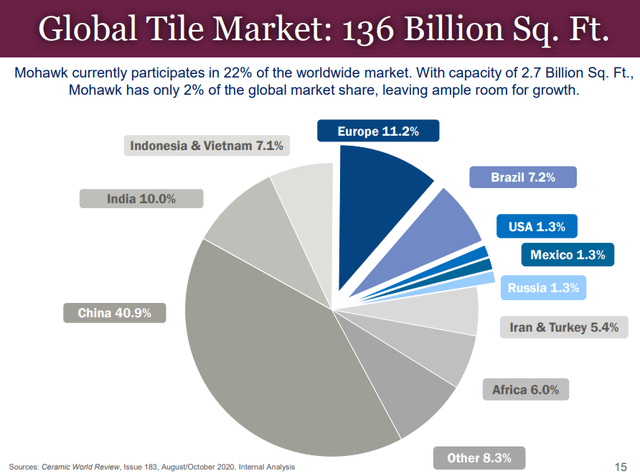

Mohawk’s Participation in the Global Tile Market (Investor’s Presentation)

Mohawk Industries is the world’s largest flooring company, competing in the US (~56% of revenue), Europe (~27%), Latin America (~8%), and Rest of the World (~9%). It’s important to highlight that the global flooring industry is highly fragmented, divided by thousands of small regional players. Mohawk’s strategy is to acquire these smaller players and integrate them to gain market share.

In the US, a history of organic growth and roll-up acquisition has led MHK to become the market leader. It currently shares a duopoly with Shaw Industries which is owned by Berkshire Hathaway (BRK.A). Fitch estimates the company has about a 20% market share in the North American flooring industry. Mohawk has ~50% market share in the US ceramic market. IBISWorld estimates that Mohawk accounts for 46.4% of total Wood Flooring Manufacturing industry revenue in the US.

The dynamics in Europe are quite similar to the US. However, Latin America and ROW are highly fragmented with small regional players. This has been a driver for their recent M&A strategy.

The global flooring industry is expected to grow at 5.2% CAGR between 2023 and 2030 according to grandviewresearch. While marketsandmarkets expect a 9% CAGR between 2023-2028 for the global flooring market. Specifically, emerging markets are projected to account for the highest CAGR.

Now that we have an idea of the industry, let’s look at what makes Mohawk unique.

Moat

Cost Advantage

Due to the high fixed-cost nature of the industry, these larger companies have a huge cost advantage over smaller players who exhibit unstable and thin margins.

Vertical Integration from Manufacturing to Distribution

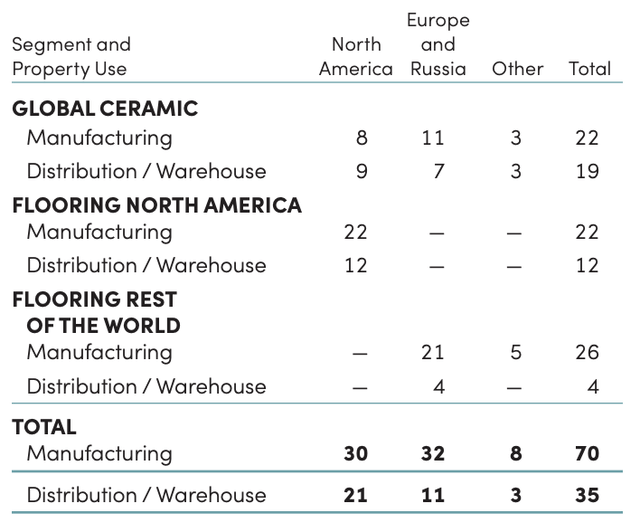

Mohawk 2022 Annual Report (Mohawk)

Mohawk owns 70 Manufacturing facilities and 35 distribution centres (see image above), as well as an 800-strong fleet of delivery trucks according to diginomica. This lowers their variable cost driven by distribution economics. In addition, Mohawk and Berkshire Hathaway’s Shaw Floors are the only two flooring companies with a nationwide distribution infrastructure in the US.

