Although we’ve lost five of the six CD offers paying 6.00% or more in the past few weeks, you can still earn 6.18% with the top-paying nationwide CD. Not only that, but we gained a contender today in the elite tier of CDs offering at least 5.75%, raising the number in that club to 16.

Bayer Heritage Federal Credit Union continues to wear the market-leading crown, with its 1-year certificate paying 6.18% APY. New today to our ranking of the top-paying nationwide CDs is Dow Credit Union, which unveiled a 13-month offer of 5.76% APY.

Key Takeaways

- The top nationwide CD rate remains 6.18% APY from Bayer Heritage Federal Credit Union.

- You can find 15 more offers in our daily ranking of the best CDs that pay at least 5.75%.

- The top rate on a jumbo CD is 5.85% on a 1-year certificate from All In Credit Union.

- Based on encouraging inflation data released yesterday, markets now anticipate that the Fed will maintain current interest rates rather than raise them, suggesting CD rates may not climb higher than current levels.

Below you’ll find featured rates available from our partners, followed by details from our complete ranking of the best CDs available nationwide.

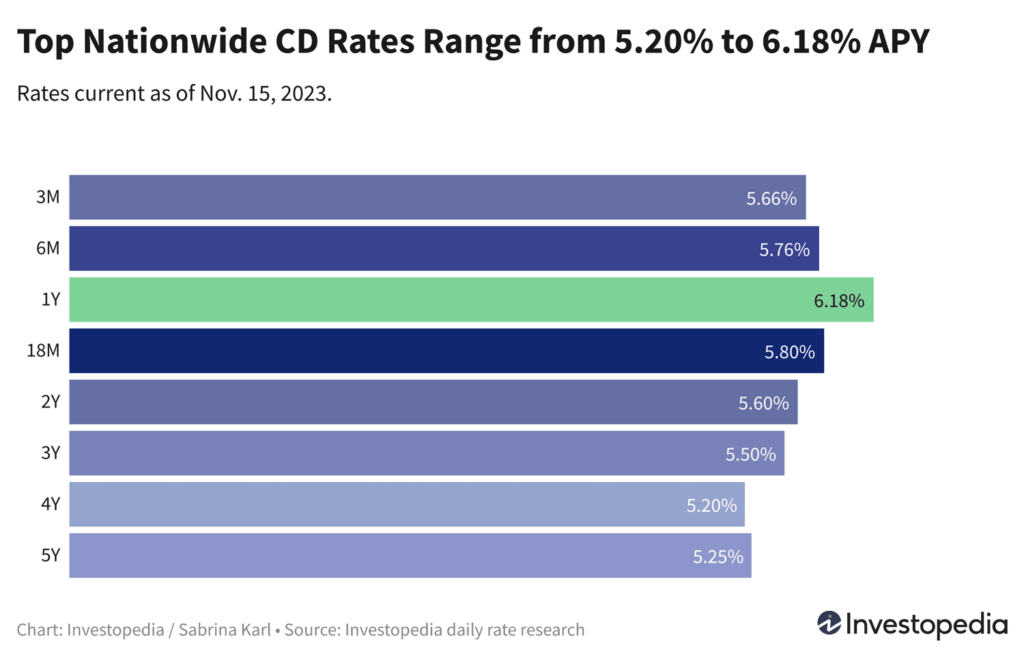

If you’re looking for a nationwide CD paying a top rate of at least 5.75%, the longest term available is 18 months. But if you want to secure one of today’s historically high rates for longer, you can lock in 5.60% APY for 2 years, or 5.50% APY for 3 years. Still not long enough? You can get a 4-year CD with a rate of 5.20% or a 5-year CD that pays 5.25% APY.

If you have enough to make a jumbo deposit of at least $100,000, you can stretch your rate a bit in the 2-year term, earning 5.68% APY. Or in the 3-year term, you can lock up a rate of 5.52% APY for 30 months.

When asked if they were choosing more or less of certain investments during recent market events in November, 28% of Investopedia readers said they were choosing CDs. This is slightly down from what readers told us in October, when 29% of investors said they were choosing CDs over stocks. CDs and money market funds were at the top of their list, followed by government bonds, ETFs, and stocks. However, only 14% of readers said they would open a CD if they had an extra $10,000 to invest.

Note that jumbo CDs don’t always pay a higher return than standard certificates. Sometimes you can do just as well—or better—with a standard CD. That’s currently the case in six of the eight terms above, so it’s smart to shop both certificate types before making a final decision.

How High Will CD Rates Go This Year?

The Federal Reserve has been aggressively combating decades-high inflation since March of last year, raising the federal funds rate with fast and furious hikes in 2022 and then more moderate increases in 2023. This has created historically favorable conditions for CD shoppers, as well as for anyone holding cash in a high-yield savings or money market account.

The Fed opted to hold rates steady on Nov. 1, its second such move in a row. That maintains the central bank’s benchmark rate at its highest level since 2001. But in his post-announcement press conference, Fed Chair Jerome Powell made it clear that holding rates in place right now does not necessarily mean the committee is finished with increases.

“Inflation has moderated since the middle of last year and readings over the summer were quite favorable,” Powell said. “But a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal.”

The Fed chair also reiterated what he has indicated in many past press conferences about the current announcement only representing a decision for today.

“We haven’t made any decisions about future meetings,” Powell said. “We’re going meeting by meeting.”

However, monthly inflation data released yesterday was encouraging, coming in below expectations. As a result, financial markets now overwhelmingly predict that the Fed will not make any further rate increases, with odds pushed below 5% for an increase at the committee’s Dec. 13 or Jan. 31 meetings, according to the CME Group’s FedWatch Tool.

As we always caution, trying to predict the Fed’s future rate moves is an unreliable exercise. But for now, it seems CD rates could roughly stabilize at their current historic levels.

Note that the “top rates” quoted here are the highest nationally available rates Investopedia has identified in its daily rate research on hundreds of banks and credit unions. This is much different than the national average, which includes all banks offering a CD with that term, including many large banks that pay a pittance in interest. Thus, the national averages are always quite low, while the top rates you can unearth by shopping around are often five, 10, or even 15 times higher.

Rate Collection Methodology Disclosure

Every business day, Investopedia tracks the rate data of more than 200 banks and credit unions that offer CDs to customers nationwide and determines daily rankings of the top-paying certificates in every major term. To qualify for our lists, the institution must be federally insured (FDIC for banks, NCUA for credit unions), and the CD’s minimum initial deposit must not exceed $25,000.

Banks must be available in at least 40 states. And while some credit unions require you to donate to a specific charity or association to become a member if you don’t meet other eligibility criteria (e.g., you don’t live in a certain area or work in a certain kind of job), we exclude credit unions whose donation requirement is $40 or more. For more about how we choose the best rates, read our full methodology.

Investopedia / Alice Morgan & Sabrina Jiang