It’s been a summer of scorching hot CD rates: on Memorial Day, only one CD paid 5.50% interest. Now, as Labor Day approaches, there are 30 paying that or more, with the two leaders still paying 5.75%.

Abound Credit Union‘s 10-month CD and MapleMark Bank‘s 12-month offer continue to pay the highest rate, while depositors willing and able to put down $100,000 can get 5.85% on a 170-day jumbo certificate from One American Bank.

Key Takeaways

- The leading rate in our daily ranking of the best nationwide CDs is holding steady at 5.75%, offered for either 10 or 12 months.

- There are still 30 “Benchmark Leaders”—those offering 5.50% or more—the same as yesterday and double the 15 available on August 1.

- The highest nationwide CD rate remains 5.85%, available as a jumbo certificate with a $100,000 minimum deposit.

- Federal Reserve chair Jerome Powell could offer clues Friday on whether the central bank will hold interest rates steady at the Fed’s next meeting in September, or hike them for a 12th time.

To help you earn as much as possible, here are the top CD rates available from our partners, followed by more information on the best-paying CDs that are available to U.S. customers everywhere.

Looking to secure one of today’s record rates for longer than two years? You can score 5.13% APY from the credit union leading our best 3-year CDs ranking, or 5.00% from one of three bank CDs in that term. But if you can manage a deposit of at least $100,000, you can stretch your term to four years with a 5.12% APY jumbo certificate.

CD SHOPPER TIP

Think you need to stick with a bank CD because becoming a credit union member is too much trouble? Think again. The credit unions we include in our rankings are open to anyone nationwide and are easy to join. Though some require a donation to an affiliated nonprofit organization, the required amount is generally modest, and some require no donation or cost at all. The process for opening an account at a credit union is also the same as opening an account at a new bank.

Beware

Despite the suggestion that a larger deposit entitles you to a higher return, that’s not always the case for jumbo certificate rates, which often pay less than standard CDs. Though today’s best jumbo offers, which typically require a deposit of $100,000 or more, beat the best standard rates in six CD terms, you can do just as well or better in the other two terms with a standard CD. So always be sure to shop every certificate type before making a final decision.

Will CD Rates Go Up in 2023?