Patents and Technology

Mohawk was late into Laminate Vinyl Tile (LVT) and had to “catch up” since 2015, meanwhile, other more established LVT manufacturers took market share from them. However, the filings of the past 2 years suggest Mohawk has finally regained competitiveness in this area (I will dive deeper into LVT in later sections). Mohawk has its unique LVT advantages, such as its patented waterproof LVT technology which offers scratch, dent and stain protection. Another example is Mohawk’s StepWise™ tiles technology which surpasses the standard tile performance in wet conditions for indoor floor tiles by over 50%.

Brand Recognition

Mohawk owns dozens of popular brands: Daltile, Marazzi, and Quickstep to name a few.

Management

Mohawk’s CEO, Jeffrey Lorberbaum, has been with the company since 2001 and holds a 15% stake in the company (Almost his entire net worth is tied up with the company).

Looking back on past guidances, the management has historically been highly conservative with guidance. This gives them credibility and tells me they are pragmatic and we shouldn’t see any negative surprises in the future.

The management has historically been keen to admit mistakes, make promises and act upon them effectively. Their “comeback” in the LVT segment highlights this.

There have been past issues with capital allocation, but I believe this is changing (I will discuss this issue in a later section).

Mohawk’s Transition from Roll-up to Growth to Restructuring

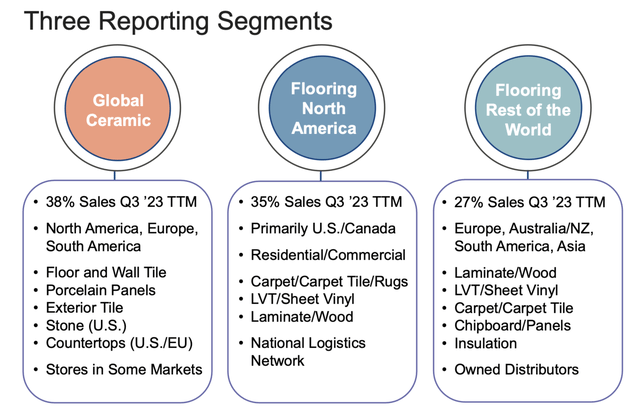

Mohawk’s Three Reporting Segments (Mohawk)

Referencing Glory_Warriors on VIC, who I believe describes Mohawk’s story extremely well:

Mohawk has transitioned from roll-up to growth to restructuring story.

1. Roll-up (1992-2015). Mohawk’s business model is to bundle new flooring categories into their last-mile distribution network. After consolidating the carpet industry, they expanded into ceramic tile (Dal-Tile, Marazzi) and laminate (Unilin, IVC). The company always had modest organic growth (+5% per year average, even in good days), but acquisitions added +5pts per year and EBIT margins expanded +125bps per year, so earnings grew rapidly. The company spent ~$300mm capex per year (5% of sales) on brownfield factory modernizations with very high returns on capital, which drove most of the margin expansion.

2. Growth (2015-2018). With no major acquisitions left and limited brownfield opportunities, but unwilling to return capital to shareholders, Mohawk pivoted to ill-advised organic growth. It spent ~$800mm capex per year (8% of sales) on greenfield factories all over the world, adding $1.2bn revenue capacity off a $10bn revenue base.

3. Restructuring (2018-2020). Three years later, revenue was still $10bn. The extra capacity was sitting unused. Factory capacity utilization fell from ~85% to ~70%, and margins collapsed. The company stopped building greenfield plants. Mohawk closed old plants to right-size the manufacturing footprint and restore margins.

4. Recovery (2021-today). Mohawk’s capacity is sold out, they are getting price in excess of cost inflation, and outgrowing a robust flooring market.

