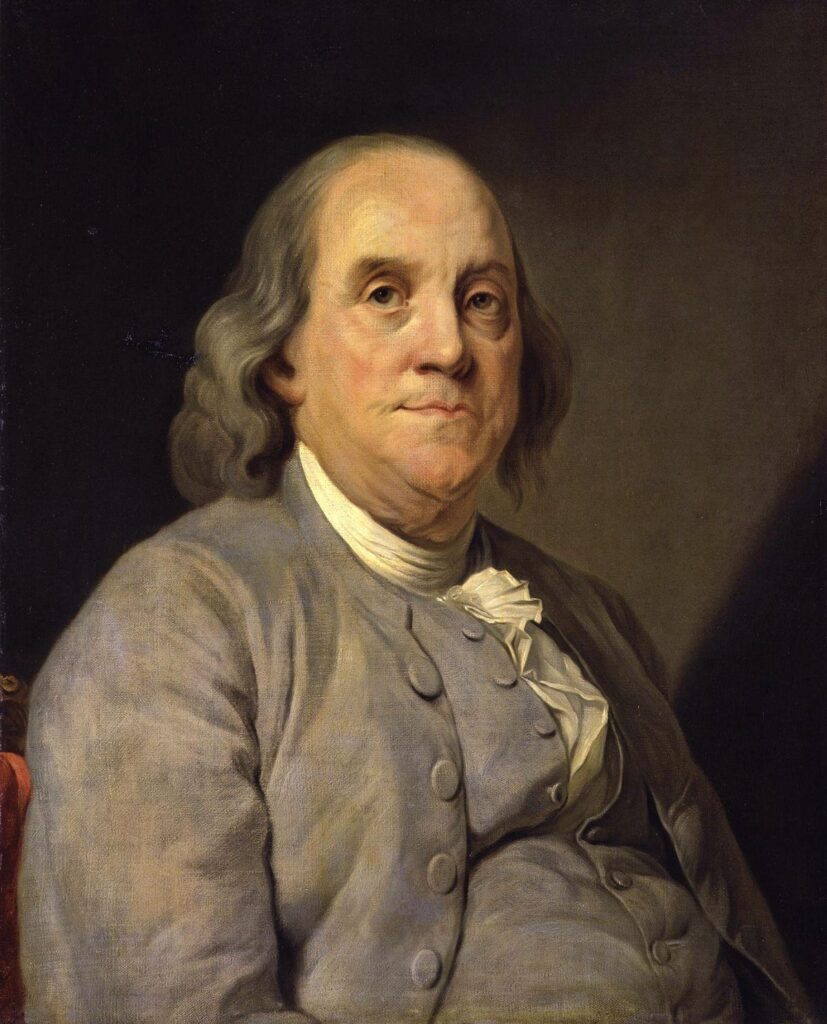

Benjamin Franklin after a portrait by Joseph-Siffred Duplessis (French, 1725-1802) (oil on canvas … [+]

People are creatures of habit. This timeless quote from Benjamin Franklin is very powerful in all areas of life, especially in the stock market.

“Your net worth to the world is usually determined by what remains after your bad habits are subtracted from your good ones.” – Benjamin Franklin

Good Habits – Bad Habits = Net Worth

Most, unsuccessful, people are not aware of their habits and they just go through life on autopilot. That’s one (big) reason why most people do not excel in life. On the other hand, successful people, consciously go out of their way to build good habits.

Habits Are Binary:

Whenever possible, I like to simplify things. It gives me clarity and helps me better understand the important elements required to make a healthy decision. That said, in my mind, habits are binary. A good habit is one that helps people move toward their desired goal(s). Meanwhile, a bad habit moves people away from their desired goal(s).

Investing Is Like Flying A Plane:

Over the long-term, the stock market has an upward bias. However, in the short-term, markets can be volatile. For most prudent investors, not someone who makes extremely risky investments, financial markets can be comparable to flying an airplane.

Turbulence may be inevitable, but with persistence, you can achieve your goal.

Here are 3 habits that most successful investors share.

1. Invest For The Long-Term

One powerful habit most successful investors share is that they are patient and invest for the long-term. People are programmed for instant gratification. Investing, however, requires patience. That’s one big reason why most people don’t win on Wall Street. Investing for the long-term is counter-intuitive because it requires people to build a different skill = delayed gratification. Most people want the quick dopamine hit of getting in to a stock then getting out very fast for a quick win. Successful investors do the opposite. They plan for the long-term. They understand the power of compounding. They understand the perils of instant gratification and they understand the power of delayed gratification on Wall Street.

2. Make Rational, Not Emotional, Decisions

Another very powerful habit most successful investors share is that they make rational, not emotional, decisions with their money. This is a core principle that I shared in my #1 best selling book, Psychological Analysis. Remember, most people are emotionally attached to their money. That means, they are making emotional, and often biased decisions with their money, not rational/objective decisions. Successful investors do the opposite. They create rules to help them make decisions rationally, not emotionally.

3. Study Price & Understand The Numbers:

Another powerful habit is to learn how to objectively analyze price, understand – and use – the numbers, to make intelligent decisions with your money. Price is the only variable that shows up in your brokerage statement. It is the only variable that determines whether you make or loss money on Wall Street. Yet, so many people get lost analyzing all these other factors and indicators that do not serve them. Instead, successful investors understand price. They understand the numbers, and more importantly they know how to use the price and numbers to make intelligent decisions with their money.

Tradingview.com has a very powerful stock screener – that helps people sort for countless variables and relate them to underlying price. Taking the time to learn how to use tools like this give successful investors a very strong edge. I spoke to Pierce Crosby, General Manager, TradingView, and he inspired me to write this article. He said, “In working with thousands of traders and investors across the globe, some consistent lessons rise to the surface. Developing good habits is a key ingredient nearly all successful investors share.”

Bottom Line:

People are creatures of habit. Ask yourself, what are my habits? Are my habits good or bad? How can I change my bad habits into good habits? Ben Franklin’s timeless advice is helpful in all areas of life, not just in the market.