J Studios/DigitalVision via Getty Images

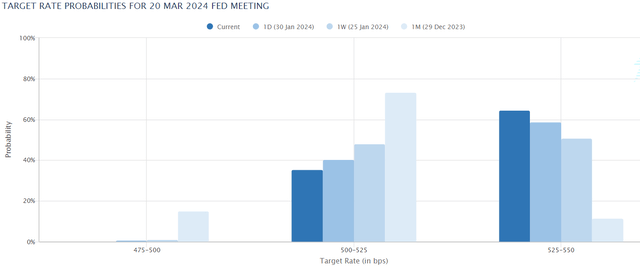

Right before we entered February, the Fed delivered quite hawkish message relative to what was baked into the cake by the market. While it was not a surprise that there will not be any interest rate cuts now, the commentary on future decisions was not as accommodative as the market hoped for.

The chart above captures the essence very well, where we can see how the probabilities of an interest rate cut have steadily decreased, with another calibration to the downside happening right after the recent Fed meeting.

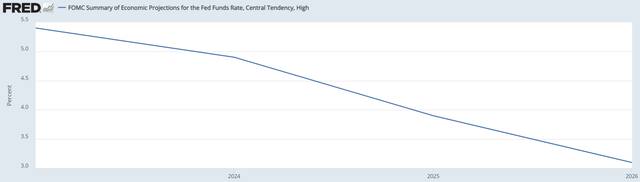

Having said, the FOMC’s “dot plot” chart still indicates lower interest rates in 2024 that are followed with more meaningful decreases in 2025 and 2026. Also, it was quite evident in Jerome Powell’s speech that downward revisions of SOFR are clearly imminent this year.

The key takeaways from this for yield-seeking investors are the following:

- SOFR has peaked, which means that there will not be incremental upwards pressure on the yields in a systematic fashion.

- Instead, the current yields are set to come down across the board as the underlying discount rate shrinks.

Now, this might trigger more aggressive dividend investors to open positions in extremely high yielding stocks before they are repriced higher due to favorable movements in the cost of financing.

Theoretically, such strategy makes sense because overly depressed stocks (which is implied by abnormal yield levels) are inherently more sensitive to any positive rate of change in systematic factors like the interest rates.

However, this obviously comes with its risks, where investors have to pay very careful attention to the underlying fundamentals and cash generation to avoid stepping into the “value trap”.

In this article below, I highlight two relevant examples, which from the surface seem attractive, but if we peeled back the onion a bit we would notice the overly speculative nature – i.e., major signs of yield unsustainability.

Finally, the recent data points from the Fed imply elevated risk for these two names since while the interest rates are poised to go down, the fact that it is likely to happen in a more back-end loaded fashion, render the financial situation way more difficult.

#1 Medical Properties Trust (NYSE:MPW)

MPW is a healthcare REIT operating in a relatively stable and straightforward business (i.e., devising a buy and hold strategy of different type of healthcare facilities). Although the underlying business is characterized with stable and predictable economic dynamics, MPW’s actual performance has been completely opposite.

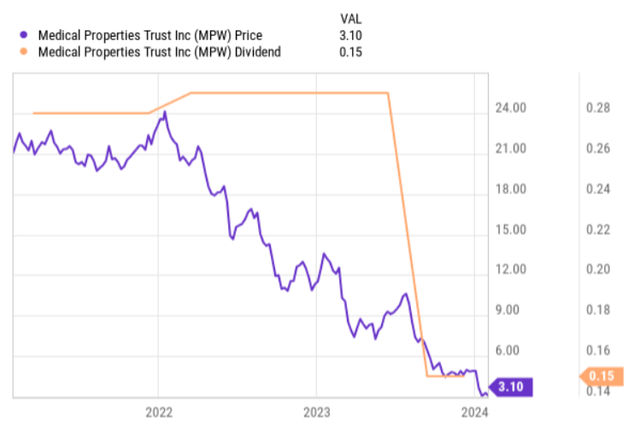

In the chart below, we can see how MPW’s share price has plunged since early 2022 and how massive the dividend cut was in mid 2023.

Despite the dividend reduction and some positive news on the balance sheet end (e.g., successful divestiture of Australian portfolio, a couple of smaller-scale asset sales), MPW still yields ~19% (on a TTM basis).

Considering the fact that MPW will be able to pay off most of the debt maturities until 2025, it might seem that the financial risk is well-managed. Plus, one might think that this gives sufficient time for MPW’s management to divest additional properties and accumulate some of the undistributed cash (stemming from FFO payout of 80%) that will ultimately strengthen the liquidity profile and allow to tackle the remaining maturities.

Nevertheless, there are two aspects, which render such thesis too optimistic or even unrealistic.

First is the tenant issue, which is nothing new for investors, who have followed MPW. As of Q3, 2023, Prospect Medical Holdings and Steward Health Care accounted for more than 25% of the total lease generation.