I would also add that between 2015 and 2019, Mohawk invested a significant amount of CAPEX to transfer IVC’s LVT technology from Europe to the US (This CAPEX is no longer needed as contextualised in our projection). And as Mohawk started the “restructuring” phase, they lowered CAPEX significantly as they closed down plants.

Capital Allocation

Between 2000 and 2022, MHK saw a Revenue CAGR of 5.53%. MHK’s success can be attributed to both organic and acquisition growth (Dal-Tile, Marazzi, Unilin etc.). Purchasing IVC Group was also critical for their LVT catch-up phase. Between 2002 to 2023, Mohawk generated 8.1B FCF, and out of these:

- $7.56B Spent on Acquisitions

- $3.1B on Goodwill Impairments

- $1.7B on Share Repurchases

- $5.5B increase in Equity Value

3.1B goodwill impairment is never good news and shows that they aren’t the best capital allocators. One of the biggest reasons for such a high impairment value was the decision to open numerous greenfield plants. While this expanded the overall capacity, it didn’t translate into improved profit margins unlike investing in brownfield plants. Some of these plants were closed as the company began their “restructuring” phase (COVID accelerated this process too).

I believe Mohawk will not make the same mistake again. Their current strategy is to acquire companies in emerging markets (“ramp up”) and consolidate them to become monopolies while continuing their efficiency improvement efforts in the US and EU. There are a few reasons why this might be the case:

1. There is nothing significant or large to buy in the US. They have so far consolidated the US market to become a duopoly.

2. They no more need to catch-up with LVT. Mohawk has been gaining LVT market shares since 2018.

3. They have announced multiple plans to invest in cost reduction measures and improve efficiency on their US and European assets. (This will be discussed more).

4. They have shifted focus towards emerging markets

5. The management prioritized share repurchases from 2018 to 2022 and shrunk the share count by 14.4%.

Let’s go over a few of these in detail.

Shift Towards Emerging Markets

In June of 2022, MHK purchased the Mexican ceramic tile business Vitromex for $293 million in cash. Then, in November 2022, MHK purchased Elizabeth Revestimentos, a Brazilian ceramic tile business, for approximately $217 million in cash.

According to the 2023 Q3 Investor’s Presentation, the management expects these 2 acquisitions to almost double ceramics sales in Brazil and Mexico. Furthermore, after acquiring Elizabeth Coatings, Mohawk will become the largest ceramic tiles producer by revenue in Brazil, which is the world’s third-largest ceramic market.

The company’s growth strategy is towards consolidating emerging markets into an Oligopoly/Monopoly like what it has successfully done in the US and Europe.

I believe Mohawk’s strategy towards emerging markets is a huge opportunity. The Flooring ROW segment has historically seen mid to high double-digit operating income margins because of how fragmented it is with small players, helping giants like Mohawk can leverage its distributional channels and economies of scale.

I believe continuing such acquisitions can increase the Flooring ROW segment’s operating income margins by at least +150bps above its 2015-2021 average after 3-5 years.

Next, let’s look at their share repurchasing history.

Share Repurchases

Share count has gone from 74.4 million in FY2018, to 71 million in FY2020, to 69 million in FY2021, and finally to 63.7 million as of Q3 2023.

This represents a 14.4% drop in shares outstanding under 4 years.

In hindsight, they shouldn’t have purchased so many shares in 2021 at $170 (as the stock price has since fallen by 40%). However as the saying goes, hindsight is 20/20. 2021 was a period of low-interest rates and a housing shortage, which explained why they bought so much. They continued to repurchase shares up until Q3 2022 when they entered agreements to acquire the Mexican and Brazilian Tile Businesses ($515m).

The fact that the management bought back 14% of the share count speaks volumes of their commitment, a great contrast to pre-2018.

In Q3 2023’s Earnings Call, an analyst asked the management why they paused their buybacks. The management responded that there’s a lot of economic uncertainty in the world so they are maintaining excess capacity at the moment. They will consider buying stock as soon as there isn’t another worldwide problem.

