Sloot/iStock Editorial via Getty Images

Following our latest update on Anglo-American production results and BHP Group‘s forward view, it is always an excellent momentum to reflect on what we learned, what has changed, and what’s new around the mining sector. For the above reason, today we are back to comment on Rio Tinto (RIO , RTPPF, RTNTF). 2023 has been a challenging year for the industry with production challenges and increasing CAPEX & costs. Here at the Lab, we have a long-standing buy rating on Rio Tinto. This is supported by 1) a fortress balance sheet with M&A optionality, 2) a better FCF generation compared to BHP Group in the 2024 and 2025 estimates period, 3) a tasty dividend yield, and 4) Oyu Tolgoi Ramp-Up Mine To Priced In.

Sector Upside

Before commenting on the Rio Tinto Q4 production results, it is essential to report the following high-level comments:

- China’s challenges are not cyclical but structural. The country faces issues in its growth model, and the property sector continues to carry a high level of debt. Chinese policymakers focus on stabilization rather than stimulus; however, a green agenda driven by decarbonization and industrial production drives the demand for metal materials. Still related to China, the impact on the supply chain has become a bigger drive. Nickel and Cobalt’s higher production, supported by Chinese funds, forced many players into negative earnings. China might pursue a similar strategy on Iron Ore in the future, and this might exacerbate mining earnings;

- Diversification is a plus and has clear benefits. First Quantum’s Cobre Panama served as a reminder that concentration can leave the equity story exposed to a black swan event. Yesterday, after it was forced to halt production, the Canadian miner announced that it would suspend its dividends, cut jobs to lower costs, and strengthen its capital position. Here at the Lab, we suggest checking on Anglo American update called Balanced Approach To Earnings Diversification in which we prefer diversified mining companies;

- Although organic growth is coming, we believe the CAPEX requirements and regulators will limit future capacity. Mining is hard, but it is more challenging these days. Anglo-American reduced its production guidance in December 2023. We believe footprint pressures and higher environmental costs limit production capacity;

- Even if China might centralize iron ore buying under the CMRG, iron ore demand will increase this year. With low steel margins and a challenging 2024 Chinese real estate sector, we were not expecting this supportive environment. This is why we released a September report on BHP called The Company Is Between A Rock And A Hard Place. With no production change in Vale and Simandou ramp-up in 2025, we believe that iron ore prices will remain higher for longer;

- We still believe there is a clear deficit environment on the copper. As reported in our latest report on Anglo American, given the recent production cut on copper, we might be in a position of commodity deficit, and prices tend to increase exponentially in this environment.

Here at the Lab, we are more constructive in the commodity price outlook, and we believe there is a favorable macro environment thanks to a loosening up of the monetary policy and resilient economic growth. Aside from the buy rating on Rio Tinto Group, we also favor Anglo American and Glencore equity stories.

Q4 Production Results Comment

As usual, here at the Lab, we are checking the latest Q4 production report. Below are presented our key takeaways:

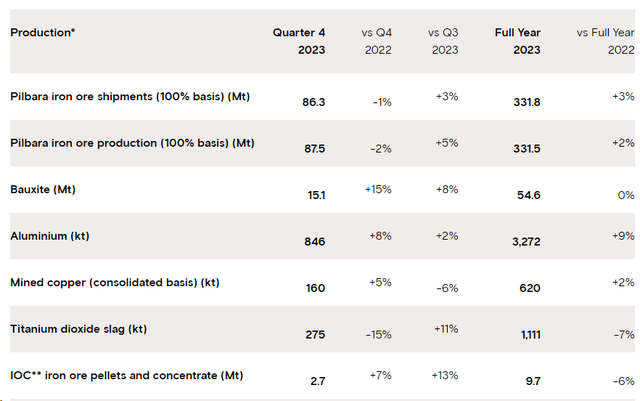

Starting with the most essential commodity, iron ore, the company’s Q4 shipments reached 86Mt and aligned with Rio’s outlook. Despite the promising results, we note higher inventory levels at China ports. The CEO will guide Iron Ore 2024 unit costs in late February.

According to the report, aluminum and alumina costs should decrease sharply in the second part of the year (lagged raw material price linkages). Still, lower prices will likely offset this development.

On the copper, as expected and already reported, the Oyu Tolgoi underground mine is delivering. The company opened 14 drawbells in Q4, and we expect higher production for 2024. On a negative note, Escondida production was softer than expected and signed a minus 9% on a quarterly basis. The company flagged potential higher copper unit costs. Therefore, we are now guiding copper cost at $2.00/b.

Related to the latest point, in our forward-thinking estimate, the Oyu Tolgoi mine will start to provide significant cash flow generation in late 2024. This project represents one of the most extensive industrial copper facilities with an estimated production of 500 ktpa from 2028 and a competitive cost curve. With this ramp-up, the company will be more diversified, with 10% of its entire EBITDA coming from copper. As we reported for Oyu Tolgoi today, we followed up with Simandou Mine.