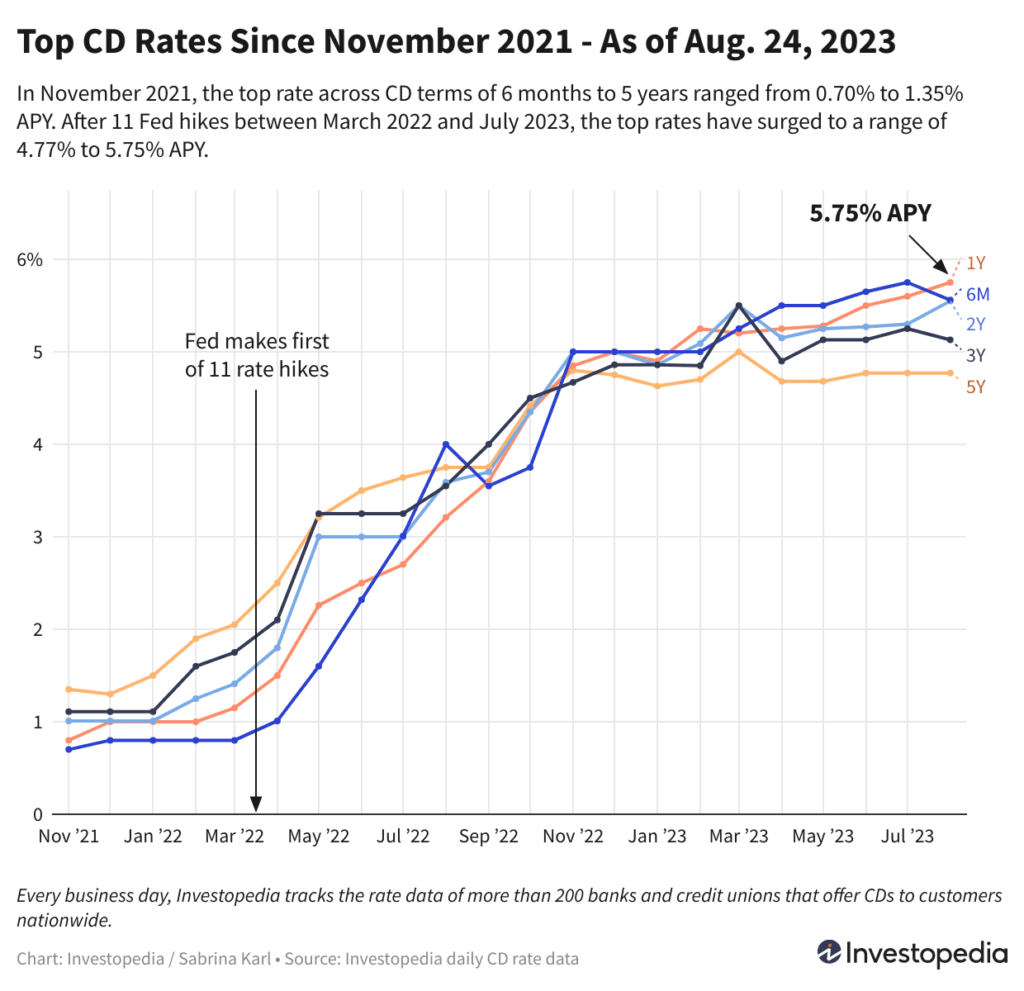

This year has already seen CD rates hit record levels, but it’s possible they could inch higher still. That’s because some banks and credit unions are still reacting to the central bank bumping the federal funds rate higher at its July 26 meeting. Also important is that the Federal Reserve has notably kept the door open to further 2023 increases.

The Fed has been aggressively combating decades-high inflation since March of last year, with fast-and-furious hikes in 2022 that eased to more moderate increases in 2023. Last month’s bump took the cumulative increase to 5.25%, raising the fed funds rate to its highest level since 2001. That’s created historic conditions for CD shoppers, as well as for anyone holding cash in a high-yield savings or money market account.

The Fed’s official July announcement provided no strong indications on whether it will raise its benchmark rate even higher this year. The written statement simply reiterated the Fed’s commitment to bring inflation back down to its target level of 2%.

In his post-announcement press conference, Fed Chair Jerome Powell indicated that the rate-setting committee has not made any decisions yet on whether to raise rates again in 2023—or if so, what timing or pace any increases would follow. He specifically stated that a hike and a pause were each possibilities at the next meeting, scheduled for September 19-20. Recent public remarks from other Fed members, meanwhile, indicate they may be divided on the issue.

Chair Powell could soon offer more clues regarding the trajectory of Fed monetary policy at the Jackson Hole Economic Symposium this week, where he is scheduled to speak Friday morning.

Currently, more than 80% of traders are betting the Fed will hold interest rates steady at its September meeting, according to the fed funds futures probabilities published by the CME Group. If the Fed goes against the market’s expectations and chooses to raise rates by another 25 basis points (bps), it would mark the 12th rate hike over the past 13 meetings, and would set the benchmark rate to a range of 5.50% to 5.75%.

It’s much more likely that the Fed could hike its benchmark rate in November or a subsequent meeting. Markets are pricing in just over a 40% chance of another rate hike before the end of the year.

Another increase by the Fed would certainly add a little more fuel to the fire for CD rates. But if the September decision is a rate hold, markets could be left guessing if that’s a temporary or permanent pause. In any case, as soon as it appears the Fed is ready to end its rate-hiking campaign for good, that will signal that CD rates have likely peaked.

Note that the “top rates” quoted here are the highest nationally available rates Investopedia has identified in its daily rate research on hundreds of banks and credit unions. This is much different than the national average, which includes all banks offering a CD with that term, including many large banks that pay a pittance in interest. Thus, the national averages are always quite low, while the top rates you can unearth by shopping around are often five, 10, or even 15 times higher.

Rate Collection Methodology Disclosure

Every business day, Investopedia tracks the rate data of more than 200 banks and credit unions that offer CDs to customers nationwide and determines daily rankings of the top-paying certificates in every major term. To qualify for our lists, the institution must be federally insured (FDIC for banks, NCUA for credit unions), and the CD’s minimum initial deposit must not exceed $25,000.

Banks must be available in at least 40 states. And while some credit unions require you to donate to a specific charity or association to become a member if you don’t meet other eligibility criteria (e.g., you don’t live in a certain area or work in a certain kind of job), we exclude credit unions whose donation requirement is $40 or more. For more about how we choose the best rates, read our full methodology.