As of Q3 2023, there is still an available amount of $229.2 million within the 2022 Share Repurchase Program for potential purchase. Based on the current price of $91, this implies the ability to repurchase approximately 2.51 million shares, equivalent to 4% of the float.

Mohawk’s Underappreciated Margins

Now, I will highlight how Mohawk’s true margins are greatly underappreciated and obscured by macro irregularities of the past few years. I believe we will see Mohawk’s true margins surfacing for several reasons:

1. Cost reductions

2. Input Costs Normalisation

3. LVT’s competitiveness returning

Cost Reduction Measures and Focus on Profitability

After the high input-cost shock of 2022, Mohawk realised that they needed to focus on cost-reduction measures to improve overall efficiencies.

During 2023 and 2022, the Company took actions to enhance future performance including facility and product rationalizations, restructuring initiatives and workforce reductions. The Company has continued to reduce costs across the enterprise by enhancing productivity, streamlining processes, controlling administrative expenses and executing restructuring actions.

The Company anticipates these global actions will deliver annual savings of approximately $135 million, with an estimated cost of approximately $215 million.

I believe these cost reduction measures will increase each segment’s operating income margins by at least +150bps in the near future.

Lower Input Costs

Secondly, I believe we will see Mohawk’s margins returning to pre-2022 levels as raw material costs normalise.

Margins suffered in 2022 due to:

1. Rapid cost escalations in materials, energy, transportation, and labour

2. High-interest rates affected new home construction and residential remodelling (less so in the US)

Crude Oil Prices (macrotrends)

We can see that crude oil price has fallen 40% since its peak in mid-2022, this will translate to lower input costs. Mohawk has also invested in renewable energy initiatives to further address energy price volatility.

The cost started gradually falling in late 2022 and it takes usually three months to six months to flow through our P&L.

In Q3 2022, lower costs led by material and energy totaled $112 million, offsetting the weaker price mix of $106 million. Now sequentially, cost declined $65 million, exceeding the lower price mix of $29 million. In the fourth quarter, we would anticipate lower costs should continue to flow through the P&L.

We are also initiating restructuring actions to eliminate older assets and improve our cost and utilization.

The pricing has declined substantially to import prices with both lower freight, as well as lower material costs. Our U.S. manufacturing costs are also coming down with it… so next year our margins should expand and we expect the profitability of the business to improve.

I believe the normalisation of raw material prices will increase each segment’s operating income profitability by +100bps in the short term.

LVT’s Returning Competitiveness

I believe LVT’s True Operating Income Margins will emerge as the economy normalises.

Mohawk’s past issue with Luxury Vinyl Tiles (LVTs)

Mohawk only gained a substantial LVT manufacturing capacity in 2014 through the acquisition of IVC Group. However, by that point, rival companies had already solidified their positions in the LVT market. The subsequent years were marked by Mohawk’s efforts to catch up, and their struggle to compete in the LVT sector became particularly evident in 2018 as they encountered growing competition from Chinese LVT imports. This caused a lag in revenue and simultaneously squeezed their margins. The unfavourable timing, coinciding with the 2018 housing cooldown, further exacerbated the situation, leading to a significant drop in stock price.

The management realised their mistake and responded honestly and appropriately. By 2019 Q4. The management announced that they’ve enhanced the production and speeds of their LVT manufacturing in the US and Europe and are now operating at similar levels to their European LVT operations.

“European LVT operations” here refers to the Belgium-based IVC Group, which has been an industry leader in LVT. The main strategy behind acquiring IVC Group back in 2014 was to transfer this more efficient technology to the US. Mohawk did encounter some production issues in-between but these were all quickly resolved. In the most recent annual report, Mohawk believes “it has a competitive advantage in its LVT and sheet vinyl markets due to industry-leading design, patented technologies, brand recognition and vertical integration”. They have successfully recaptured their competitiveness but the market doesn’t seem to recognise this.