Rio Tinto Q4 production results

Source: Rio Tinto Q4 production results

Simandou Upside

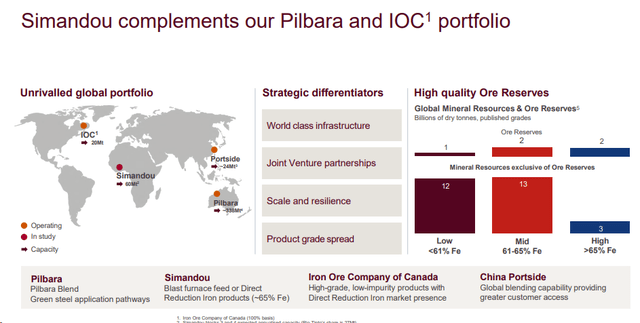

Following the capital market day in Sydney, we believe there is an additional upside to priced in for Rio Tinto. In detail, the company updated the investor base with the Simandou progression. This is the world’s largest and highest quality undeveloped iron ore mine, discovered in 2002. This deposit is located in Guinea. The Simandou mine has been divided into four exploration blocks, each half estimated to contain approximately 2Bnt of recoverable high-quality iron ore reserves grading 67% Fe. In detail, blocks 3 and 4 are owned by Simfer, a JV between Simfer Jersey Ltd (85%) and the Guinea Government (15%). But, Simfer Jersey Ltd is a JV between Rio Tinto Group (53%) and Chalco Iron Ore Holdings (47%).

Source: Investor Seminar

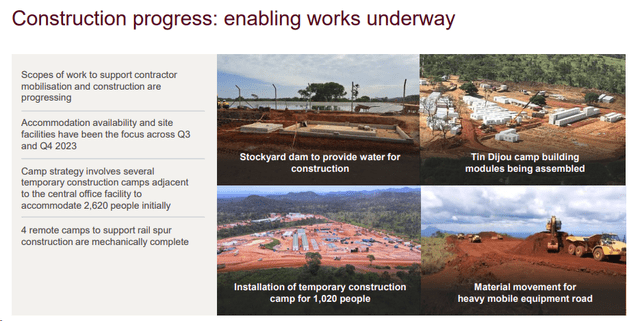

There is clear evidence in the mining with critical steps moving forward, such as the railway, Maribaya port update, and Kindia tunnel. Rio Tinto targets its first production in 2025.

Following Rio’s guidance, the mine targets a 30mth ramp up to 60Mtpa. We anticipate a gradual production to arrive at 60Mtpa by late 2028. Looking at the CAPEX, Rio’s share is set at $6.2 billion, of which $500 million has already been spent in 2023. The company is guiding its proportional share of investments at $2 billion annually in 2024 and 2025 and $1.5 billion in CAPEX in 2026. Looking at the OPEX, the Simfer mine is $10/wmt (mine gate) with sustaining CAPEX (rail and port) at $1/t costs. Using a blended methodology and a long-term iron ore price set at $85/t (in line with BHP Group estimates), we arrive at a post-tax IRR of 12%.

A steady ship in 2024

In our assumption, we lift iron ore prices from $100 to $125/per ton. As already reported in the BHP analysis, we see the following:

Iron ore prices will likely range between $100-135/per ton. This is due to lower inventories, limited supply growth in 2024, and stable demand (mainly supported by the recent stimulus announcements in China). Southeast Asia and India also have a potential upside.