Unfortunately, early this year more negative news were circulated to the public indicating that MPW’s largest tenant (Steward) has failed to service the pre-agreed payments that were part of the relatively recent restructuring plan. Even worse, to avoid a disaster MPW was forced to step in once again and inject fresh liquidity in the tenant’s books, thereby inflating further the effective exposure (lease payments, debt payments, equity stake).

Second aspect, is really the combination of major restructuring and unfavorable interest rate environment, which as outlined above is set to remain at this restrictive territory for some while.

So, end of January this year, Steward announced that it has assigned restructuring consultants that will dig deep in Steward’s financials to arrive at a solution that would maximize shareholder value given all of the moving pieces. Usually, it takes several weeks to assess and determine the optimal route, what is then followed by almost immediate execution to halt the cash drain and preserve any value that is left.

Here there are at least two issues (risks) with the current restructuring agenda:

- Any asset disposals, spin-offs, equity financings and other similar capital sourcing maneuvers are inherently less possible and more expensive during a restrictive interest rate environment.

- Restructuring advisers focus on the shareholder value perseveration (or maximization), which might not necessarily end up in the best interest of MPW, which is nowhere close to being the major shareholder.

Hence, my base case is that MPW will have to cut its dividend further to shield its balance sheet and close the potential cash flow gaps that could stem from non-paying Steward.

#2 PIMCO Corporate and Income Opportunity Fund (NYSE:PTY)

PTY is a ~10% yielding CEF that is managed by PIMCO. The overall focus of PTY is in the high yielding fixed income space, where together with a significant load of external leverage, the Management aims to keep the dividend at an attractive and stable level.

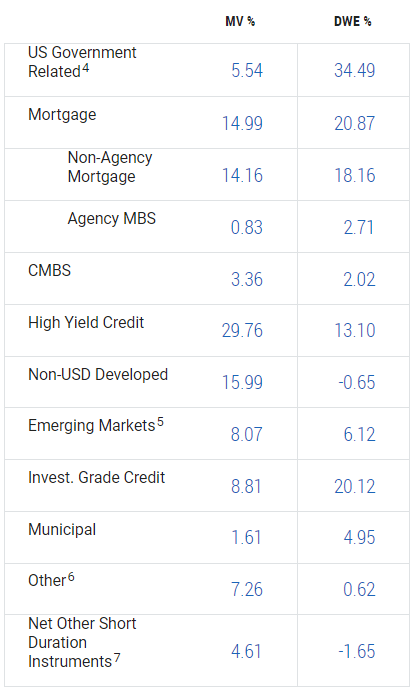

If we look at the underlying sector mix, it will become clear why PTY is able to facilitate relatively high yielding dividends.

PIMCO Investments LLC

For example, high yield credit, non-agency mortgages and emerging markets constitute more than half of total PTY’s exposure. All of these fixed income segments provide rather attractive current income streams because of the inherent risk profile.

A critical aspect in the context of PTY’s yield is the notion of external leverage, which as of now explains ~27% of the total AuM. This way, PTY is able to magnify the core yield that is generated by the underlying investments (i.e., capturing the difference between cost of debt and investment yield).

Nevertheless, in my opinion, PTY is also on the path towards reducing its dividend.

There are three reasons for this.

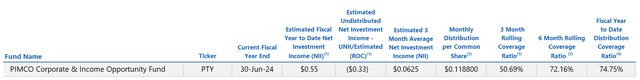

First, the 3-month rolling dividend coverage of PTY is clearly in an unsustainable territory, where the Fund has to tap into its current NAV base to keep the current dividend level intact.

Second, given the recent data points from the Fed (i.e., SOFR staying this high for longer), we can imply that PTY will have to carry the dividend funding shortfall for quite some time. In other words, the cost of financing levels will continue to remain high, maintaining negative status quo from the external leverage (yield-enhancement) perspective.

Third, elevated SOFR will continue to set a pressure on the asset valuations, which is extremely unfavorable in the current case of PTY when the Management has to divest parts of its asset base to cover the shortfall.

In a nutshell, I would not be surprised if PTY decides to revisit the prevailing dividend level to shield its current NAV base until the interest rates normalize.

The bottom line

While the interest rates are poised to go down, it seems that it will take a bit longer time for that to happen. The implied certainty about interest rate peak level and downward trajectory in future SOFR, might trigger yield-seeking investors to enter double-digit dividend yielders before lower interest rates kick in and bring up the valuations.

However, allocating in double-digit instruments without a careful analysis of the underlying fundamentals might result in rather unfavorable outcomes even against the backdrop of normalizing interest rates.

MPW and PTY are clear examples of this, which currently provide enticing dividend yields that embody meaningful probabilities of dividend reductions, where the fact that interest rate cuts will be more back-end loaded have just increased the chances of such an event happening.