2020 was the inflection point of LVT’s competitive return as highlighted in their quarterlies. Many of these incremental increases in LVT margins thereafter were “hidden” by the macro extremes of 2021 and 2022. 2021 was a time of low-interest rates, low input costs, and high demand (inflated margins), whereas 2022 was the polar opposite. Both years are unrepresentative of LVT’s true operating income margins.

Pent-up demand will be released when interest rates do fall. We could see margins returning and exceeding past ceilings by at least +100bps. This brings us to the next section.

Macro and Cyclicality Outlook

On Emerging Markets

The increasing population in emerging markets and rapid urbanisation, coupled with an expanding middle class, will lead to a substantial demand for the development of infrastructure in residential and commercial spaces.

The rapid urbanisation and industrialisation in emerging markets will lead to more construction of commercial buildings (hotels, hospitals, airports, public spaces etc.). Government and private investments are expected to expand within the next few decades as well.

Mohawk is in the perfect position to capture such growth given its strong balance sheet, technology, and pre-existing logistical networks and expertise. They can leverage their vast economies of scale after consolidation in a high fixed-cost industry.

On Developed Markets

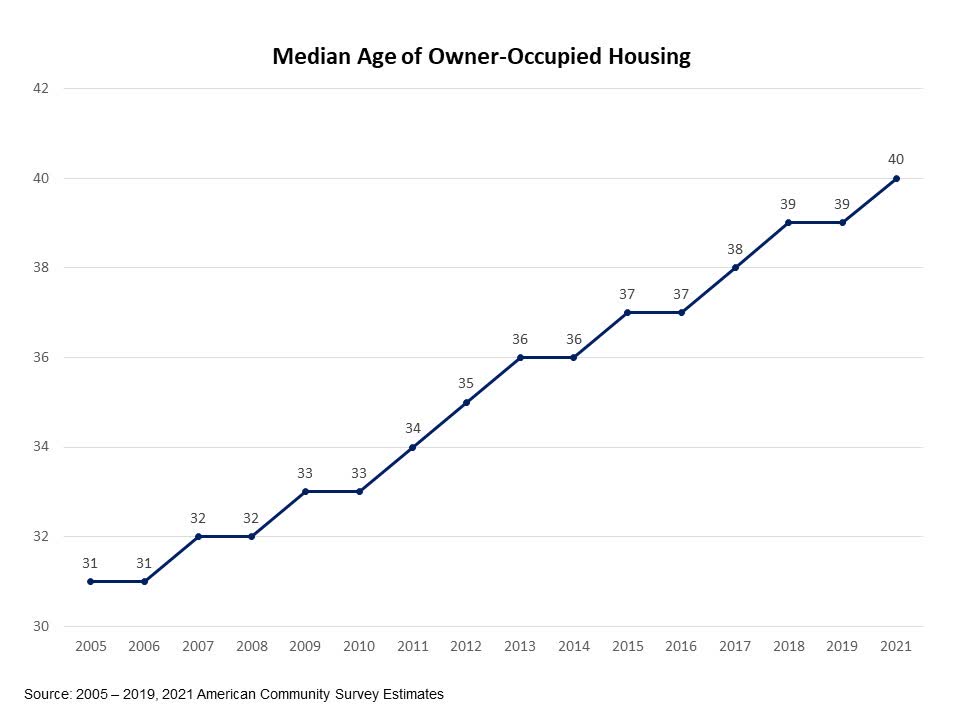

Median Age of Owner-Occupied Housing (eyeonhousing.org)

Mohawk’s management has stated in their 2023 Q3 Earnings Call that they will benefit from the significant pent-up demand when the industry rebounds. Specifically, the U.S. has been plagued by an ageing U.S. housing stock which has yet to recover from the GFC. The management quoted a JPMorgan survey which indicated more than 80% of homeowners indicated they are planning renovation projects in the near term.