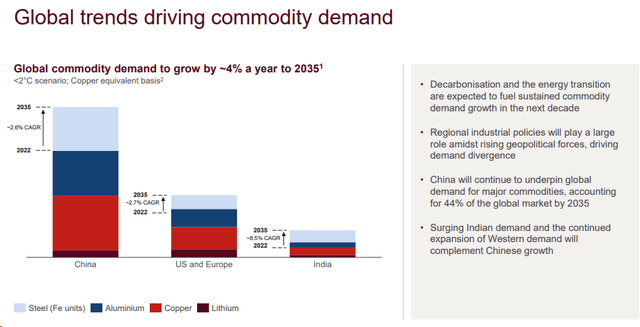

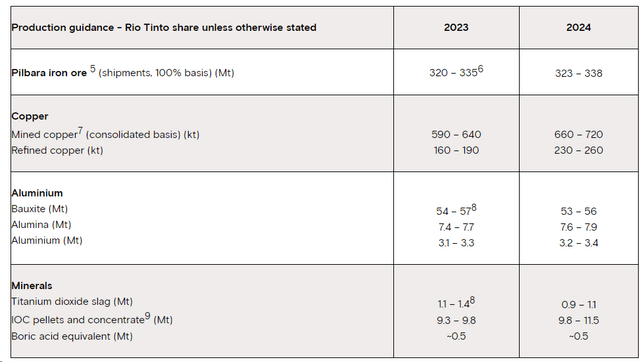

In the CMD, key market themes were decarbonization and India & ASEAN upside. ASEAN countries are Brunei Darussalam, Burma, Cambodia, Indonesia, Laos, Malaysia, Philippines, Singapore, Thailand, and Vietnam. Together, they represent a market with a GDP of more than $2.9 trillion and a population of 647 million people. In our previous estimates, iron ore H1 performances realized at an iron ore price of $100 per ton. Rio Tinto CEO envisages robust growth in copper with a 4% per year to 2035. At 2023 -end, we forecast sales and EBITDA of $53.6 and $24 billion, respectively. Considering our 2024 commodity outlook for Iron Ore and Copper reported above and the below production guidance (Fig 2), we project sales of approximately $55 billion in 2024, with an EBITDA estimate of $28.7 billion. In our estimates, supported by an FCF of $12 billion and considering a dividend payment of $8.8 billion, Rio Tinto will close 2024 cash positive for almost $4 billion. Looking at the company’s primary commodity, in 2024, iron ore and copper sales will likely reach $27 and $10 billion, respectively, with an estimated core operating profit of $13.5 and $4.3 billion. In our calculation, these commodities represent almost 80% of Rio Tinto’s EBIT profit.

Fig 1

Source: Rio Tinto corporate website – Fig 2

Additional financials are:

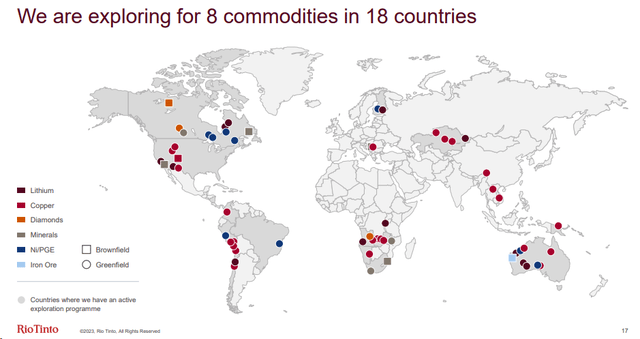

- The company is investing $250 million in greenfield exploration. This is one of the world’s most significant exploration budgets;

- Rio Tinto sustaining capex is now guided to $4 billion with $6 billion in essential CAPEX. Therefore, Rio is targeting CAPEX at the higher end of its guidance;

- A 60% payout ratio in line with the company’s estimates;

- The company left unchanged its commodity production;

-

The company has agreed to dispose of Lake Macleod’s salt operation for a cash consideration of $251 million. This is a rather attractive valuation;

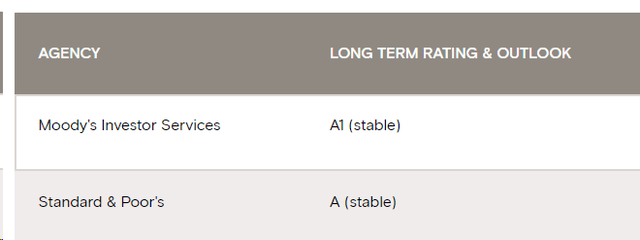

- In addition, the mining company will continue to seek to anchor its fortress balance sheet around a Single A credit rating (Fig 4). Rio Tinto’s EBITDA projection is set at approximately $24 billion this year, and the company’s net debt is almost irrelevant. In numbers, we see debt at 800 million for this year, and with the 2024 FCF projection, the company will likely be cash-positive for almost $4 billion.

Exploration budgets and new projects

Fig 3

Source: Rio Tinto corporate website – Fig 4

Valuation and Risk

The company is one of the world’s largest diversified mining companies. On a 12-month target price, our internal team uses a 5x EV/EBITDA multiple (this is unchanged and in line with peers’ valuation). Based on our forecast commodity price MIX, we arrived at an EBITDA of $28.7 billion, and considering that Rio is cash-positive (in our year-end projection), our equity value is set at $147.5 billion. For the above reason, there is a +25% stock price opportunity to grab. This potential performance is ante Rio Tinto dividend per share payment. To support this valuation, we should emphasize that the company has a 2024 ROIC projection of +40% and is currently trading at a 2024 EV/EBITDA of approximately 4x with a 10% FCF yield. Therefore, valuing the company with a 5x EV/EBITDA, we remain buy-rated with a target price of $87.5 per share (US Dollar) and £68.75 per share. Looking at its direct comps, both BHP Group and Anglo trades are at a 2024 EV/EBITDA multiple of 5.69x and 4.2x, respectively.

Downside risks include the volatile nature of commodity prices & FX and political risks such as the Mongolia Government, which owns a 34% equity stake in the Oyu Tolgoi mine. In addition, we should consider operational delays and CAPEX restraint in Guinea (Simandou mine); these could impact company performance significantly.

Conclusion

The company’s 4Q production was in line with expectations, and 2024 production guidance was unchanged. Oyu Tolgoi is ramping up, and the Simandou project is very well progressing. Even if copper unit costs appear to be higher than anticipated, we have a favorable view of iron ore development, and we do not expect these to result in a material change impact on our earning estimates. Rio Tinto remains our preferred iron ore miner. Therefore, we confirm our buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.