After years of construction trailing demand, substantial new homebuilding will be required for many years to come. A report from the National Association of Home Builders in February 2023 noted that ~50% of owner-occupied homes in the U.S. were built before 1980, with around 35% built before 1970. Moreover, the national housing stock only saw a ~8.3 million units increase through new construction from 2010 to 2021, merely 10% of the total owner-occupied housing stock. They concluded that the shortage of new construction will lead to an expanding remodelling market, driven by the need to enhance or repair ageing structures. Increasing home prices further incentivises homeowners to invest more in home improvement, suggesting that remodelling may outpace new construction in the long run.

Other Macro Points

The unemployment rate remains low, so any recession possibility is unlike the GFC when unemployment-led foreclosures were common. Furthermore, the shortage of single and multi-family housing persists, both in the US and EU. New construction and homebuilding accounts for around 20% to 25% of Mohawk’s business according to the Q3 2023 Earnings call. The housing supply deficit remains at ~5 million in the US and an ageing housing & low stock should drive near-term and future growth in new construction & remodelling.

Many homeowners are “locked” into their houses since they purchased or refinanced during COVID’s low-interest rate environment. Of the mortgages currently outstanding, 90% are <5%, 80% are <4% and 50% are <3%. There are no economic incentives for current owners to sell their houses and purchase an equivalent one at higher mortgage rates. This causes further shortages and requires new construction to shore up the supply deficit.

There is significant pent-up demand for remodelling and replacement. For example, carpets usually get replaced every 3-5 years but Covid and the past year’s cost of living crisis have delayed it. Incidentally, carpets account for ~60% of Flooring NA’s revenue. Also, Floating Floors (a type of LVT) change styles, dimensions, and interlocking mechanisms every 4 to 5 years (doesn’t change much but just enough to make people buy an entire new room of flooring, even if only one of their floorboards broke). This means one tiny replacement will require many people to replace their entire flooring.

Energy prices have declined ~80% from the peak, lowering input cost. Some prices have yet to normalise (i.e. Rubber), but once they do, we will see a significant improvement in margins. The ongoing US Tariffs on Chinese LVT & vinyl flooring will continue to support US businesses, for which Mohawk is the industry leader.

Lastly, demographic changes with Millennials and Gen Z will cause further pent-up demand for housing purchases.

The reasons above signal that as inflation and interest rates fall, much of this pent-up demand will be realised. Lower input costs will also drive margins up. All in all, this becomes the perfect setup for a housing boom. MHK has a track record of liquidity and a strong balance sheet even through the depths of the GFC. So, the possibility of a recession in FY2024 will only delay the timing of the thesis, instead of invalidating it. Meanwhile, we see a further increase in pent-up demand and ageing supply.

The pent-up demand for houses – for housing, for improvements and remodelling that hasn’t been done, we don’t lose it, it just comes back later. – 2023 Q3 Earnings Call

Balance Sheet

MHK has a pristine balance sheet that will help it cruise through any interest-rate hikes and potential recessions. It will also enable them to capitalise on the construction and renovation upcycle more effectively than smaller operators with tighter capacity and margins.

Overall, 63% of MHK’s debt is fixed, and 37% are floating, this means a further rise in interest will not affect their balance sheet too significantly.

FIXED 529m: 1.750% Senior Notes, payable June 12, 2027; interest payable annually

FIXED 500m: 3.625% Senior Notes, payable May 15, 2030; interest payable semi-annually

FLOATING 600m: 5.85% Senior Notes, payable September 18, 2028; interest payable semi-annually

Mohawk usually generates between 10-15% OCF/Revenue. The lowest it has gotten was 5.3% of revenue in 2011 during the depths of the GFC. If we model 5% of its current revenue as of 2023, it equates to roughly 580 million in operating cash flow. This shows Mohawk’s strength to maintain high liquidity and a robust balance sheet.

Valuation

Currently, MHK’s consensus FCF yield is 10.47% (from Capital IQ). If you are Buffett, that’s all the valuation you’ll need.

However, going more in-depth, this is how I see the situation play out:

1. Mohawk consolidates businesses in emerging markets and leverages their size.

2. Continued cost reduction measures and “restructuring” those inefficiencies

3. Share repurchases

4. Housing boom due to housing shortage and pent-up demand

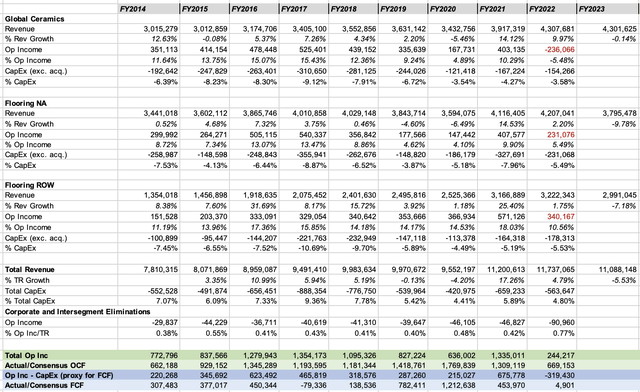

Hence, I adopt a conservative ceiling for the operating income margin by considering the averages between FY2016 and FY2020. This means:

- 11.4% ceiling for Operating Income Margin for Global Ceramics

- 8.82% ceiling for Operating Income Margin for Flooring NA

- 15.22% ceiling for Flooring ROW

I expect margins to return to the ceiling around FY2025 driven by raw material price normalisation and higher demand driven by remodelling and new construction.

In addition to the ceiling price, I expect there to be further margin expansions as detailed in previous sections:

- +150bps on Flooring ROW due to growth and pricing power in emerging markets (within 3-5 years).

- +125bps for all segments due to the company’s cost reduction measures (within 1-3 years).

- +100bps for Flooring NA and ROW

Base Case Revenue Growth Rate Assumptions

- 4.5% Revenue growth rate for Global Ceramics

- 3.5% Revenue growth rate for Flooring NA

- 7% Revenue growth rate for Flooring ROW, below historical averages, even considering aligns with a base case view of their emerging market strategy.

- The 10% increase in the global ceramics segment of FY2024 portrays the revenue Brazil & Mexico acquisition.

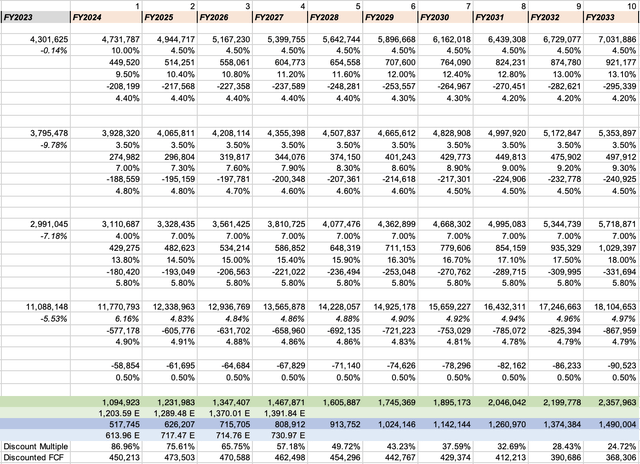

Historical Financials (Capital IQ) Projected Financials (Author’s Calculations)

Note that: Mohawk only reports revenue, operating income, depreciation, and CapEx for its segment financials. Therefore I’m using Operating Income as a proxy for Operating cash flow as there are no better alternatives. Historically, normalised Operating Income is quite close to the OCF figure, operating income is also usually lower than the OCF of the same year so I believe this is an acceptable proxy.

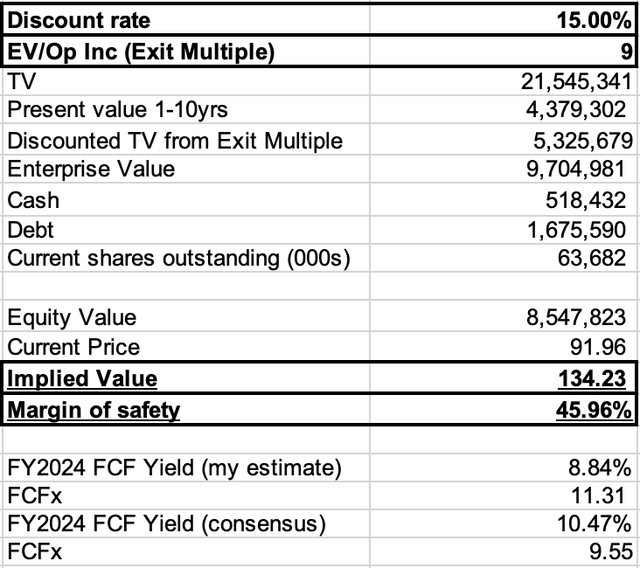

DCF with Exit Multiple (Author’s Calculations)

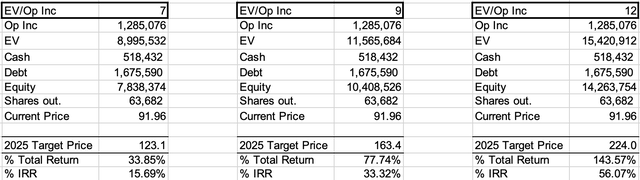

Historical EV/EBIT for Mohawk has been within 9-15 for the past 2 decades (Capital IQ). I’ve used conservative estimates (close to take-private multiples) of 7, 9, and 12 respectively for bear, base, and bull cases.

Multiples Analysis (Author’s Calculations)

This brings us to a target price of $123, $163, and $224 respectively for bear, base, and bull cases.

Risks

Housing boom gets delayed due to recession: We have a large enough margin of safety to wait. Pent-up demand will be realised eventually as they “won’t lose it, it just comes back later” Historically Mohawk has always been well-protected against recession, in fact, it will be an opportunity for them to acquire businesses at depressed valuations due to their strong balance sheet. A recession will delay the thesis without having material impacts on the balance sheet or upcycle outlook as it’s a structural issue.

Inflation becomes more entrenched, causing interest rate hikes: Debt would not be an issue as 65% are fixed rates. Possible high-interest rate-induced Recession will delay the core thesis as mentioned above.

Toxic Acquisitions: We might see goodwill writedowns, however, this should not have a significant material impact on cash flow. Individual acquisitions going forward will rarely exceed 500m if management implements their emerging market growth strategy. There is no reason for Mohawk to acquire in the U.S. as they are already a duopoly.

Catalyst

Lower Interest Rate: It stimulates economic activities, and encourages construction companies and households to renovate and build. This will signal the start of the housing/construction boom and its subsequent pent-up demand realisation.

Positive Macro Data and Mohawk releases better than consensus results and outlook: This encourages more institutional flows into the construction and renovation sector.

Activist participation: I believe this stock can be a prime target for activists: Given it’s a strong cash generator in a structural up-cycle, activism will guarantee shareholder value realisation.

PE candidate: This can be a potential LBO candidate and generate 20-30% IRR for PE firms at current prices. PE firms can benefit from the structural up-cycle and use its high OCF to pay off their leverage.

Conclusion

MHK is a high cash flow generator and an industry leader that has seen its shares fall due to macro issues. MHK has a track record of maintaining high liquidity and a strong balance sheet even during the depths of GFC.

In the event of a recession occurring in the near future, it doesn’t negate the thesis but merely postpones it. I am confident that the company will navigate through uncertainties more resiliently than its competitors, leveraging its experience and cost advantage.

As input costs normalize, I anticipate an improvement in margins, further accentuated by recent measures aimed at enhancing efficiency. Additionally, a higher appreciation for their LVT margins is expected, contributing to the overall positive outlook for MHK.

Finally, the industry is positioned towards a renovation and construction upcycle due to the structural issue regarding ageing and lack of supply